Forex Brokers We Recommend in Your Region

The AUD/USD has rallied rather significantly during the course of the week, breaking above the 0.68 level. The market threatened the 0.69 level on Friday but did pull back a bit. At this point, it does make a certain amount of sense we get a short-term pullback, but if we can hold the 0.68 level on some type of bounce, it’s likely that this market will try to get to the 0.70 level above. On the other hand, if we were to take out the bottom of the weekly candlestick, then the Aussie would more likely than not drop toward the 0.66 level.

The EUR/USD has rallied during the course of the trading week, breaking above the 1.09 level after the ECB raised interest rates, while the Federal Reserve chose to hold interest rates. All things being equal, the 1.10 level above is a psychological barrier that people will be paying attention to. That being said, it looks like we are starting to show a little bit of exhaustion on Friday, so I do think that a short-term pullback is likely. However, I do not expect a big move in the short term as I think we are still stuck in a range.

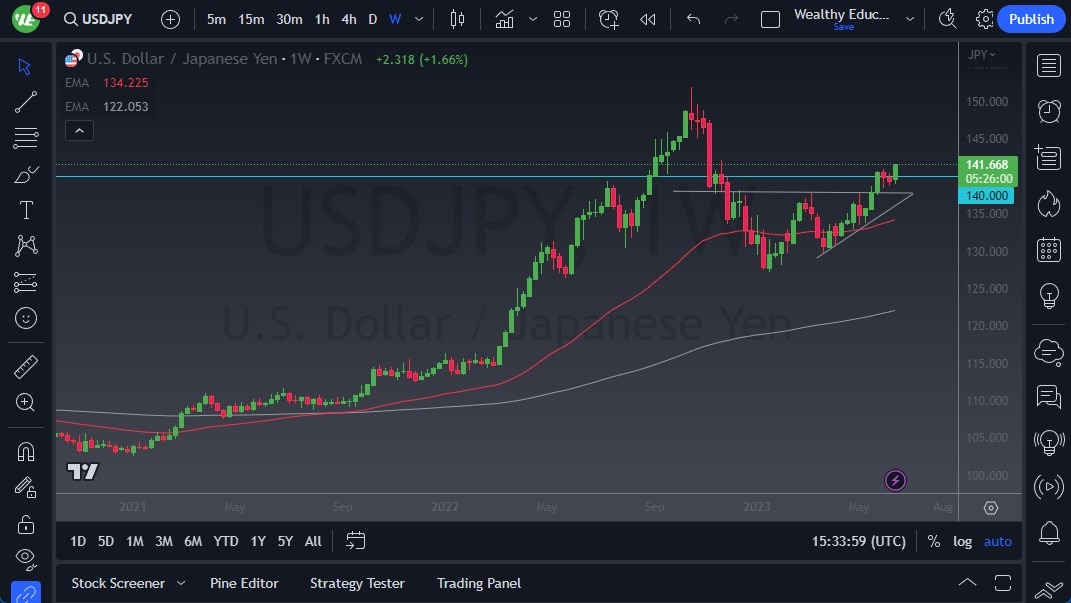

The USD/JPY has rallied significantly during the course of the week, as we continue to see a lot of very bullish behavior. The ¥140 level is going to be psychologically important, but the real support is going to be down at the ¥138 level. The ¥138 level is the top of an ascending triangle, and therefore it should be a massive “floor in the market.” As long as the Bank of Japan remains this loose with monetary policy, I just don’t see how the trajectory does anything but go higher. In fact, the “measured move” suggests that we could be going as high as ¥148 based upon the ascending triangle, and perhaps even the massive “W pattern.”

The GBP/USD has rallied significantly during the week as well, as it has been a rout against the US dollar. At this point, the market is likely to continue to go to the upside, with a target of 1.30 above. Short-term pullbacks will offer buying opportunities, but you will be better served waiting for some type of value to appear. After all, the selling off of the US dollar is still fresh, and of course might even be a little overdone in the short term.

The NASDAQ 100 has shot straight up in the air during the course of the trading week, testing the crucial 15,250 level. This is an area that has been a major resistant barrier previously, and therefore I think you will have to pay close attention to it. If we break above there, then we could go much higher, perhaps looking to the 16,000 level. Short-term pullbacks at this point continue to be buying opportunities from what I can see, even though it’s obvious to me that we are overbought. Quite frankly, this is a massive “FOMO market.” Keep in mind that the NASDAQ 100 is driven higher by about 7 stocks, so unless Tesla and the other start falling, this market will be squeezed higher.

Gold markets initially fell during the trading week but turned around to show signs of life and form a massive hammer. This hammer was based around the $1950 level, an area that has been important multiple times. With that being the case, I think we’ve got an opportunity to get a little momentum in the market to the upside. If we can break above the $2000 level, then it’s likely that gold will start racing toward that high again, threatening the “triple top.” That being said, I think in the short term gold is more likely than not to stay in this $50 range, so if you are a short-term trader, this might be a good market for you.

The DAX rallied during the course of the week, reaching highs again, and even breaking out to a fresh, new high. At this point, it looks like the DAX is ready to continue going higher, and a break above the top of the weekly candlestick certainly is very bullish. It’s worth noting that even though the European Central Bank raised rates during the course of the week, it seems as if the stock market in Frankfurt simply chose to ignore this. We have seen a lot of bullish pressure recently, and I think that will continue to be the case going forward. This will be especially true if the Euro starts to lose a little bit of strength.

The Hong Kong 50 has had a rather bullish week, touching the 50-Week EMA near the HK$19,950 level. Having said that, we are right at the convergence of not only the 50-Week EMA, but also a short-term downtrend line. The question now is whether or not this and of course the HK$20,000 level will offer enough resistance to keep the market from breaking out. If the market were to break above HK$20,000, then you could see a bigger move, perhaps up to the HK$22,000 level. In that vicinity, you would be testing the 200-Week EMA.

On the other hand, if the market fails in this area, it’s very likely that the HK 50 will go looking toward the HK$18,000 level again, as it has been in a downtrend for a couple of years now. Furthermore, some of the data coming out of China is starting to deteriorate.