EURUSD, NZDUSD, GBPUSD and USDJPY Talking Points:

- The Market Perspective: EURUSD Bearish Below 1.0750

- Reversals that occur within candles – daily, weekly, monthly, etc – can create ‘wicks’ or ‘tails’ that indicate reversals of different intensities

- While the BOJ-powered USDJPY reversal was the most dramatic amongst the Dollar-based majors; the turns from NZDUSD, EURUSD and GBPUSD have added significance

Recommended by John Kicklighter

Get Your Free USD Forecast

For those that aren’t technical traders, the concept of large ‘wicks’ or ‘tails’ may sound odd. That said, there was some remarkable activity in the markets through the Yen crosses and Dollar pairs among other areas that can be quickly picked up by observing the reversals reflected by these chart patterns (learn more about candlesticks and their patterns here). Given the amount of information that can be gleaned from a quick review of a candlestick chart, I consider it an efficient analysis technique to comb through many markets. When large wicks show up on daily candles, it suggests there was a significant reversal within that time frame. The larger the wick, the more dramatic the turn and volatile the underlying market. Of course, if you were scanning the broader market Wednesday; the performance that clearly stands out was from USDJPY. With implied volatility ramped to extremes before the Bank of Japan meeting, there was bound to be severe fallout. Yet, USDJPY and the Yen crosses weren’t the only market experiencing exceptional market activity of this sort.

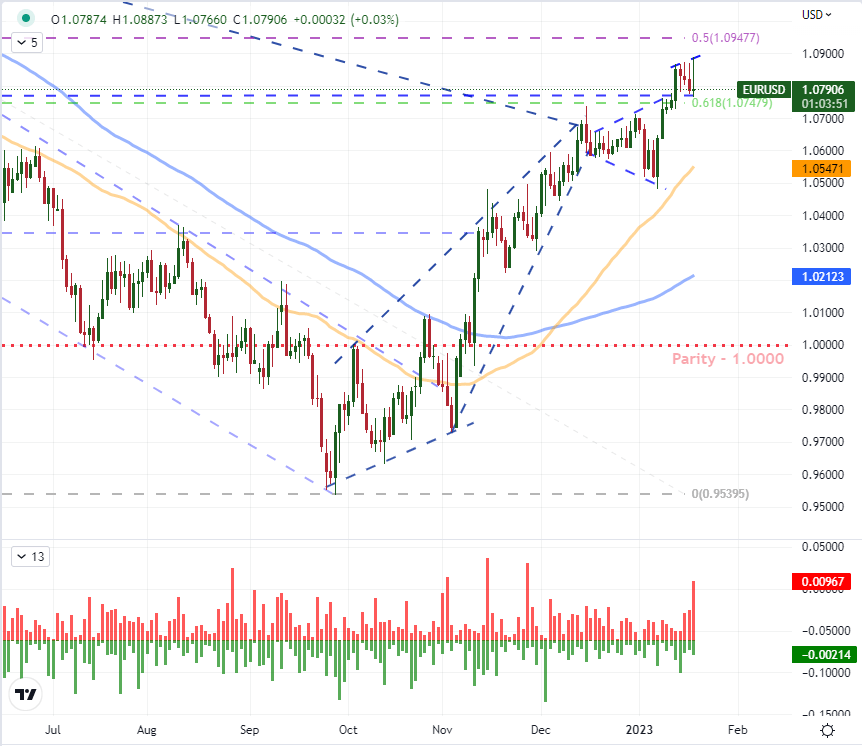

It is not exactly clear to me that there was a principal fundamental driver behind the US Dollar this past session, but nevertheless the Greenback earned a significant respite after initially pressuring further significant technical support against some major counterparts. Perhaps the motivation was a safe haven bid earned through the slide in risk assets like equities through the active New York session, because interest rate expectations interest rate expectations for the Fed actually slid lower through the day. For EURUSD, there is a modest safe haven advantaged afforded the Dollar still, which could speak to the moderate level reversal we see here. The upper wick on the daily candle was just shy of 100 pips which is the largest intraday reversal since November 28th – the second such rejection that attempted, and failed, to make resistance out of 1.05. The about face for EURUSD keeps the pair within its week-long range and key technical support below around 1.0750. If there is a break to be found, it would be better served to find a subsequent fundamental charge to project follow through.

| Change in | Longs | Shorts | OI |

| Daily | -6% | -1% | -3% |

| Weekly | 6% | -15% | -8% |

Chart of EURUSD with 50 and 100-Day SMAs, Daily Wicks (Daily)

Chart Created on Tradingview Platform

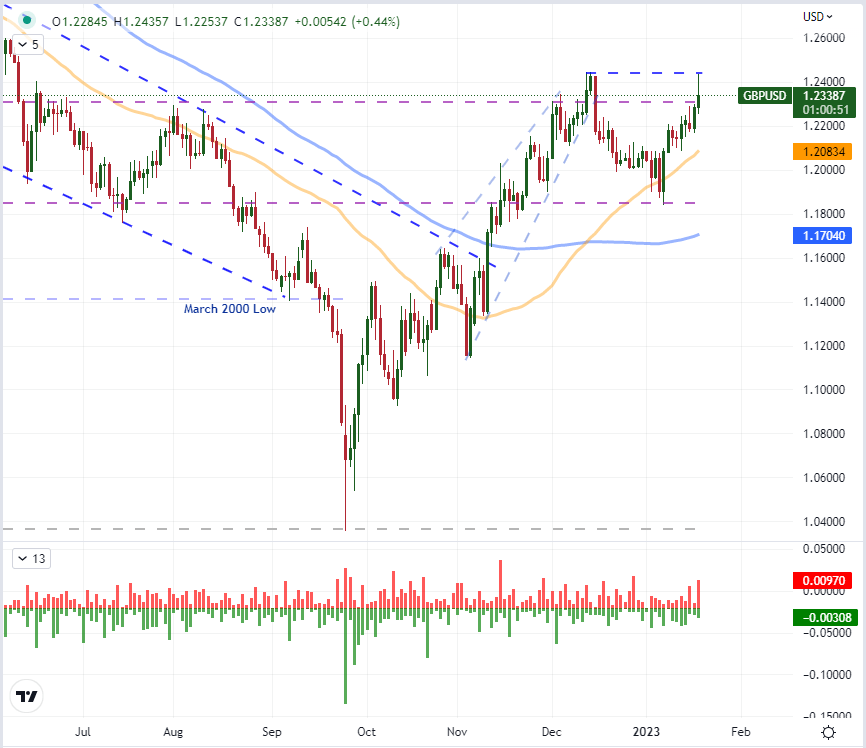

On a nominal scale, the GBPUSD’s own intraday reversal was approximately the same size as the EURUSD’s. For the so-called ‘Cable’, the reversal is working less on a charged short-term range and instead offers some initial formality to the double top at 1.2445 initially set with the stall out in mid-December. For GBPUSD’s own historical context in mind, the upper wick was ‘only’ the largest since December 28th, but it is more significant compared to those recent historical references because there has been a run up for cross these past few weeks. Fundamentally, there is less relative safe haven consideration between these two currencies; and UK CPI meeting expectations at an oppressive 10.5 percent clip no doubt feeds into BOE rate expectations. In this pair’s case, a ‘path of least resistance’ perspective makes more sense than a full-tilt reversal – unless something unexpected happens.

| Change in | Longs | Shorts | OI |

| Daily | -10% | 7% | 0% |

| Weekly | -23% | 14% | -4% |

Chart of GBPUSD with 50 and 100-Day SMAs, Daily Wicks (Daily)

Chart Created on Tradingview Platform

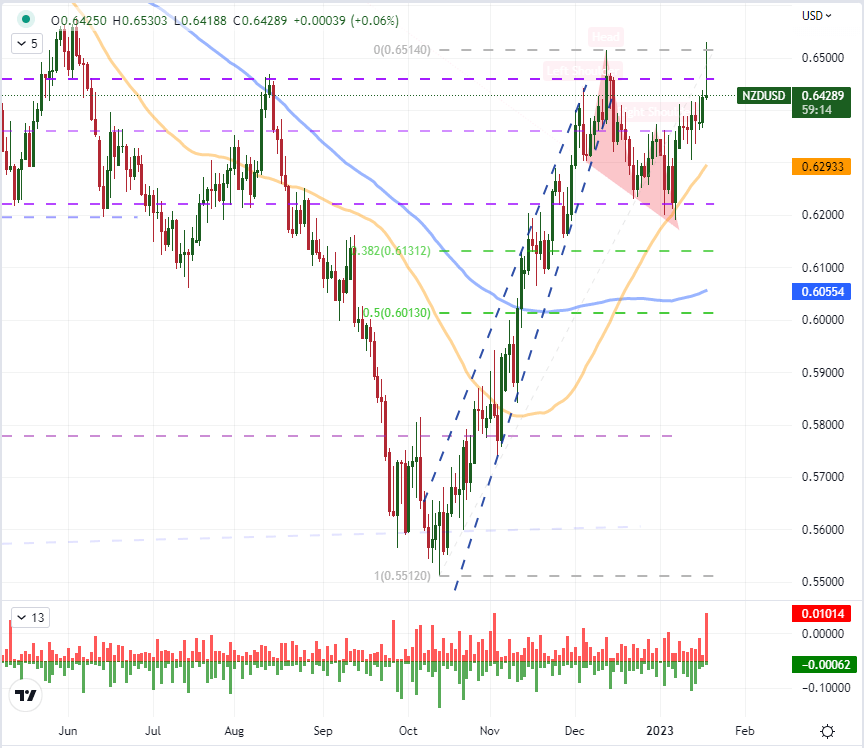

Where we can ramp up the impact of the safe haven status while also absorbing the impact of a deflated carry trade perspective, NZDUSD is a pair with some fundamental significance. While the US 2-year yield (a proxy for ‘medium term’ rate expectations) has slipped this past session, the New Zealand equivalent has fallen more quickly. The differential dropped by 4 basis points to 0.32 percent Wednesday. As for the ‘risk’ status, the Kiwi Dollar is considered a major because of its AAA-rated sovereign debt and its historically high yield. With that fundamental disparity in higher contrast, it is less surprising to see NZDUSD’s own 100-point wick reflecting extremes. This is the largest intraday reversal from highs for this pair since March 2020 – during the height of pandemic. There is additional technical relevance in the relative position of the December 13th high with its own stand out tail and the midpoint of the February 2021 to October 2022 bear trend at 0.6460. Whether this pair capitalizes on the turn with follow through likely depends on whether risk aversion will continue to build a head of steam.

| Change in | Longs | Shorts | OI |

| Daily | -11% | 0% | -6% |

| Weekly | -11% | 0% | -5% |

Chart of NZDUSD with 50 and 100-Day SMAs, Daily Wicks (Daily)

Chart Created on Tradingview Platform