ECB Rate Decision Key Points:

Recommended by Zain Vawda

Get Your Free EUR Forecast

The European Central Bank has raised interest rates as inflation remains sticky as 2023 approaches. The Central Bank expects to raise rates further based on a significant revision of the inflation outlook. Food price inflation and underlying price pressures have strengthened across the economy and are expected to persist for the foreseeable future. Average inflation reaching 8.4% in 2022 before decreasing to 6.3% in 2023, with inflation expected to decline markedly over the course of the year.

The Euro Area economy may contract in the current quarter as well as Q1 2023, largely due to the energy crisis, high uncertainty, weakening global economic activity and tighter financing conditions. ECB staff project that a recession should be relatively short-lived with limited growth for 2023 expected and has been revised down compared to previous projections.

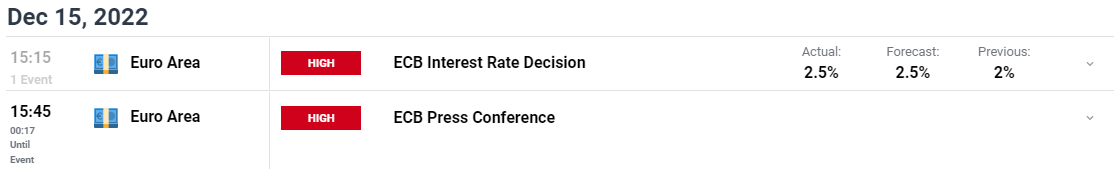

For all market-moving economic releases and events, see the DailyFX Calendar

The ECB stated that they will announce detailed parameters for the reduction of APP holdings at its February meeting. ECB President Lagarde during her press conference bemoaned the slow rate of job creation while reiterating her recent stance that energy aid remains temporary and targeted. Lagarde stressed that inflationary pressures are being felt across a variety of industries with wage growth a concern, as it is expected to grow at rates far exceeding historical norms adding to inflationary pressure with inflation risks skewed to the upside. Despite the slowdown to 50bps hikes the ECB’s message is definitely a hawkish one.

Recommended by Zain Vawda

Trading Forex News: The Strategy

The recent rally in the EUR/USD has been largely driven by a weaker dollar and improving data out of the Euro Area. Yesterday’s decision by the US Federal Reserve hasn’t seen any long-lasting moves for the pair with today’s 50bps hike by the ECB expected to deliver much of the same.

***UPDATES TO FOLLOW****

Market reaction

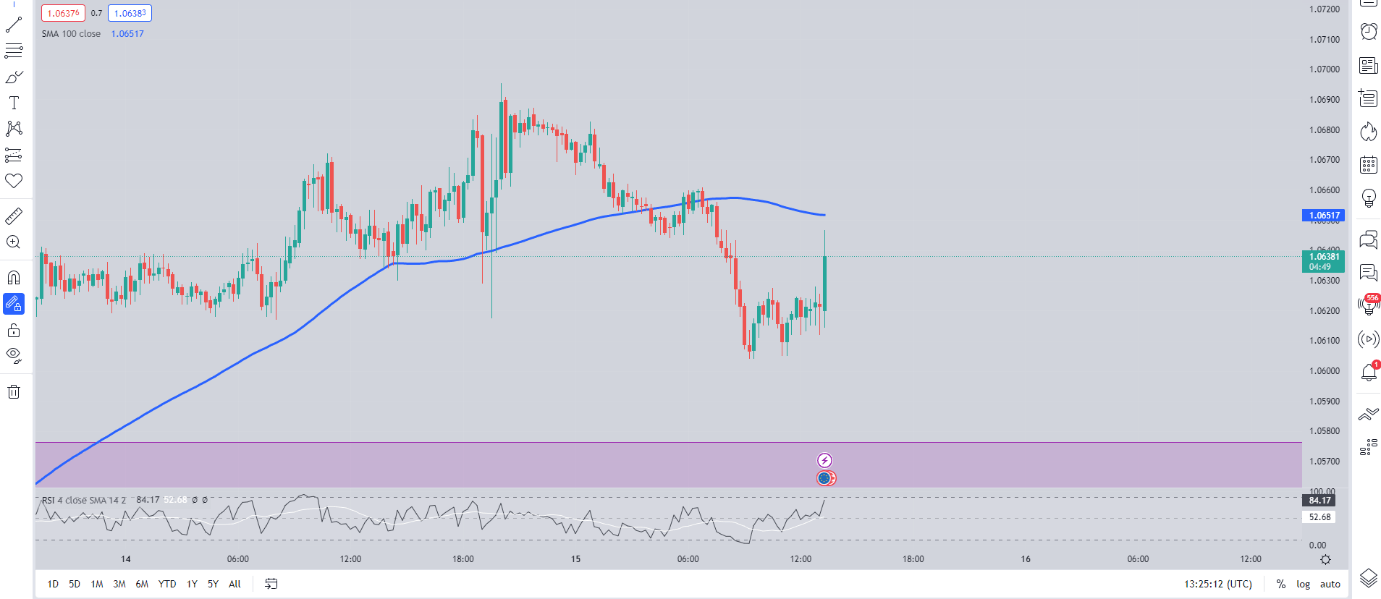

EURUSD 15M Chart

Source: TradingView, prepared by Zain Vawda

EURUSD initial reaction saw a 30 pip spike higher. We have seen further upside following the hawkish comments from President Lagarde pushing EUR/USD above the 1.0700 handle. Downside pressure may come into play as the dollar index continues its move higher since yesterday’s FOMC decision.

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently SHORT on EUR/USD, with 59% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are short suggests that EUR/USD may continue rise.

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda