USD, EUR/USD, GBP/USD, USD/CAD Talking Points:

- It’s been a range-bound week in the US Dollar so far with drive coming from both FOMC on Wednesday and the ECB on Thursday. Focus shifts to the NFP report out of the United States for tomorrow morning.

- EUR/USD has relented after a failed test at the yearly highs but GBP/USD has continued to push, setting a fresh 11-month high earlier this morning. USD/CAD is showing consolidation ahead of tomorrow’s jobs report that will be released alongside the NFP report at 8:30 AM ET.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

There’s another pocket of headline risk on the calendar for tomorrow morning with the release of Non-farm Payrolls but another factor has come back into the equation as regional banks in the United States are under pressure again.

When this theme showed up in March, it led to lower US yields and a weaker US Dollar, helped along by EUR/USD jumping right back to a key resistance zone around the 1.1000 handle. And while stocks saw some initial pressure on March 9th and 10th, the next week brought a bounce as lower rates seemed to help buffer the fear.

But yesterday, just after Jerome Powell voiced confidence in the banking system, banking risk showed back up with PacWest. And this of course comes along with fears of contagion, as the hope that banking jitters were in the rear view has now been nullified and, like 2008, the plot continues to thicken as more banks come under pressure.

Now, that’s not to say that this is another 2008 nor does it suggest that it isn’t: But markets abhor uncertainty and that’s precisely what we have in front of us right now. This can stoke risk aversion as investors re-prioritize, from looking for a return on capital to a return of capital. This is what helps to explain Yen-strength in such scenarios, despite the Yen being a lower-yielding currency than the US Dollar or Euro of British Pound. This helps to explain the Yen-strength that will often accompany risk aversion scenarios even though the JPY is one of the lowest-yielding currencies in the world.

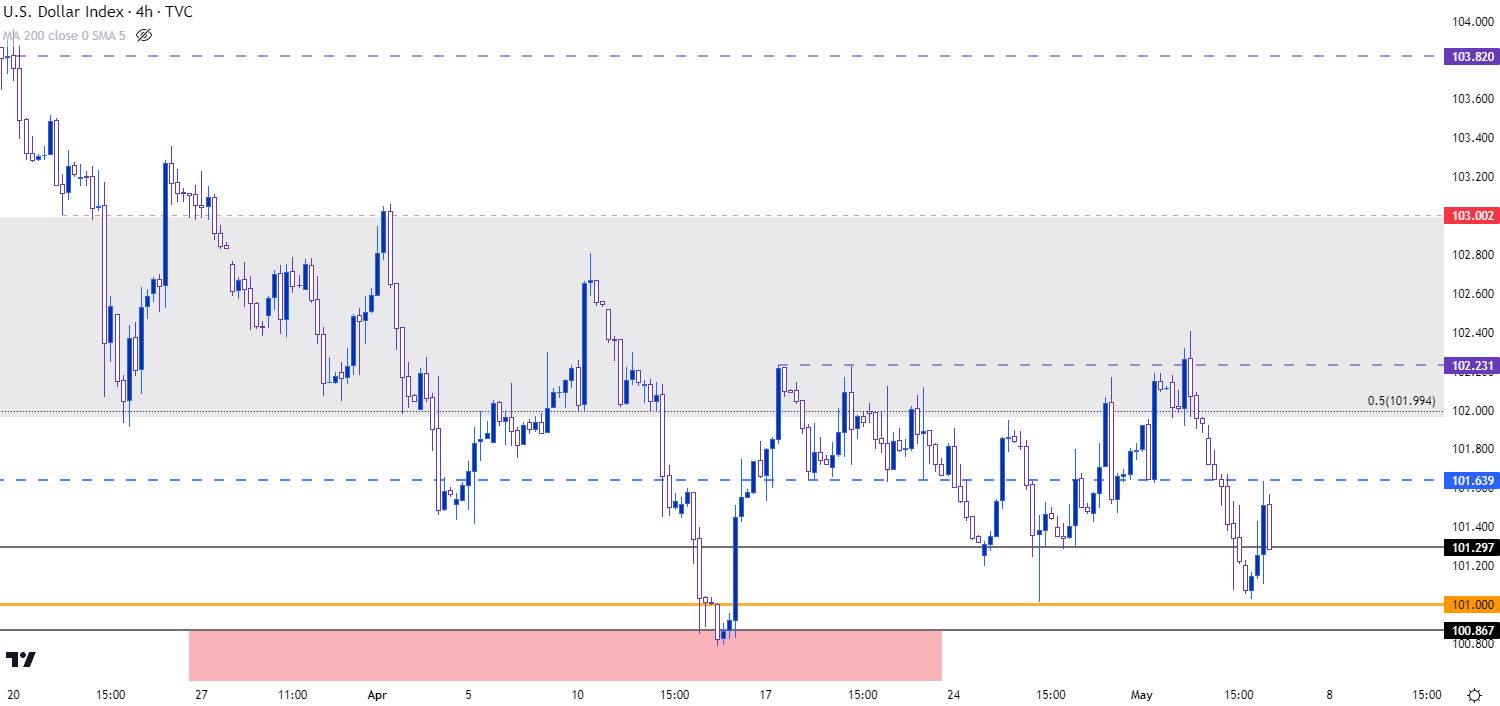

Tomorrow brings the April NFP report to markets and at this point, the US Dollar has held its key support at 100.87, keeping the door open for the double bottom provided that the low remains unfettered into the end of the week.

US Dollar – DXY Weekly Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

On a shorter-term basis, the USD continues to exhibit tonalities of a range, with price making another trip to support after a resistance inflection earlier in the week. So far buyers have held support above the 101 handle in DXY which came into play after the FOMC rate decision on Wednesday. But, notably, the currency got a boost around the ECB rate decision the morning after and price has moved back to the familiar area of 101.64, which has shown as both support and resistance over the past few weeks as the DXY range built.

Above that level is resistance potential at 102 and then 102.23 comes into the picture; with the 103 level looming large overhead.

US Dollar – DXY Four-Hour Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

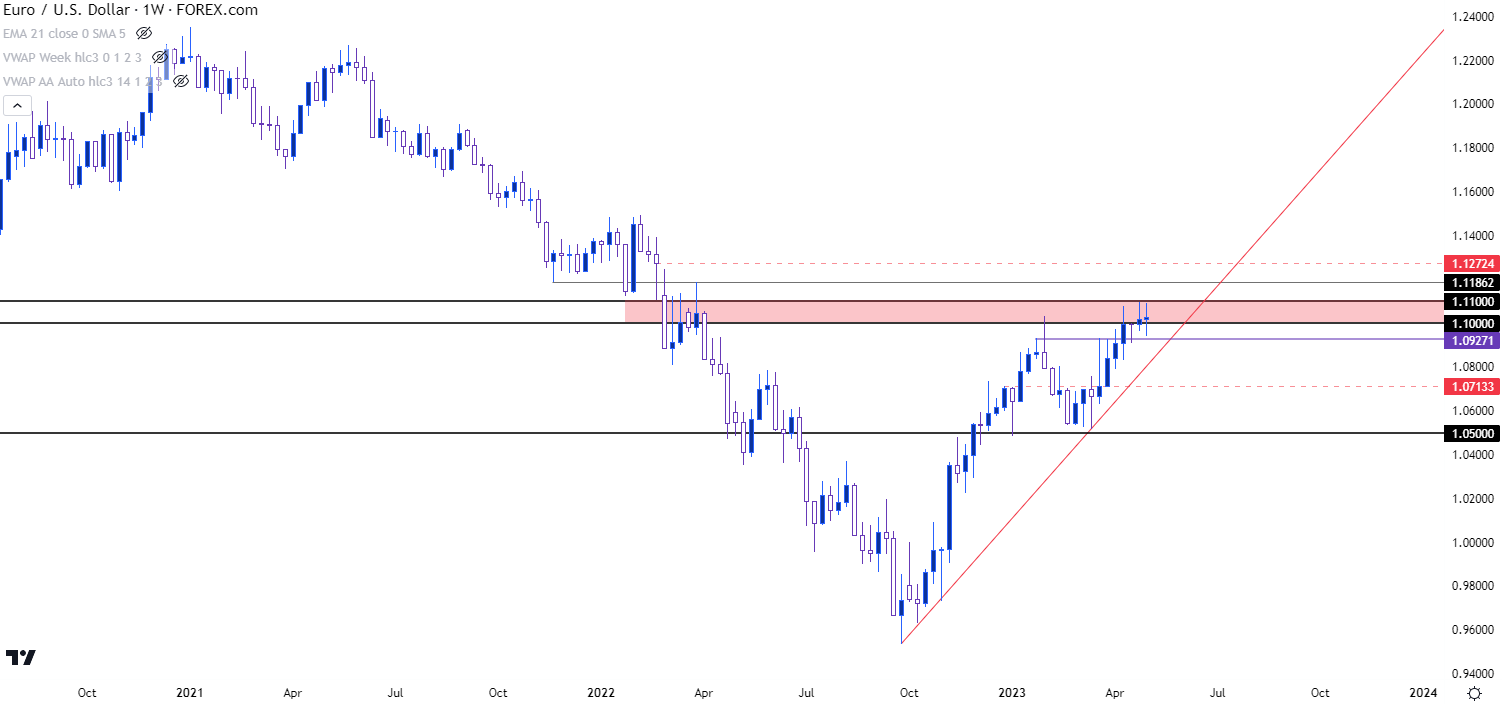

EUR/USD is still holding very near resistance but, at this point, bulls have shied away from the prior high this week.

EUR/USD Weekly Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

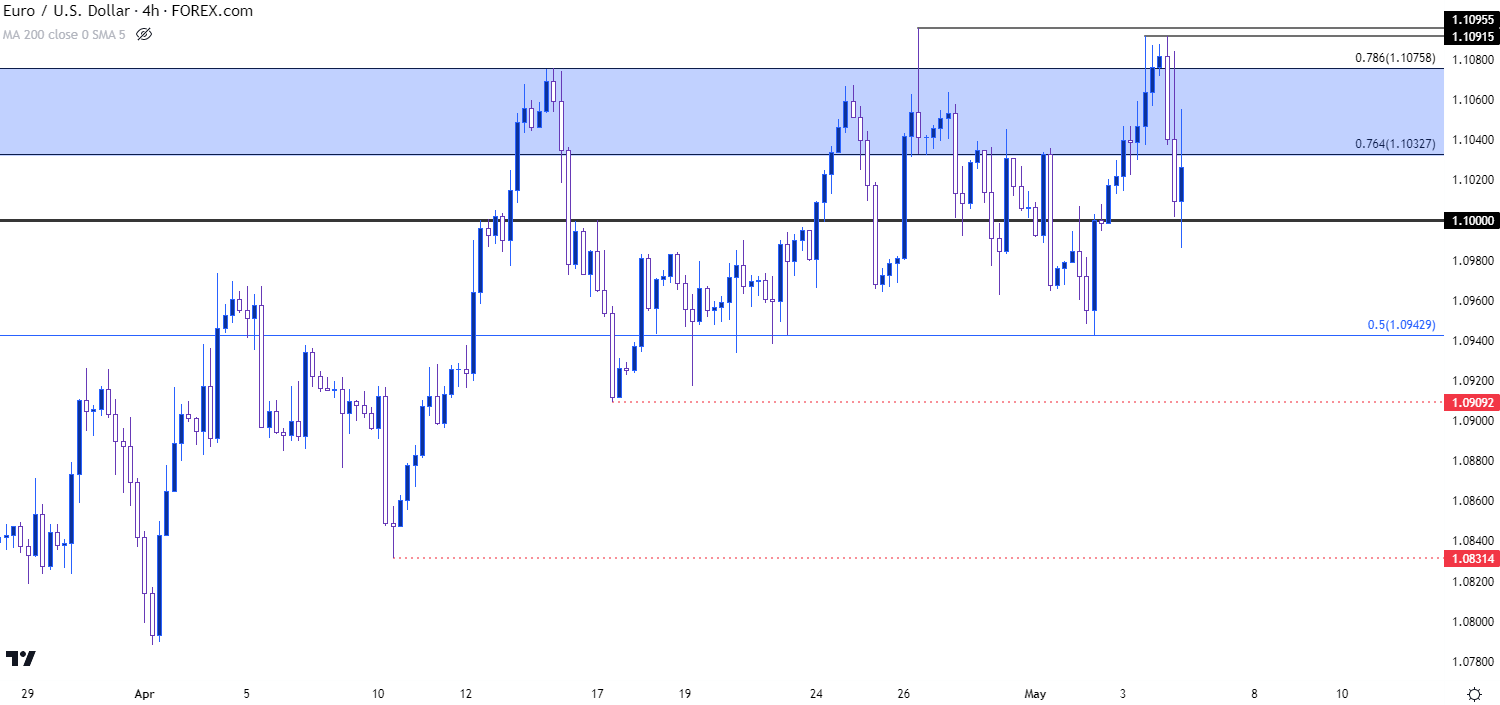

Last week set a swing high at 1.1096 in EUR/USD before prices pulled back to the 1.0943 Fibonacci level for a support test, which showed on Tuesday. But, after that support test EUR/USD made a beeline back up to the highs and came very close to re-testing last week’s high, falling just four pips short over two consecutive attempts both before and after the FOMC rate decision yesterday.

This morning’s ECB-fueled drop pushed the pair right back to the 1.1000 level, which has since helped to hold support. This keeps the matter as somewhat non-directional going into tomorrow’s NFP report as the near-term range in the pair remains in-place.

But, given the reaction this week from 1.0943 Fibonacci support, there’s a couple of interesting possibilities to work with.

Going back to the prior weekly EUR/USD chart, a breach below the 1.1000 handle on a weekly basis will give greater appeal to the longer-term resistance that remains in-place, perhaps even opening the door to bearish trend scenarios. That would seem to sync with a USD-bottoming thesis, so would probably need to be supported by USD-strength after tomorrow’s NFP print.

On the long side of EUR/USD, a breach of 1.1096 opens the door for fresh yearly highs, with follow-through resistance potential around 1.1121 and 1.1186.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

GBP/USD 11-Month High

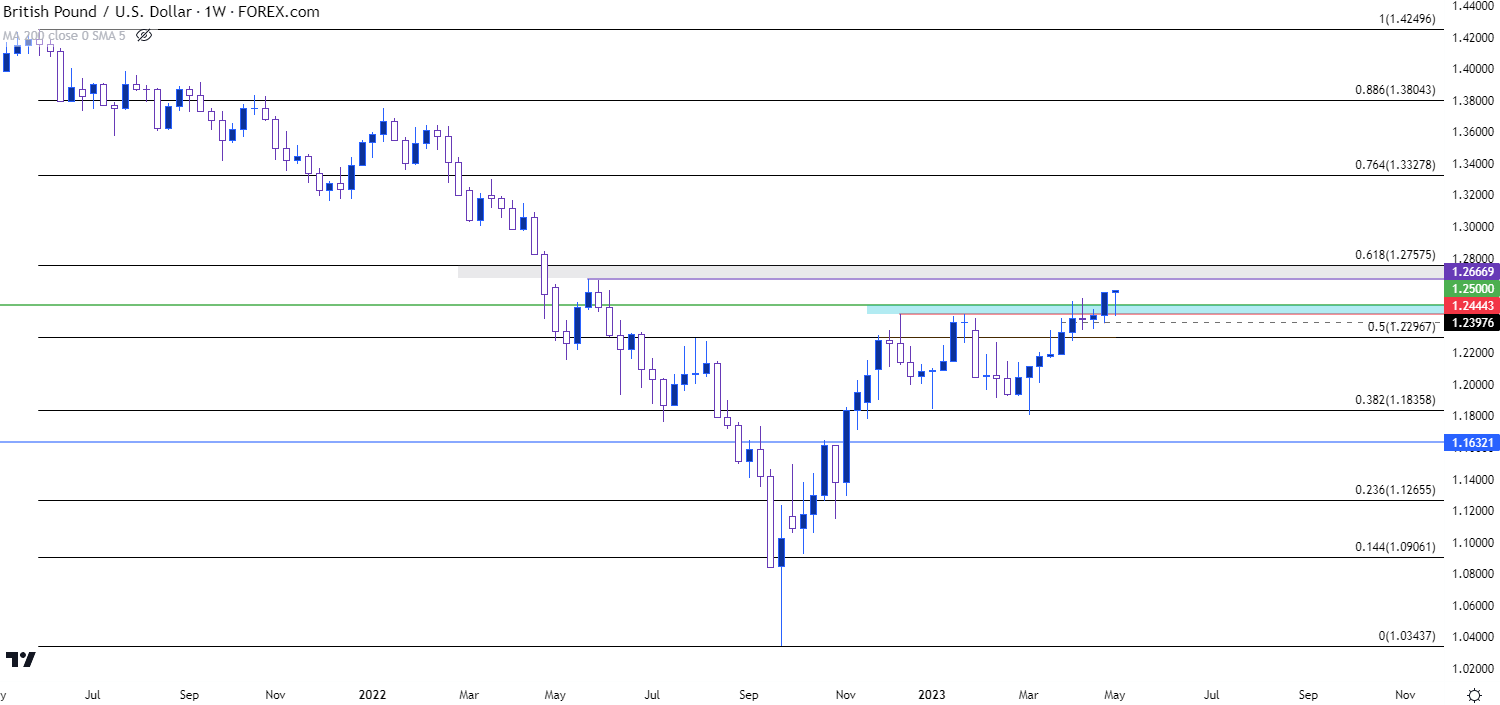

Next week brings a Bank of England Super Thursday rate decision. GBP/USD has pushed up to a fresh 11-month high this morning after a strong response from a key level at 1.2444.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

The weekly bar at this point is impressive with a little more than a day left to go. It’s currently showing as a dragonfly doji but it also has a similar appearance to a hammer. The low for this week is at a familiar area of prior resistance, the same 1.2444 that was in play twice in December and January to help set the highs. And we can see that zone offering resistance until last week’s breakout beyond the 1.2500 level.

As this week opened the breakout pulled back but has so far been bid from a higher-low. If bulls can force some additional pressure into the end of this week, shaping that weekly candle into a legitimate hammer formation, the door will be open for bullish continuation scenarios with focus on next resistance around the 1.2758 area on the chart.

GBP/USD Weekly Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

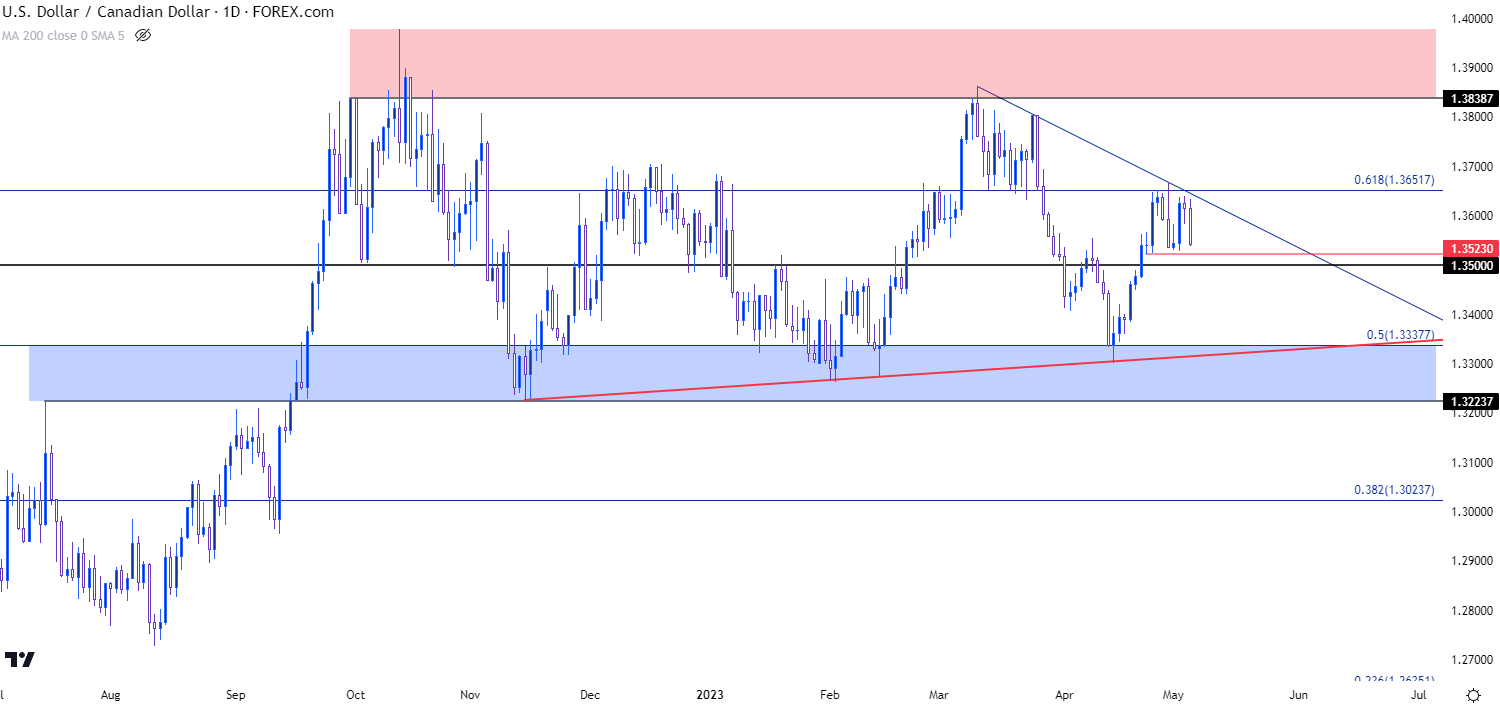

USD/CAD

Tomorrow at 8:30 AM ET could be especially pensive for USD/CAD as both economies will be reporting labor data at the same time.

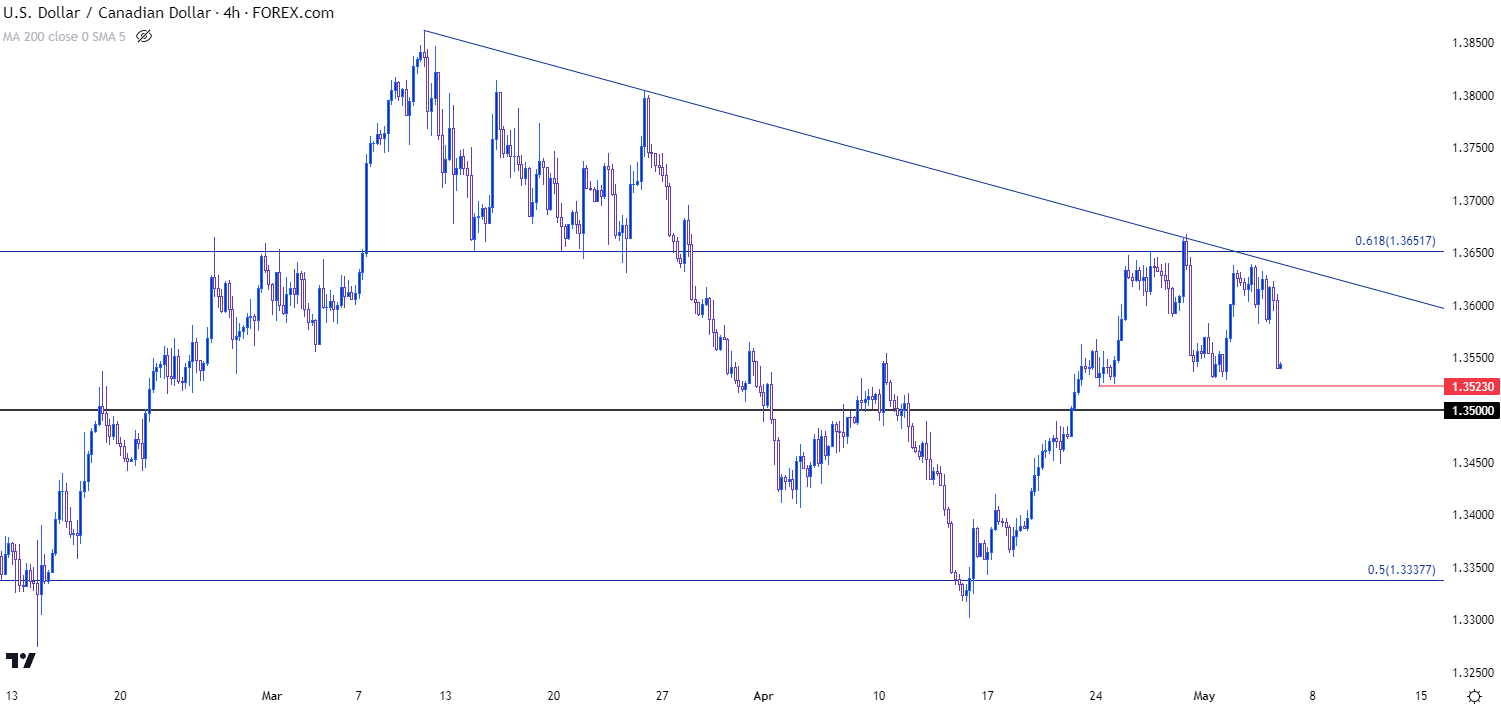

USD/CAD had an attractive bullish trend in the latter-half of April that started to pullback ahead of the May open. As discussed in these articles, it was the 1.3652 level that was notable, as this was a spot of prior support that came back as resistance over a three-day sequence last week. The drop from that level led into a bounce up to a lower-high, with price remaining below both the 1.3652 price and the bearish trendline connecting swing highs from March and late-April.

USD/CAD Daily Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

The big question now is whether sellers can turn this into something more than a pullback. There’s a couple of spots of support potential sitting just below current price, around 1.3523 and then around the 1.3500 big figure.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

— written by James Stanley, Senior Strategist