INDICES

Yesterday, European stocks stayed strong. The Stoxx Europe 600 rose 2.05%, Germany’s DAX climbed 1.95%, France’s CAC 40 jumped 2.44% and the U.K.’s FTSE 100 was up 1.67%.

EUROPE ADVANCE/DECLINE

84% of STOXX 600 constituents traded higher yesterday.

52% of the shares trade above their 20D MA vs 32% Tuesday (below the 20D moving average).

56% of the shares trade above their 200D MA vs 51% Tuesday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 4.76pts to 28, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: Basic Resource

Europe Best 3 sectors

health care, technology, real estate

Europe worst 3 sectors

banks, energy, basic resources

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.62% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -15bps (above its 20D MA).

ECONOMIC DATA

UK 08:00: BoE Inflation Report

UK 08:00: BoE Interest Rate Decision, exp.: 0.1%

UK 08:00: BoE Quantitative Easing, exp.: £745B

UK 08:00: MPC Meeting Minutes

UK 08:00: BoE MPC Vote Hike, exp.: 0/9

UK 08:00: BoE MPC Vote Unchanged, exp.: 44083

UK 08:00: BoE MPC Vote Cut, exp.: 0/9

GE 08:00: Sep Factory Orders MoM, exp.: 4.5%

EC 09:30: Oct Construction PMI, exp.: 47.5

FR 09:30: Oct Construction PMI, exp.: 47.3

GE 09:30: Oct Construction PMI, exp.: 45.5

UK 10:00: Oct New Car Sales YoY, exp.: -4.4%

UK 10:30: Oct Construction PMI, exp.: 56.8

EC 11:00: Sep Retail Sales YoY, exp.: 3.7%

EC 11:00: Sep Retail Sales MoM, exp.: 4.4%

FR 11:00: 10-Year OAT auction, exp.: -0.25%

FR 11:00: Sep Retail Sales MoM, exp.: 6.2%

FR 11:00: Sep Retail Sales YoY, exp.: 3%

EC 12:40: ECB Guindos speech

UK 13:30: BoE Gov Bailey speech

GE 16:00: Bundesbank Weidmann speech

EC 16:10: ECB Schnabel speech

MORNING TRADING

In Asian trading hours, EUR/USD climbed to 1.1735 while GBP/USD fell to 1.2962. USD/JPY dropped to 104.28. AUD/USD was little changed at 0.7178. This morning, official data showed that Australia’s trade surplus totaled 5.63 billion Australian dollars in September (3.70 billion Australian dollars expected). In U.K, Bank of England kept its benchmark rate at 0.10% as expected, while increasing QE target to 875 billion pounds (845 billion pounds expected) from 745 billion pounds.

Spot gold advanced to $1,908 an ounce.

#UK – IRELAND#

Sainsbury, a chain of supermarkets, reported 1H results: “Total Retail sales up 7.1 per cent (excluding fuel) with like-for-like sales up 6.9 per cent. (…) Loss before tax £(137) million, reflecting £438 million of one-off costs associated with Argos store closures and other strategic and market changes. (…) Full year underlying profit before tax now expected to be at least five per cent higher than last year, reflecting stronger than expected sales, particularly at Argos. (…) The Board has approved an interim dividend of 3.2p. (…) Whilst we will aim to find alternative roles for as many colleagues as possible, around 3,500 of our colleagues could lose their roles as a result of our proposals.”

Aveva, an IT company, published 1H results: “Revenue was £332.6 million, representing a reduction of 15.1% (H1 FY20: £391.9 million). Adjusted EBIT reduced by 37.9% to £56.3 million (H1 FY20: £90.6 million), (…) on a statutory basis, a loss before tax was incurred of £24.2 million (H1 FY20: Profit before tax of £24.0 million). (…) Interim dividend maintained at 15.5 pence per share.”

#GERMANY#

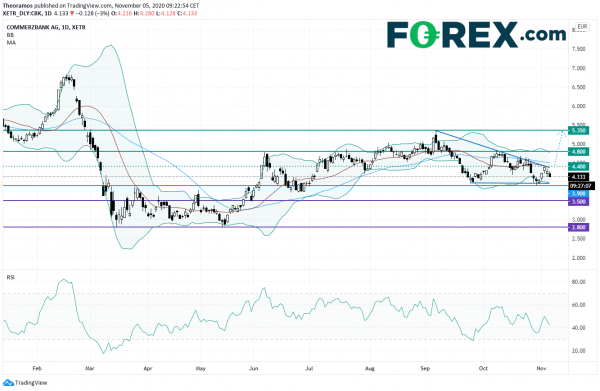

Commerzbank, a banking group, posted a 3Q net loss of 69 million euros, compared with a net profit of 297 million euros in the prior-year quarter, citing 201 million euros restructuring charge. Risk result rose to 272 million euros from 114 million euros in the prior-year period, but down from 469 million euros in 2Q. CET1 ratio climbed to 13.5% from 12.8% in the prior-year period. The bank sees a negative net result for the full-year and risk result is estimated to be 1.3 – 1.5 billion euros. In addition, CET1 ratio is expected to be at least 13% at the end of the year.

From a technical point of view, the stock is trading within a hypothetical descending triangle in place since September 2020. A break above the upper boundary of the pattern around 4.4E, would call for a new up leg towards 4.8E and 5.350E in extension. Alternatively, a cross below 3.9E would invalidate the pattern.

#FRANCE#

Societe Generale, a banking group, announced that 3Q net income grew 0.9% on year to 862 million euros, the first quarterly profit of the year. Gross operating income rose 9.1% on year to 1.98 billion euros, while cost of risk reduced to 518 million euros from 1.28 billion euros in the prior quarter.

#SPAIN#

Endesa, a Spanish electric utility company, reported that 9-month net ordinary income rose 38.4% on year to 1.70 billion euros and EBITDA grew 8.2% to 3.14 billion euros on revenue of 12.96 billion euros, down 12.5%.

#BENELUX#

ING Groep, a financial services group, reported that 3Q net income declined 41.4% on year to 788 million euros, as loan loss provisions rose 69.9% to 469 million euros, but down from 1.34 billion euros in the prior quarter. Meanwhile, net interest income dropped 5.7% to 3.33 billion euros.

ArcelorMittal, a steel producer, posted 3Q net loss narrowed to 261 million dollars from 539 million euros in the prior-year quarter, while EBITDA slid 15.2% on year to 901 million dollars on revenue of 13.27 billion euros, down 20.2%.

#ITALY#

UniCredit, an Italian bank, announced that 3Q underlying net profit dropped 37.2% on year to 692 million euros, while net write-downs on loans and provisions increased 31.6% to 741 million euros, but down 21.0% on quarter. Meanwhile, net interest income slid 8.6% to 2.30 billion euros. The bank confirmed its underlying net profit targets of above 0.8 billion euros for 2020 and 3.0 – 3.5 billion euros for 2021.

EX-DIVIDEND

BP (BP/): $0.0525