The one-minute scalping strategy

The one-minute scalping strategy involves identifying potentially winning trades in the market through the use of signals, then buying a position with the aim of closing it when the currency pair has earned just a few pips of movement.

This position will likely only be held for minutes at a time, and as such, it’s not unusual for forex scalpers to conduct hundreds of these trades every day, and then exit trades quickly.

The one-minute forex scalping strategy can be done with any currency pair, though it’s typically easier to conduct this forex trading strategy with major pairs.

This is because they tend to have the tightest spreads, and since this strategy targets tiny price movements, wider spreads could eat into your potential profits.

Also, the time you attempt the one-minute forex scalping strategy could make a difference to your potential profits. The best time to attempt this strategy is reportedly during times of high volatility.

Price action scalping strategy

The price action scalping strategy involves the study of a currency pair’s price movements. To conduct this strategy, traders typically use historical data to identify any potential future trends.

Candle bars are a good technical indicator to use for this, as they give you details about an FX pair’s closing price, its opening price, and its high and low prices during specific times.

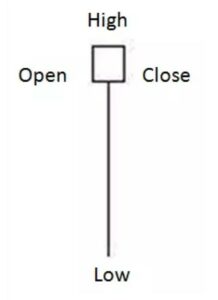

There are several different signals you can keep an eye out for on candle bar charts that could signify market trends. For instance, the “hammer” is a signal that markets are bullish and often shows a higher probability of markets moving upwards. This signal looks as follows:

Source: Admiral Markets

In this example, you would ideally buy a stake in a currency pair on the up-trend, then sell it again in short succession to turn a small profit as the price increases.

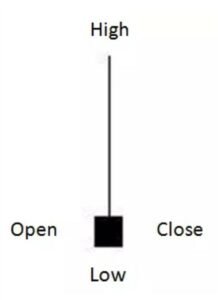

Another signal to keep an eye out for is the “shooting star”. This signal indicates bearish market conditions and a higher probability of the market moving downward. This signal looks as follows:

Source: Admiral Markets

When you see this signal, you could think about investing in a currency pair when the market finally manages to break the low. Then, when the closing price is in slight profit, you can sell your position for small gains.

There are several different signals and indicators worth keeping an eye out for when you conduct the price action trading strategy, which could make it less suitable for beginner traders.

Trend trading scalping strategy

Trend trading involves spotting and predicting trends before you make a trade. This is another form of day trading, as many separate trades are made over the course of a day.

When you conduct the trend trading strategy, traders often use scalping indicators, such as Bollinger Band charts, to predict trends ahead of time.

Since you’re required to spot trends in order to trend trade, scalp traders typically need experience timing the market, and as such, there tends to be a lower success rate when compared to other scalping methods.

Equally, when a trade does go your way, the profits tend to be greater. This is because you have analysed the market and predicted a trend before trading, so you have an idea of the price at which you’ll close your position.

This differs from more short-term scalping strategies, such as the one-minute method, as they rely on constant market monitoring to sell when the price increases slightly.

Range trading scalping strategy

When a forex currency pair’s price moves, it typically has thresholds that it normally trades between.

Traders who use the range trading scalping forex strategy will typically aim to buy a currency pair near its average low price, and then take a profit when it approaches its average high price. These thresholds are commonly referred to as “support” and “resistance” levels respectively.

The “support” is the level at which falling prices change direction and begin to rise, seen as a “floor” that holds up, or “supports”, prices. Meanwhile, the “resistance” threshold is the level at which prices stop rising and start to fall, often seen as a “ceiling” stopping prices from rising higher.

The range trading forex scalping system can be conducted at any time of the day, though you may find that it is most effective when the forex market lacks any obvious long-term trends.

To find periods with no discernable trend, you could try and identify overbought and oversold currencies.

To do so, you would aim to spot a currency pair moving between its lower support level and its upper resistance. For example, if a currency pair is exhibiting a “rectangular range”, it will typically look like this:

Source: Valutrades

As you can see, the price of this currency pair is moving between a higher resistance level and a lower support level. This is known as the “range”.

There are several other forex scalping indicators that would signify that range trading can be conducted, such as a “diagonal range”, which shows a sloped range, or a continuation range, which shows a trend in a triangle pattern.

Momentum trading scalping strategy

A momentum trading scalping strategy involves buying a particular currency pair when it is already on the rise, and then selling it when the price rise has peaked.

This is potentially one of the trickiest ways to scalp, as the strategy involves trading on very precise signals so you can figure out when a currency pair will peak. Momentum trades are commonly referred to as “swing trades”.

This strategy typically requires swing traders to have an in-depth knowledge of signals and indicators, as there are often plenty of false signals that can throw off your predictions.

It may also be wise to keep on top of any news that could move the price of a currency pair. When you know what’s happening in a country, you can more accurately predict how long a currency pair will rise for, and when it will peak.