On 30 December 2022, the State Bank of Vietnam (SBV) issued Circular 20 guiding activities of one-way money transfer from Vietnam to abroad and payment, money transfer for other current transactions of institutional residents and individual residents (Circular 20/2022), which took effect from 15 February 2023. In this post, we summarise certain key points of Circular 20/2022.

1. Permitted purposes and transfer limits

Iinstitutional residents

1.1. For the first time, the SBV provides a detailed guidance on permitted one-way overseas money transfer purposes and overseas money transfer limits applicable to organizations. In general, organizations may transfer money abroad for (i) providing financial sponsorship and aid, (ii) giving rewards to overseas non-residents participating in programs and contests held in Vietnam, and (iii) other purposes using funding sources received from overseas non-residents, including allocating funds to overseas participants of scientific research projects and topics, and refunding sponsorship money for projects in Vietnam under commitments and agreements with foreign parties.

1.2. The specific foreign currency amount permitted to be transferred will base on the supporting documents. However, if the transfer is for financial sponsorship and aid for programs, funds and projects for the development in the field of culture, education (i.e. scholarship funding) and health, the transferred amount for each time will be limited at USD 50,000 (or an equivalent amount in other foreign currencies). Circular 20/2022 does not impose any specific limit for remaining purposes.

Individual residents

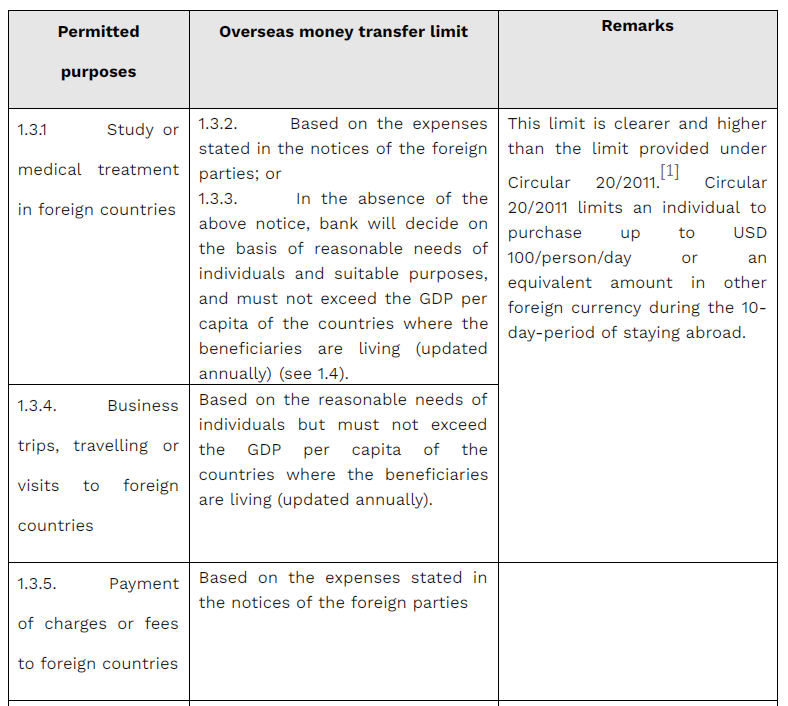

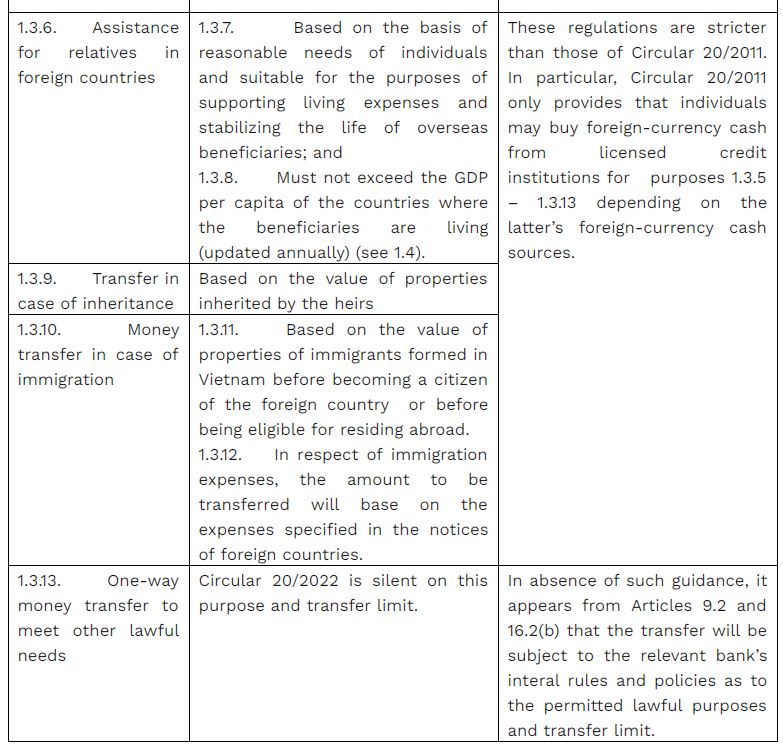

1.3. The table below sets out the purposes and limit which an individual resident can transfer abroad:

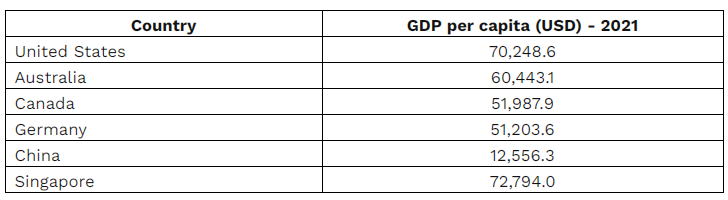

1.4. Below is the GDP per capita in USD for the year 2021, which is the latest information published on World Bank’s website, of some countries:

2. Sources of money

2.1. Foreign currencies transferred abroad by organizations must come from either of the following sources: (i) foreign currencies available on payment accounts; (ii) term deposits in foreign currencies; or (iii) foreign currencies purchased from licensed banks.

2.2. The sources of foreign currencies used for transfer overseas by individuals include (i) the aforementioned sources, and (ii) savings in foreign currencies, and (iii) own foreign currencies source.

3. Further guidance on payment and money transfer for other current transactions

3.1. Circular 20/2022 further clarifies “the payment and money transfer for other current transactions” of organisations and individuals prescribed under Article 4.6(g) of the Foreign Exchange Ordinance 2005 to include the payment transactions relating to:

3.1.1. international sale activities such as temporary import/export, re-export, re-import, transit, sales agent, processing of goods, sale and purchase of goods via Commodity Exchange;

3.1.2. social insurance contributions and social insurance payment;

3.1.3. insurance/reinsurance premiums, insurance compensation and benefits, etc.;

3.1.4. legally effective decisions or judgments of courts or arbitrations, or decisions of competent Vietnamese authorities; and

3.1.5. fines and compensation for property damage or injury that have not been covered by insurance.