- Preliminary data showed that Canada’s retail sales increased in October.

- The FOMC minutes confirmed policymakers were ready to move in smaller steps.

- Investors are awaiting the US nonfarm payrolls report.

The USD/CAD weekly forecast is bearish as this week’s bearish trend will likely extend to next week, given the weakening dollar.

Ups and downs of USD/CAD

On Tuesday, the Canadian dollar climbed against the US dollar as investor risk appetite increased, and preliminary domestic data showed that Canada’s retail sales increased in October.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

The minutes from the Federal Reserve’s November meeting confirmed that the central bank would downshift and raise rates gradually from its December meeting, causing the decline of the USD/CAD on Thursday.

The anxiously anticipated report of the Nov. 1-2 meeting revealed officials were mostly comfortable they could now proceed in smaller steps, with a 50 basis point rate increase expected next month following four consecutive 75 basis point rises.

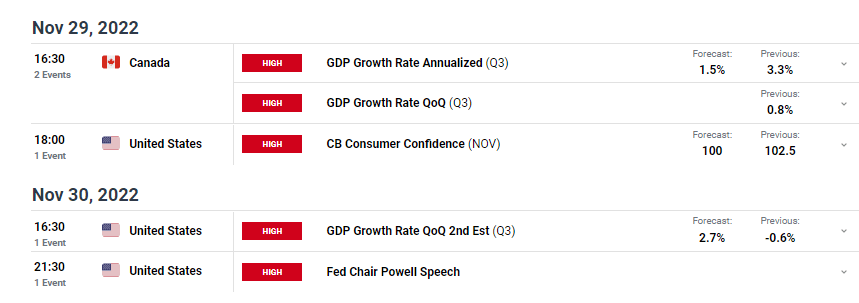

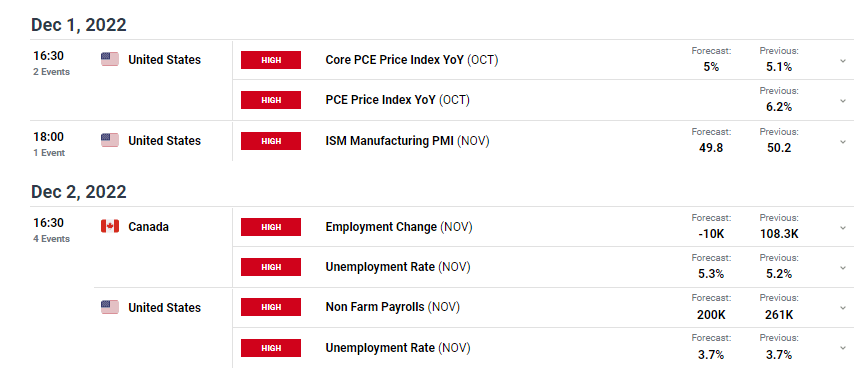

Next week’s key events for USD/CAD

Next week is packed with important news releases from Canada and the US, including GDP data from both countries and employment data from Canada. However, investors will pay more attention to the nonfarm payrolls report from the US.

According to a Reuters poll of analysts, the US economy probably added 200,000 new jobs, which would be the weakest increase since December 2020. Estimates ranged from 150,000 to 240,000. Five of the last six jobs reports have exceeded consensus expectations, and a sixth positive report could result in higher USD/CAD prices.

USD/CAD weekly technical forecast: Bears to pounce 1.3251

Looking at the daily chart, we see the price trading below the 22-SMA and the RSI below 50 favoring bearish momentum. The previous bullish trend found strong resistance at the 1.3802 level. After many failed attempts and a bearish RSI divergence, the price broke below the 22-SMA to start the bearish trend. Since then, the price has made consecutive lower lows and lower highs, further confirming the bearish trend.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Bears currently face strong support at 1.3253 and have allowed bulls to return for a 22-SMA retest. If bears can come back as strong as they were before, the price will likely break below 1.3253 next week. However, if bulls get stronger, the price might break above the 22-SMA and 1.3500 resistance to retest the 1.3802.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.