franckreporter

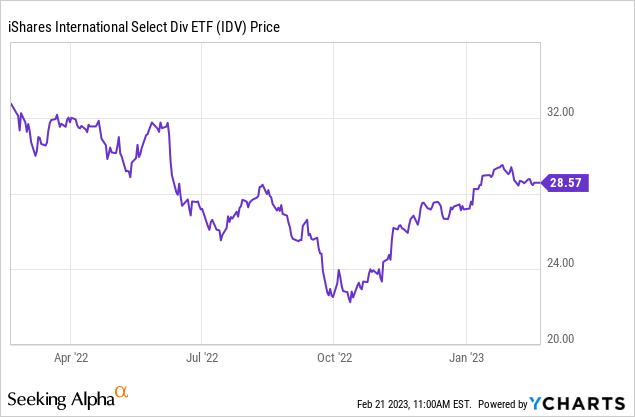

For income seekers looking to diversify away from U.S equities, the iShares International Select Dividend ETF (BATS:IDV) with its 7% yield is tempting, especially given that at around $28, its shares are more than 13% down in the last year.

Now, at a time when the Federal Reserve looks to continue to tighten monetary conditions in the U.S. together with economic slowdown concerns, some geographical diversification is indeed wise. But, there are risks involved. Thus, in addition to the downside risks of individual holdings because of specific country-level realities, the aim of this thesis is to look specifically at currency risks.

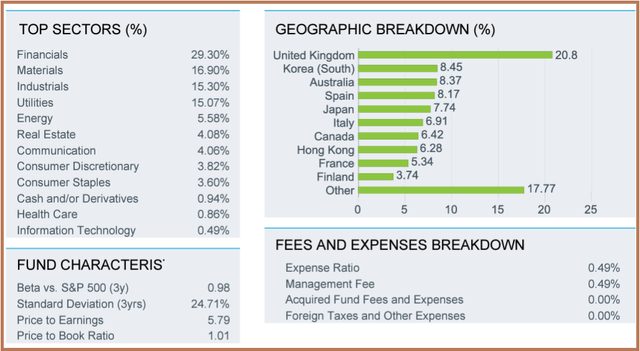

I start by identifying the holdings and the country-level exposure.

IDV’s Holdings, Country Exposure, and Dividends

As per the fund managers, this exchange-traded fund (“ETF”) provides exposure to one hundred established, high-quality international companies located in developed markets. In addition, similarly to dividend aristocrats back home, these are the stocks that have consistently made distributions to shareholders over time.

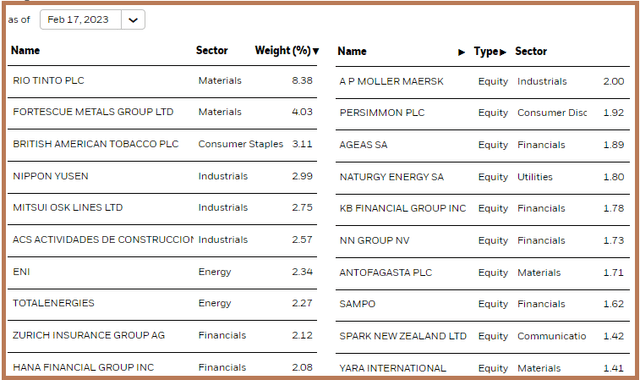

Thus, as seen by the list of the top holdings below, investing in IDV allows investors to diversify their income-seeking strategies to international markets without necessarily undergoing the pains of analyzing individual stocks.

Top 20 Holdings (www.ishares.com)

Now, in case you just glance at the top ten holdings in the left-hand side table above, without looking at the sector composition (as pictured below), you may believe that this ETF is composed primarily of companies from the materials sector in the form of Rio Tinto Plc (RIO) and Fortescue (OTCQX:FSUMF), without forgetting British American Tobacco (BTI) or Consumer Staples and industrial plays like Nippon Yusen (OTCPK:NYUKF).

However, a more detailed look at the holdings and sector exposure reveals a completely different picture, namely that IDV is composed of a significant portion of financial stocks, at 28.99%. This preponderance of financial names only becomes evident when looking at the stocks from the 11th to the 20th position as shown on the right-hand side.

Now, financial plays including banks form part of some of the highest dividend-paying stocks, and this is the reason why IDV pays a higher dividend yield of 7% when compared to the SPDR S&P International (DWX), which pays only 4.5%. The reason for DWX’s lower yields is due to the significant amount of utilities, at 21.88% of overall assets, and only 15.2% of financials.

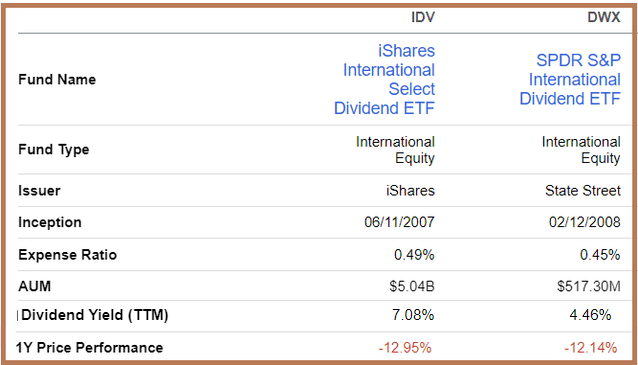

Thinking aloud, another reason for these two ETFs not paying the same yields also depends on the individual stocks they hold. Now, due to differences in the stocks held, their one-year performances should normally also vary considerably, but this is not the case as shown in the table below.

Comparison IDV and DWX (seekingalpha.com)

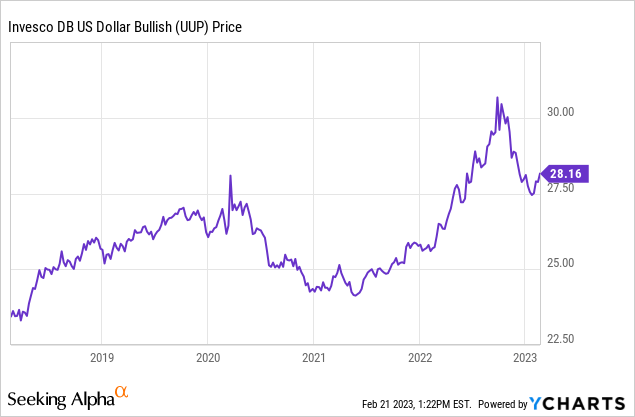

One of the reasons for this is the strong dollar.

Currency Risks

In 2022, the dollar went to its highest level since 2000, before retreating in October as shown in the chart below following bets by traders that the Federal Reserve would turn less hawkish as some economic indicators were indicating that inflation was increasing slower than expected. Today, it is the contrary, as there are some hints that the Fed will have to continue showing hawkishness in order to combat inflation, with higher rates providing support for the greenback. This higher probability of the Fed being hawkish has induced a V-shape recovery in the chart below, implying dollar strength.

Now, given its dominant position in international trade and finance, a strong appreciation within a short span of time should have significant implications for most countries. Diving at the corporate level, the fund management process involves iShares deploying investors’ capital from the U.S. to international markets to buy shares of publicly listed companies. Hence, in case the dollar-to-foreign currency rate is on the high side, the fund managers get more assets for the same amount invested due to the shares being priced in local currency. Consequently, when the value of the dollar continues to rise, the local currency gets devalued, implying that the total equity value of IDN’s assets is worth less in dollar terms.

Hence, due to currency-related risks, investing internationally involves risks of capital depreciation, in addition to the usual liquidity, and geopolitical risks of trading in the stock market. In this respect, the geographic breakdown shows the large diversity of countries where the fund is invested.

Top sectors and Geographic Breakdown (www.ishares.com)

Therefore, depending on prevailing foreign exchange in the countries where the investments have been done, returns can be negative, and this is what has happened with IDV as the dollar has strengthened.

This dollar factor also plays a role in the way countries fight inflation, as the weakening of their currency against the dollar makes things more complicated for their financial authorities. Thus, it is estimated that, on average, a 10% appreciation of the dollar has a 1% impact on inflation, but, still, investors should note that the iShares ETF provides exposure to developed markets, not to emerging countries.

Comparing with ETFs Holding U.S. Equities

Now, inflationary pressures due to a strong greenback can become particularly strong in emerging countries, because they are more dependent on imports than developed ones as the share of their imports invoiced in dollars is more. This not only creates wide imbalances in their balance of payments but also reduces the amount of money available to local governments for supporting the economy, thereby increasing recession risks.

Pursuing further, while higher borrowing costs (induced by hiking interest rates) also raise risks of a protracted economic slowdown in developed markets, the effects of a recession should be less devastating, namely because of the strength of the banking sector. Thus, as per S&P Global’s Global Banking Industry Country Risk Assessment, the majority of Europe’s and the U.K.’s banks provide for low to very low risks.

Here, with the U.K. and continental Europe constituting a combined 45% of the underlying fund (as pictured above), do expect some volatility during a recession, but not to the same degree as emerging markets. This provides some comfort to those who are long-time holders of IDV.

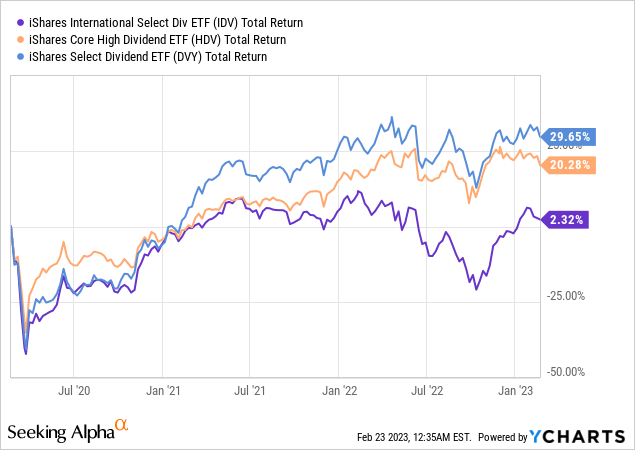

However, with uncertainty as to service inflation which has increased to 7.6%, its highest level in more than a decade, the U.S. central bank may have to maintain a tighter monetary policy for a longer period of time. For this matter, the Fed minutes on Wednesday 22 confirmed that more rate hikes would be necessary for controlling high inflation. Coincidentally, IDV started underperforming the iShares Core High Dividend ETF (HDV) and the iShares Select Dividend ETF (DVY) in March 2022 when the Federal Reserve started to raise interest rates as per the charts below.

Performance Comparison (seekingalpha.com)

I specifically mention HDV and DVY as these two hold U.S. equities and should normally have suffered more as a result of interest rates being increased by the Fed, thereby reducing business appetite in the country as a result of a sharp rise in borrowing costs. However, the fact that IDV’s international equities have suffered more, shows that it is the strong dollar that is more detrimental to IDV’s performance.

Discussion

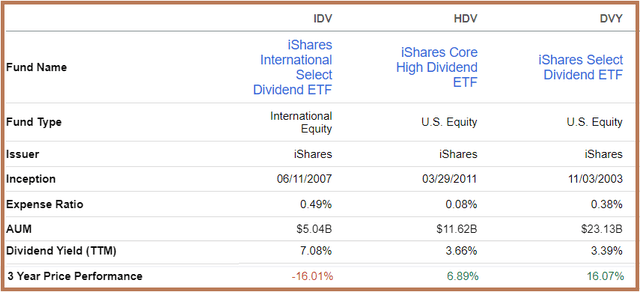

Thus, looking at the performance measured over a three-year period, IDV’s shares are down by 16%, in sharp contrast with either HDV or DVY, which are up, as shown in the comparison table below.

Comparison of performances and other metrics (seekingalpha.com)

The degree of IDV’s underperformance (-16%) even partly offsets its higher dividend yields (7%) and shows that focusing on the income potential alone does not make sense. At the other end of the spectrum, despite paying more modest, (but still above 3% yields), both U.S. equities-focused funds have enjoyed a more consistent performance, while also charging fewer fees.

For those who still have some doubts, I elaborate on the capital appreciation aspect in the charts below. These illustrate the total return which is the performance obtained after the dividends obtained are reinvested instead of being cashed out. Now, with a three-year return of only 2.32% despite its 7% dividend yields, IDV (in deep blue) lags behind its U.S. peers by a considerable amount.

Consequently, looking forward, with the Fed likely to remain hawkish in 2023, it is preferable to opt for local equities, unless you are a long-term holder of IDV.

Conclusion

By going through the list of holdings and country-level exposure, this thesis has explained the reasons for IDV’s high dividend yields. Also, the fact that it provides exposure to developed markets implies a lesser degree of volatility than for emerging market funds in case global recessionary risks become more acute as interest rates across the board remain high.

On the other hand, taking into consideration capital appreciation and total returns, the iShares International Select Dividend ETF has underperformed its U.S-equities peers considerably at a time when the dollar has appreciated. Finally, unless you already hold it for the long term as an income source, it is not the right time to make a fresh investment.