Please adhere to the figures in the recommendation, while maintaining capital management.

Forex Brokers We Recommend in Your Region

The risk is 0.50%.

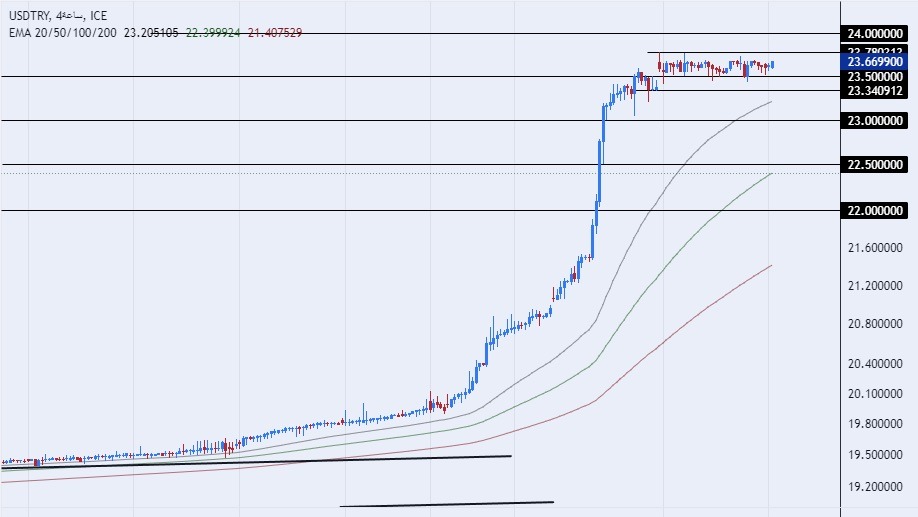

- Entering a buy order pending order from the 23.00 level.

- Place a stop loss point to close below the 22.80 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance levels at 23.50.

- Entering a sell order pending order from the 24.00 levels

- The best points for placing a stop loss close to the highest level of 24.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 23.50 support levels.

The Turkish lira stabilized against the US dollar during the beginning of the weekly trading, as the Turkish currency maintained its levels below 24 against the dollar after it recorded a free fall for about a month. The stability in the current price of the Turkish lira comes amid a state of cautious anticipation regarding the expected reforms in the country’s fiscal and monetary policy after a new economic group took over the country’s financial and economic affairs amid the Turkish president’s desire to control the high inflation rates in the country.

Investors are awaiting the decision of the Central Bank of Turkey during the current week, which is expected to result in a strong increase in interest rates. Meanwhile, reports revealed that banks from the Arab Gulf states, especially the United Arab Emirates, were heading to bridge the financing gap that resulted from the decline in the volume of loans from Western banks in the country. In the details, a report revealed that Abu Dhabi Commercial Bank and Emirates NBD provided loans to local banks in Turkey.

The Gulf banks’ moves come amid improved political relations between most of the Arab Gulf states and Turkey. It is noteworthy that the size of the country’s cash reserves has witnessed a great depletion, especially amid attempts by the Turkish Central Bank to support the price of the lira during the past years.

On the technical front, the dollar pair against the Turkish lira maintained stability without major changes during the early trading this morning, to stop the pair after a wave of strong rise. For nearly a month, the dollar pair against the lira recorded new highs on a daily basis.

Currently, the pair has settled at 23.67 levels from the middle of last week’s trading, as the pair is trading above the support levels that are concentrated at 23.50 and 23.00, respectively. The price also settles below the resistance levels that are concentrated at 24.00 and 24.50. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend.

Until the announcement of the expected changes in monetary policy, caution may be the master of the situation, with the pair’s gains momentum declining, as it is expected to record stability until the next central bank meeting. Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.