The drama swimming in cryptocurrency markets—characterized by sagging asset values and a drumbeat of scandals involving crypto banks, investment firms, and exchanges—is generating a river of state legislation defining, licensing, and regulating digital assets.

An analysis of action across state capitals reveals more than 60 legislative proposals in 25 states addressing some feature of the love-hate US relationship with blockchain technology, virtual currencies, and nonfungible tokens—certificates of ownership for one-of-a-kind digital assets. Many of the measures would nurture the business climate for these assets with tax incentives and legal structures that pull them into broader commercial and tax codes. But a growing number of the bills seek to regulate businesses that invest, trade, or manage digital assets.

Pointing to this transition, legislative analysts say the states—particularly New Jersey, New York, and California—are shifting from a focus on business development to consumer protection.

“I’m seeing a mix of legislation that encourages cryptocurrency and digital assets, while seeing bills that protect against fraud,” said Heather Morton, a policy analyst at the National Conference of State Legislatures. “I would say that the majority of the bills are still focused on encouraging, but I do see more protection-type legislation than before.”

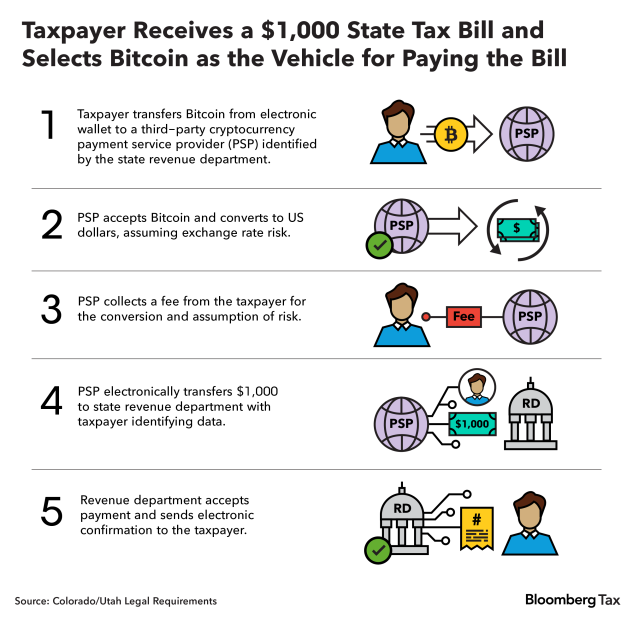

Ryan Maness, a tax analyst with the political consulting firm MultiState, said lawmakers expressed wide optimism for digital currencies during the 2022 legislative cycle. Bitcoin mining tax credit bills were debated in a half-dozen states. Colorado and Utah agreed to accept cryptocurrencies for the payment of taxes and fees. The 2023 legislative cycle will likely be shaped by the roughly 66% drop in the value of Bitcoin from its peak, and the bankruptcies of the digital asset lender BlockFi, the bank Celsius Network LLC, and—most glaringly—the exchange FTX.

“The question is,” Maness said, “How much will all the bad press affect lawmakers’ eagerness? So will this move them toward the consumer protection side, or will they continue to encourage the industry?”

Political handicapping is difficult during the early weeks of a state legislative session, but Maness said some of the licensing and consumer protection measures have reasonable chances of enactment, particularly in northeastern states. Bills protective of crypto mining in Republican-controlled state legislatures also could catch fire this year. Bills with a distinct libertarian flare—including an Arizona measure treating Bitcoin as legal tender—remain long shots.

Jersey’s Proposed Model

New Jersey is poised to enact perhaps the most comprehensive regulatory regime in the country, with bills moving quickly through the state Legislature.

The most prominent is the Digital Asset and Blockchain Technology Act, A2371/S1756, which creates an expansive licensing process for businesses that accept, store, trade, lend, or issue digital assets. If enacted, the bill also would impose a menu of record-keeping and disclosure duties on brokers, exchanges, and investment firms, plus arm the state with new enforcement authority.

Significantly, the bill would shift primary authority for regulation to the New Jersey Bureau of Securities from the Department of Banking and Insurance, said Christopher Gerold, who filed 23 enforcement actions against crypto and decentralized finance companies as chief of the securities bureau between 2017 and 2021.

“By allocating regulatory oversight of cryptocurrency to the bureau, the bill acknowledges the growing awkwardness of fitting quickly evolving cryptocurrency businesses within the antiquated money transmission framework, which is common in almost every state and was originally adopted to regulate check cashers and payment servicers,” said Gerold, who is now a partner at Lowenstein Sandler LLP in New York.

The bill passed the Assembly in October by a vote of 72-1. It won unanimous support in the Senate Budget and Appropriations Committee on Jan. 19.

New Jersey also is close to enacting a blockchain promotion program, A3288/S3142, which would nurture awareness of decentralized digital technologies and recommend strategies for integration into governmental and commercial functions. The bill won unanimous Assembly support last October.

A third bill would create the Virtual Currency and Blockchain Regulation Act, A1975/S1267, to provide certain incentives for virtual currency businesses to locate in New Jersey. Blockchain companies, including Bitcoin miners, would be exempt from sales tax on energy purchases and could claim income tax credits against jobs created in the state. The bill also would direct the state to develop a blockchain-based system to accept submitted tax returns. The measure passed the Assembly in October by a vote of 45-23.

New Jersey lawmakers also will consider A385/S3321, which would require the state to create a “digital payment platform” to support cash-heavy businesses without accesses to traditional financial institutions, such as cannabis retailers. The process would “facilitate regulatory compliance” and “allow for payment of sales tax to local municipalities,” according to the bill.

Across the Hudson

Across the Hudson River, lawmakers in New York could expand the state’s already substantial BitLicense rules and the recent ban on Bitcoin mining, said John Olsen, New York state lead for the Blockchain Association.

The 2015 BitLicence rules—which granted authority to the N.Y. Department of Financial Services to license, regulate, and discipline cryptocurrency businesses—blazed the trail for state crypto regulators. The state further irritated the industry last November, when Gov. Kathy Hochul (D) approved a two-year moratorium on new permits for mining operations powered by fossil fuels and proof-of-work authentication methods to validate blockchain transactions.

Rep. Clyde Vanel (D) is sponsoring several bills promoting the industry and protecting consumers. He’s already introduced A954, that would create a task force to study the impact of widespread cryptocurrency use on the state; A2599, that would form a task force to study options for a state-issued cryptocurrency; and, A2532, that would permit state agencies to accept crypto for payments of taxes and fees.

Vanel also is the author of an investor protection measure, A944, which would bring the offenses of virtual token fraud, illegal rug pulls, and private key fraud into the criminal code. New York, he said, must “create the proper guardrails for investors while blockchain technology and cryptocurrency are growing.”

Vanel and Olsen pointed to a possible anti-fraud bill from Attorney General Letitia James (D), who recently called for more aggressive crypto regulation.

“There have been too many abuses,” she said in her inaugural address. “Too many seniors and working people have lost their pensions and their hard-saved money as a result of these risky products.”

Golden State Outlook

California is another state operating with a new sense of urgency for regulating digital asset companies following the collapse of FTX. Gov. Gavin Newsom (D) vetoed a bill in September that would have established licensing requirements for crypto firms. Lawmakers already have drafted a replacement bill addressing the governor’s concerns.

Assemblymember Timothy Grayson (D) introduced AB39, which would grant the Department of Financial Protection and Innovation authority to license, regulate, and discipline digital financial asset businesses starting in 2025.

“It’s clear that licensure is the next natural step for this industry,” Grayson said. “And it is equally clear that until we take that step, Californians will continue to be vulnerable to prevalent and preventable financial scams.”

Mining Protection Bills

Several states are taking a friendlier approach. Missouri, Mississippi, Montana, and Oklahoma have introduced crypto mining protection laws.

The bills would permit small-scale Bitcoin mining in private residences and large-scale mining in areas zoned for industrial use. The proposed laws also would bar local units of government from imposing limitations on mining through zoning or noise ordinances, and bar utilities from creating discriminatory power rates targeting mining operators.

Montana’s legislation, SB 178, takes an additional step. It would bar the state and localities from imposing any “additional tax, withholding, assessment, or charge” when digital assets are used for payment.

The bills have drawn opposition from groups concerned about the potential loss of local control over mining facilities, which are frequently criticized for generating excessive carbon emissions and noise pollution. The Montana Environmental Information Center argues that the rulemaking authorities of the state Public Service Commission and local governments shouldn’t be restricted.

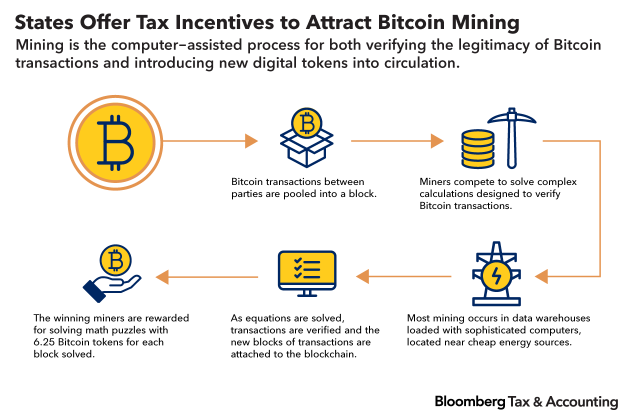

A few states are examining tax incentives for commercial mining operations, which have expanded quickly in the US after China officially banned Bitcoin mining in 2021.

Oklahoma is considering SB 1600, which would offer a generous tax credit against large capital investments in new mining operations. Lawmakers also will consider SB 443, directing the state to partner with mining companies to remediate orphaned oil and gas wells, and harness the energy to power mining facilities.

‘#Bitcoin Is Freedom’

A few states are pursuing measures reflecting some of the more libertarian ideology embraced by crypto true believers.

Several bills were introduced in January by Arizona Sen. Wendy Rogers (R), who’s considered to be a conservative firebrand and Bitcoin enthusiast. Last year she tweeted, “Centralized digital money controlled by the central bankers is slavery. Decentralized #Bitcoin is freedom.”

Rogers sponsored SB 1235, which would require Bitcoin to be regarded as “legal tender,” and SB 1493, which would permit Arizona to pay state employees in virtual currency. Another, SB 1239, would permit Arizona to accept cryptocurrency for any tax, fee, or fine payable to the state. Rogers also proposed SB 1240 and SCR 1007, which would call for a constitutional amendment stating that virtual currency is exempt from state taxation.

Colorado and Utah are the only states currently accepting crypto for tax payments.

Wyoming, another state with a rich digital currency history, will consider a plan creating a state-sponsored stablecoin—a type of crypto backed by fiat currency. The bill, SF 127, would create the Wyoming stable token, “a virtual currency representative of and redeemable for one United States dollar.”