A rare Yuan settlement between Bangladesh and Russia as part of a $12 billion nuclear power plant collaboration may have ushered in a new front to progress the Chinese currency’s use overseas, but de-dollarization progress will remain limited due to Beijing’s tight control of its financial system and capital account, analysts said.

Bangladesh and Russia agreed to use the Yuan to settle payment for a nuclear plant Moscow is building in the South Asian country, a Bangladesh government official said earlier this week, reports the South China Morning Post.

Russia had wanted the payment to be made in Rouble “but that’s not possible for us”, Uttam Kumar Karmaker, a senior official with the Bangladesh Ministry of Finance, said according to Reuters.

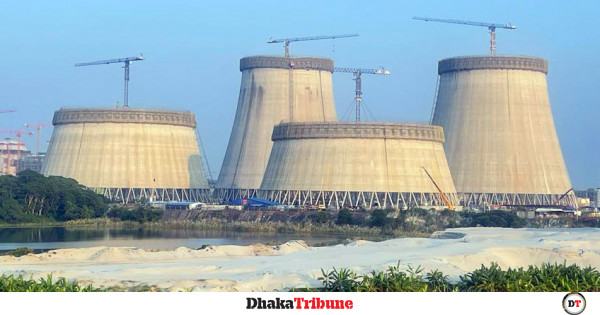

Bangladesh is constructing the first of two nuclear power plants in collaboration with Rosatom – a state-owned atomic energy company – as part of a US$12.65 billion project, 90 per cent of which is financed through a Russian loan repayable within 28 years, with a 10-year grace period.

Beijing has seen a higher share of its currency used in trade finance, international payments, foreign exchange transactions and central bank reserve assets, although they are still quite small compared to the US dollar.

Many countries are also dumping their US treasury bills, increasing gold reserves and settling bilateral trade in local currencies.

The world’s second-largest economy has not set a target for Yuan internationalization, but it is wary of US dollar weaponization as Russia was largely kicked out of the US dollar system following its invasion of Ukraine last year.

“A crucial determinant of whether the [Yuan] can go beyond low-threshold internationalization will be whether it can achieve sufficient network effects to be used in transactions not involving Chinese entities,” according to a report released by the Washington-based Centre for Strategic and International Studies on Tuesday.

“Currently, there is little evidence of [Yuan]-denominated trade settlement that does not directly involve China, except possibly between Russia and a few other countries.”

The decision to settle their deal in Yuan resolves a year-long payment deadlock between Bangladesh and Russia.

Dhaka had been unable to pay Moscow using US dollars after Russia was banned from accessing the Society for Worldwide Interbank Financial Telecommunications (Swift) international money transfer system last year.

The transaction will now be completed in Yuan via the Cross-border Interbank Payment System, which was developed by China in 2015.

“Bangladesh has opted against using the US dollar because its currency has fallen sharply against it, and it is running low on US dollar reserves,” Jayant Menon, a senior fellow at the ISEAS-Yusof Ishak Institute in Singapore.

“There are country-specific factors at play here.”

This may provide Beijing with a new direction to advance the use of the Yuan in some of China-led organizations, including BRICS – the association of five major emerging national economies of Brazil, Russia, India, China and South Africa – and its Belt and Road Initiative.

Brazil, the largest South American country, has also agreed to settle bilateral trade and investments in Yuan, and called for more local currency settlement within the Brics bloc.

“Why should all the countries use US dollars for settlements and not the Yuan or other international currencies,” Brazilian President Luiz Inacio Lula da Silva said during his visit to China last week.

“We are in the 21st century, and we can do something different.”

Beijing has already been working with Middle Eastern countries to accept the Yuan for oil transactions, which has been priced almost exclusively in US dollars for decades.

President Xi Jinping visited Saudi Arabia, China’s largest source of crude oil imports and a key partner of the Belt and Road Initiative, in December to attend the Gulf Cooperation Council and said there should be a new paradigm for energy cooperation.

Menon said there is a broader trend emerging within some BRICS countries to avoid the use of US dollars, “but it is still early days and volumes remain low”, he said.

“Opening up the capital account before reforming the financial system can be a highly risky exercise. Strengthening the domestic capital market prior to additional liberalization of the capital account will be critical,” Menon added.

“It is only through these measures that the internationalization of the Yuan will increase, and that is a long way off.”

Gary Ng, a senior economist at Natixis, said the growing economic power in the developing world and the autonomy of monetary policy without the influence of the United States has pushed the increasing influence of the Yuan among China’s key trade partners.

“Most countries need to trade in the dollar even if the US is not the biggest trading partner. To some, it can imply unnecessary exposure to the dollar, such as the US monetary policy, as BRICS now has a comparable GDP size of the G7,” said Ng, referring to the Group of 7 (G7), which is made up of the seven major advanced economies, including the US.

“China wants a greater role in the global financial system and geopolitical influence. For others, it can be about greater control over their trade and capital flows, foreign relations and geopolitical power play in reducing their dependence on the dollar.”

Ng said, however, while Yuan transactions and its importance in trade may increase in the future, it cannot fully replace the US dollar because of its own risks and limitations, such as less liquidity and China’s closed capital account.

“De-dollarization may not always be a good thing. Most debt is denominated in dollars, and the de-dollarized countries still need a reserve currency with strong confidence from markets and high liquidity,” he said.

“Let’s not also forget the freely convertible nature versus the [Yuan]. [The] dollar is still the No 1 choice in this aspect.”

This article was first published in the South China Morning Post