Japanese yen and USD/JPY takeaways

- The US dollar is among the day’s weakest major currencies after the cooler-than-expected US CPI report this morning.

- USD/JPY is still holding above confluent support in the 134.00 zone, keeping a near-term bullish bias intact.

- A break below that area could lead to a deeper pullback toward previous support near 132.00 or even 130.00.

USD/JPY fundamental analysis

This morning’s US CPI report, which came in a tick below expectations on the headline reading (4.9% y/y vs. 5.0% eyed) and in-line with expectations on the core reading (5.5% y/y), has led to a surprising amount of selling pressure in the US dollar today.

As is often the case with US economic data, expectations for the CPI report’s impact on Federal Reserve policy is the “transmission mechanism” to market prices.

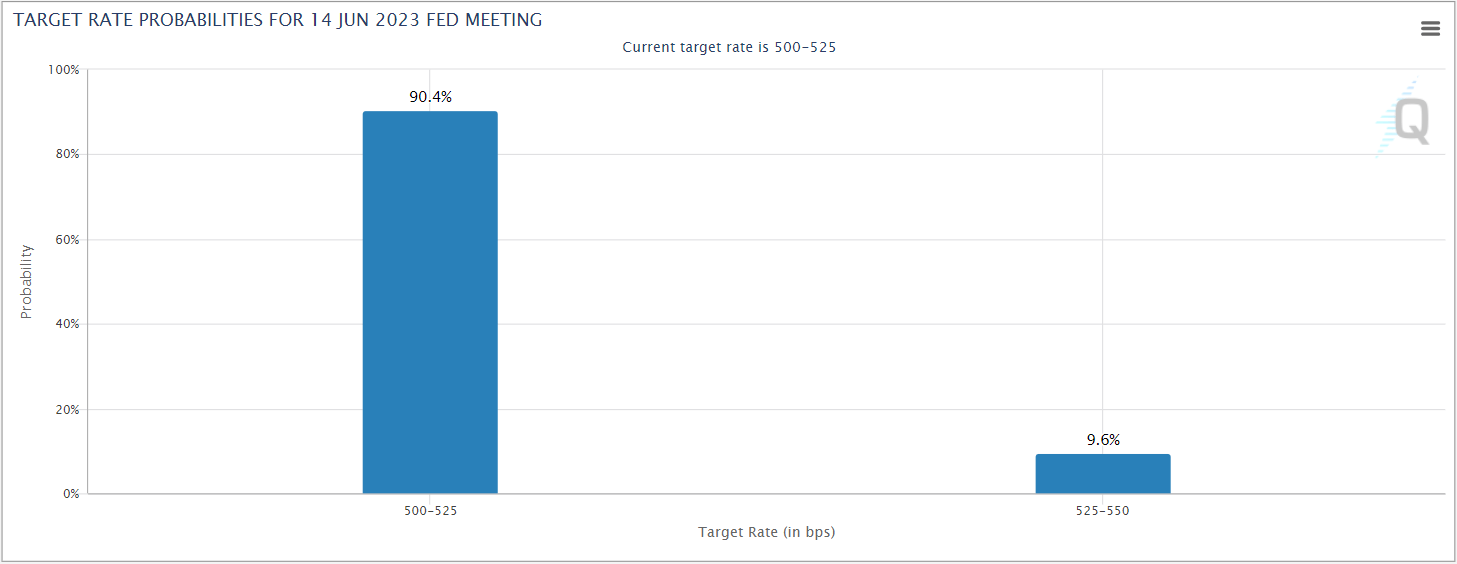

In other words, Fed Chairman Jerome Powell left the door open to another interest rate increase if warranted by economic data in last week’s Fed meeting, but the bar was always going to be high given the concerns about the past rate hikes and the fragility of the banking system. Today’s cooler-than-expected inflation report essentially dashed those hopes, and traders are now pricing in just a 1-in-10 chance of a rate hike from the Fed in June, down from ~20% pre-CPI:

Source: CME FedWatch

Of course, interest rate differentials and monetary policy divergences are especially stark in yen crosses, given the Bank of Japan’s perpetually dovish policy. Even under new Governor Ueda, the central bank appears likely to leave interest rates near the zero lower bound for the foreseeable future, with quantitative easing continuing apace.

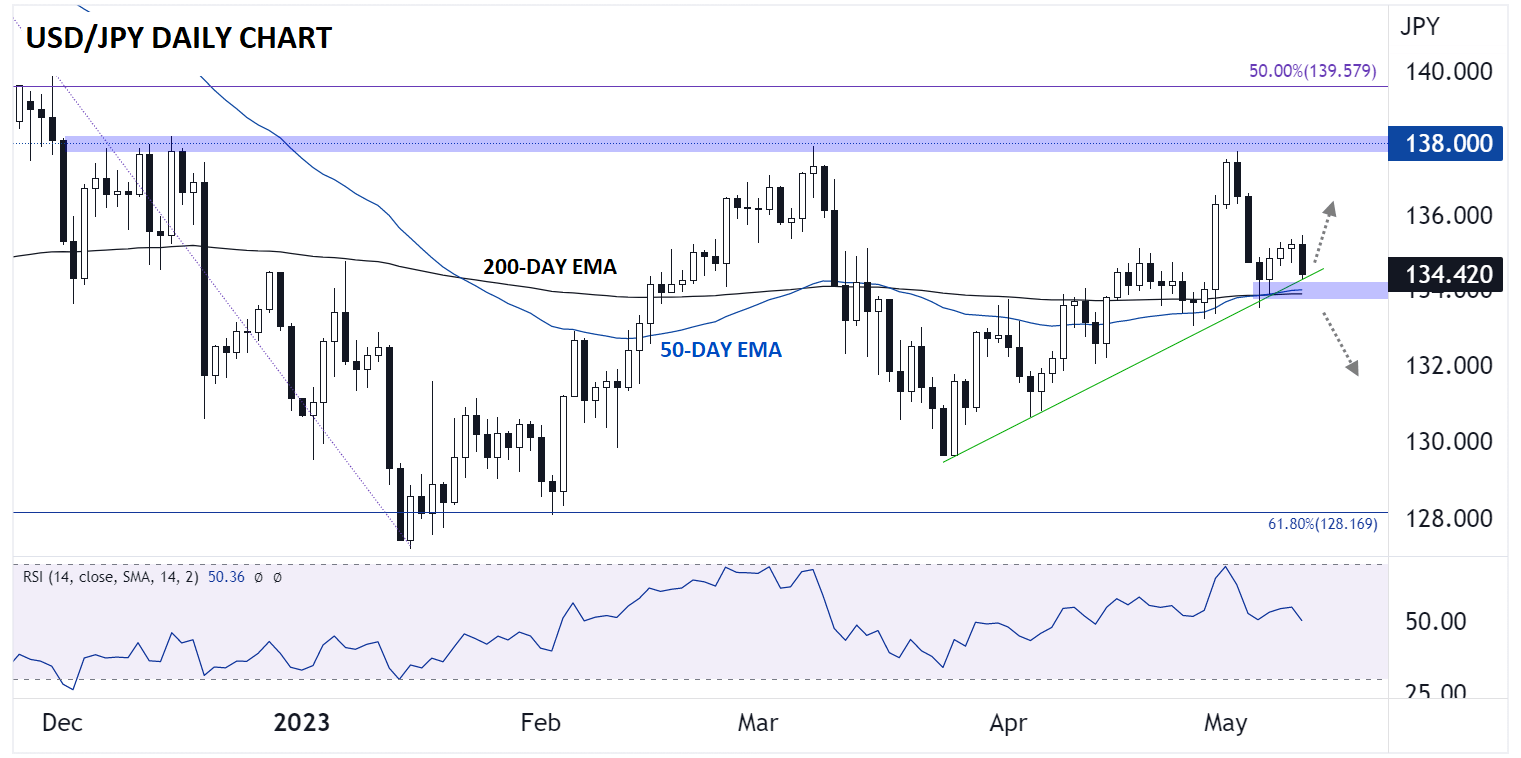

Japanese yen technical analysis– USD/JPY Daily Chart

Source: StoneX, TradingView

Looking at USD/JPY, the pair is still holding above a short-term bullish trend line, as well as its 50- and 200-day EMAs in the 134.00 area despite today’s weakness in the greenback.

As long as that support confluence holds, the path of least resistance for USD/JPY continues be to the topside, with room for a potential rally back to previous resistance in the 138.00 area if bulls can get into gear heading into next week.

Meanwhile, a break below support in the 134.00 area would open the door for a deeper pullback toward previous support near 132.00 or even the March lows around 130.00 in time.

— Written by Matt Weller, Global Head of Research