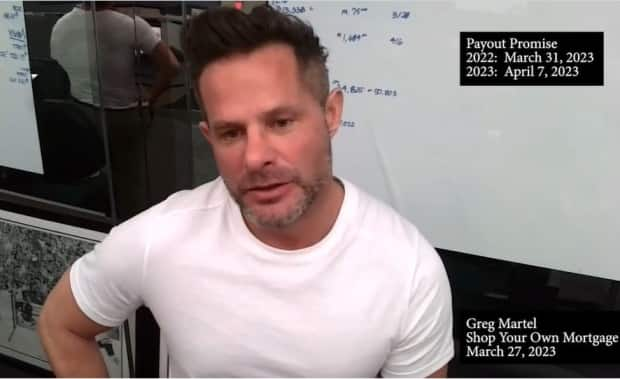

The Victoria mortgage broker at the centre of a growing financial scandal says he’s not running a Ponzi scheme even though gloomy investors heard details Friday that their missing money is likely gone for good.

In a statement emailed to CBC, Greg Martel said his company My Mortgage Auction Corp. (MMAC) has “… the ability to enable all investors to recoup their investments.”

“As you know, on May 4, My Mortgage was placed into receivership,” he said. “That is regrettable, but My Mortgage is not insolvent nor, as has been alleged, is it a Ponzi scheme.”

Martel is the sole director of MMAC which sold high interest bridge loans as investments. For example, court documents showed one deal that promised a return of 16 per cent on an eight-week investment of $50,000, returning $8,000 in interest.

The receivership was granted at the request of an Alberta numbered company that claims MMAC and Martel owe it over $17.6 million dollars.

The number of investors caught up in the scandal is unclear, but on Friday, over 500 people attended an investors virtual town hall organized by receiver PricewaterhouseCoopers (PwC). As court-appointed receiver, PwC is charged with finding MMAC’s assets, liquidating them and dispersing whatever money results from the process.

In one particularly distressing detail, PwC partner Neil Bunker disclosed that to date, investigators have not found any concrete information supporting the existence of $186 million in loans receivable MMAC listed as assets in its September 2022 financial statement.

Missing records

“These are the loans investors thought they were investing in,” said Bunker. “At this stage, the receiver has yet to locate any records that support the loans receivable balance. It would be ideal if Mr. Martel would provide us that information, but so far he’s chosen not to do that.”

Bunker was asked by investor Kalia Leslie if the investments were real or just a Ponzi scheme.

“If there are no records it certainly points to the concept that this was a Ponzi scheme,” he said.

A Ponzi scheme is a form of fraud where investors are lured into a non-existent enterprise that pays out early investors with the funds put in by investors buy-in later. American Bernie Madoff was convicted of masterminding a $64.8-billion Ponzi scheme, the largest in history. He died two years ago in a U.S. prison.

Bunker said former MMAC employees, including Shop Your Own Mortgage CEO Julie Lyons, have been co-operating with the receiver. Lyons was singled out in an affidavit from a Nanaimo, B.C., investor who claimed she continued to sell him investments totalling $318,000 in March of this year, even though MMAC was already defaulting on client payments.

$279.98 remaining in company bank account

According to Bunker, assets located so far include two heavily mortgaged properties purchased in 2022: a 4,170-square-foot, five-bedroom home in Langford, B.C. — about 14.5 kilometres west of Victoria — and a 9,220-square-foot, six-bedroom home in Las Vegas, along with a number of motor vehicles and cash of just $279.98 in an MMAC bank account, through which $58 million dollars flowed between Nov. 4, 2022 and May 3, 2023.

“Right now, we haven’t found a lot,” Bunker told investors.

The exact whereabouts of Martel is unknown, although on social media he lists his residence as Newport Beach, Calif. Process servers were unable to find him in Victoria and a court summons was emailed to him. CBC has made a number of interview requests via texts and emails to Martel.

So far, court proceedings against him have taken place ex parte, meaning without his participation or representation. The next court date is May 17.

A report prepared by PwC noted that Martel transferred “significant” MMAC funds to other companies he owned or controlled.

On Tuesday, B.C. Supreme Court Justice Shelley Fitzpatrick ordered the assets of Martel, MMAC, Shop Your Own Corp. in California and Martel Investments Ltd. frozen, granting Martel a $5,000 monthly stipend for living expenses.

However, Martel also owns a number of other companies, including a car share business in both Canada and the United States, that Bunker admits will make following the money difficult.

In his emailed statement, Martel attributed the problems in getting clients their money to exponential growth in 2022 that led to staffing and administration issues.