The EUR/USD currency pair

Technical indicators of the currency pair:

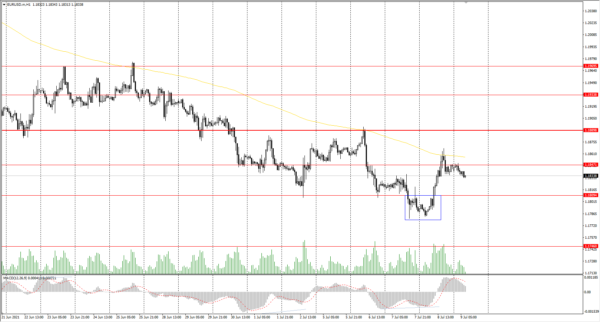

Prev Open: 1.1789

Prev Close: 1.1846

% chg. over the last day: +0.48%

The European Central Bank has slightly adjusted its monetary policy. The ECB raised its inflation target to 2%. The figure is symmetric, meaning that negative and positive deviations from the target are equally undesirable. Eurozone inflation is expected to fall in June as labor shortages, and delays in raw material supplies are beginning to decrease. The rate of asset purchases on the ECB balance sheet decreased, which supported the euro.

Trading recommendations

Support levels: 1.1809, 1.1746, 1.1609

Resistance levels: 1.1847, 1.1889, 1.1934, 1.1969

The trend is still bearish. But there was an initiative from the buyers, who pushed the price to the moving average, forming a false breakdown zone below. The MACD indicator returned to the positive zone. Under such market conditions, it is better to trade intraday. It is necessary to wait for a pullback to the nearest resistance levels for short positions. Long positions can be considered from the support levels. The divergence on the MACD indicator on higher timeframes is not yet completely worked out; in other words, there is still potential for growth.

Alternative scenario: if the price breaks out through the 1.1889 resistance level and fixes above, the general uptrend is likely to be resumed.

News feed for 2021.07.09:

- ECB President Christine Lagarde’s Speech at 13:00 (GMT+3).

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3799

Prev Close: 1.3789

% chg. over the last day: -0.07%

The British pound is trading in a narrow price range. The LIBOR lending rate on the interbank market in London began to decline again, which is favorable for the British currency. Today, the UK will present the GDP report for the month and the quarter, and the head of the Bank of England will give a speech. Volatility on the GBP/USD currency pair will increase.

Trading recommendations

Support levels: 1.3756

Resistance levels: 1.3835, 1.3923, 1.4002, 1.4075, 1.4101, 1.4138, 1.4191

The GBP/USD trend is bearish on the H1 timeframe. Buying pressure has become weak now; the price drops below the moving average. The MACD indicator is in the negative zone, but there are signs of divergence. Under such market conditions, traders are better to look for both sell trades from the resistance levels and buy trades from the support levels on the intraday timeframes.

Alternative scenario: if the price breaks out through the 1.3922 resistance level and consolidates above, the bearish scenario is likely to be canceled.

News feed for 2021.07.09:

- UK GDP (m/m, q/q) at 09:00 (GMT+3);

- UK BoE Gov Andrew Bailey’s Speech at 13:00 (GMT+3).

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 110.60

Prev Close: 109.75

% chg. over the last day: -0.77%

The situation on the USD/JPY currency pair has changed. Yesterday, the price broke down through the change priority level on a big impulsive move, and the quotes fell by 0.77% by the end of the day. The Japanese Yen futures continue to increase due to a decline in US government bond yields (inverse correlation). This is the reason why the USD/JPY currency pair differs from the other pairs, where the main currency is the US dollar.

Trading recommendations

Support levels: 109.62, 109.31

Resistance levels: 110.47, 110.73, 111.06, 111.48, 110.73, 112.18

From the point of view of technical analysis, the trend has changed to a downtrend. Yesterday, the price confidently broke down through the change priority level and fixed lower. Under such market conditions, it is best for traders to look for sell positions from the resistance levels. There are no optimal entry points for buy positions now.

Alternative scenario: if the price rises above 110.73, the uptrend is likely to be resumed.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2474

Prev Close: 1.2532

% chg. over the last day: +0.46%

The USD/CAD currency pair began a corrective movement downwards within the ascending trend. Today, Canada will report on the labor market, which will allow estimating the fundamental picture and forecasting the actions of the Bank of Canada. At the moment, the Canadian dollar is highly correlated with the US currency and oil prices.

Trading recommendations

Support levels: 1.2519, 1.2478, 1.2404, 1.2347, 1.2312, 1.2260, 1.2190

Resistance levels: 1.2587

Technically, the trend remains bullish. The price is trading above the moving average, but there is a strong deviation from the midline. The MACD indicator has returned to the positive zone but with signs of divergence. Under such market conditions, it is best to trade on the lower timeframes. Buyers need to wait for a slight pullback to the nearest support levels. Traders can also look for entry points on intraday timeframes for short positions, but only with short targets because it will be trading against the trend.

Alternative scenario: if the price breaks down through the 1.2370 support level and fixes below, the downtrend is likely to be resumed.

News feed for 2021.07.09:

- Canada Employment Change (m/m) at 15:30 (GMT+3);

- Canada Unemployment Rate (m/m) at 15:30 (GMT+3).