- The EUR/USD pair challenges critical support.

- The US UoM Consumer Sentiment should bring high action later today.

- The downside pressure remains high, so a new lower low activates more declines.

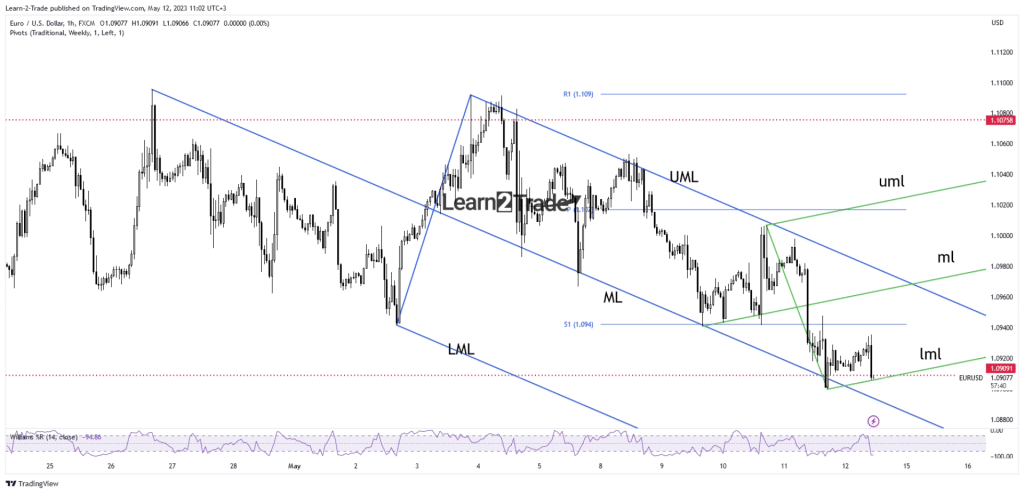

The EUR/USD price dropped as low as 1.0899 yesterday, registering a fresh low. Now, the pair is trading at 1.0907 at the time of writing. The bias remains bearish, so a deeper drop seems probable.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

Despite mixed US data reported yesterday, the greenback remains strong in the short term. The PPI rose by 0.2% less compared to the 0.3% growth estimated. Core PPI registered a 0.2% growth as forecasted, while Unemployment Claims jumped to 264K in the last week, far above the 245K expected.

Today, the United Kingdom’s economic data brought some action to the financial markets. The GDP and Index of Services came in worse than expected, while Manufacturing Production, Industrial Production, Goods Trade Balance, Prelim Business Investment, and Construction Output came in better than expected.

Later, the US UoM Consumer Sentiment represents a high-impact event and could bring more action. The economic indicator is expected at 63.0 points versus 63.5 points in the previous reporting period.

Furthermore, the Prelim UoM Inflation Expectations and Import Prices data will also be released. Positive US figures could lift the greenback.

EUR/USD price technical analysis: Upside correction

Technically, the EUR/USD pair registered a strong downside movement after registering only false breakouts above 1.1075. It has dropped within the descending pitchfork’s body and has reached the 1.0909 key level.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

As you can see on the hourly chart, the pair. The price has registered only false breakdowns below this obstacle, and now it moves sideways. Now, it has dropped to retest the 1.0909 support level. New false breakdowns may announce a potential leg higher.

On the contrary, a new lower low activates more declines. From the technical point of view, the median line (ML) of the descending pitchfork represents dynamic support.

Observing the smaller ascending pitchfork shows that if the price stays above the lower median line (LML), the currency pair could jump higher.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money