- The Bank of England updates markets on interest rate policy on Thursday.

- Consumer sentiment and inflation reports in the UK and the Eurozone bring a close to the end of the trading week.

- The US national holiday on Monday sets the tone for a quiet week state-side.

The US trading week is foreshortened by the Juneteenth national holiday, and inflation and consumer sentiment reports out of the UK turn the focus this week to sterling-based currency pairs. The Bank of England updates the markets on its interest rate decision on Thursday, and euro-currency-pair traders can expect volatility to pick up around the time that consumer sentiment reports are released.

Forex

GBPUSD

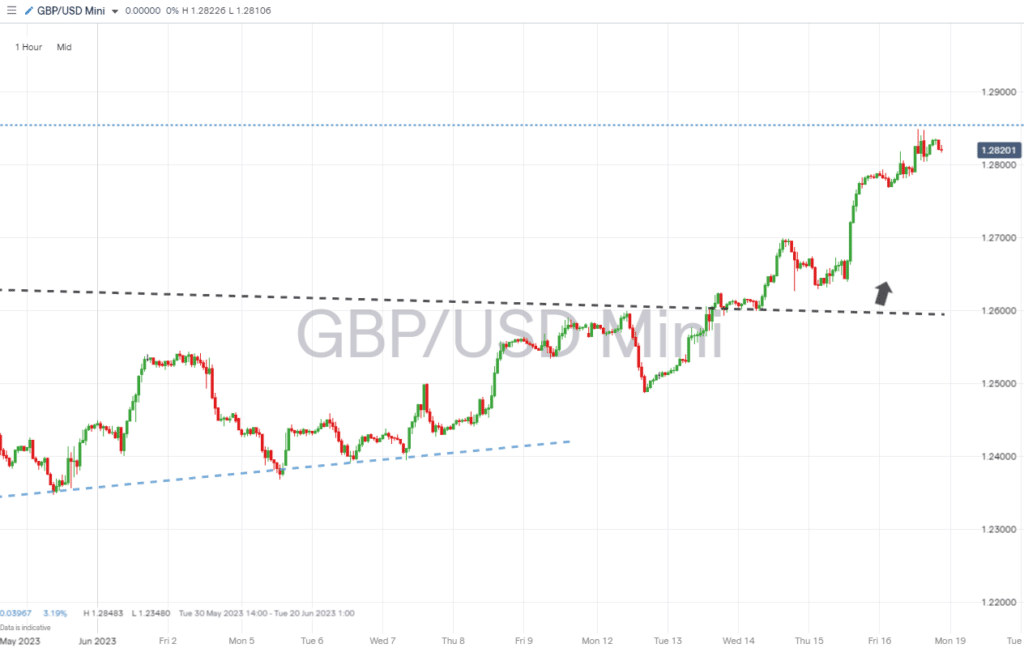

Analysts have priced in a 25-basis point interest rate hike from the Bank of England, but comments made last week that rates might have to stay higher for longer will make the guidance offered by the Bank likely to trigger price moves.

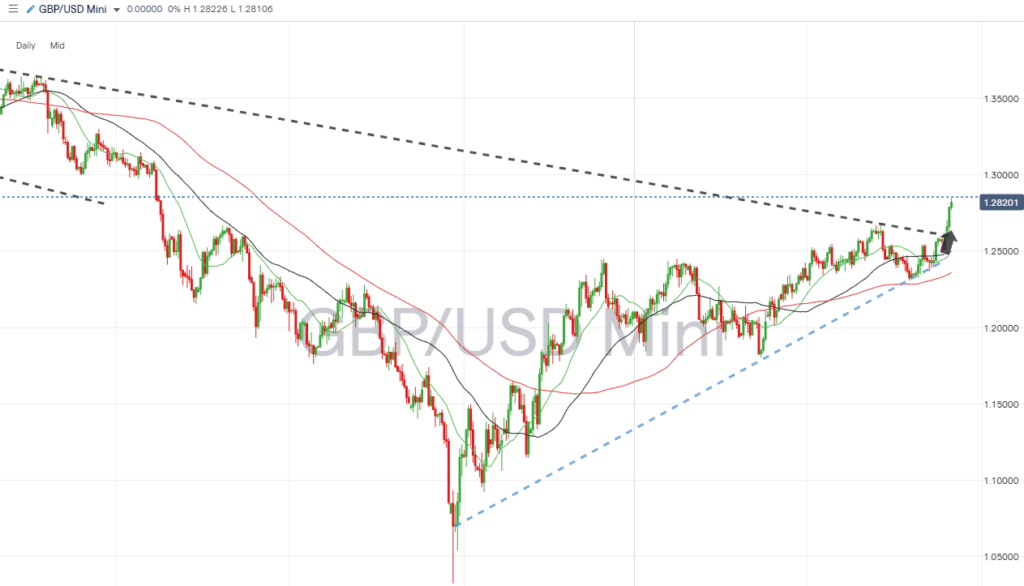

Daily Price Chart – GBPUSD Chart – Daily Price Chart – Trendline Break Confirmed

Source: IG

GBPUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of GBP currency pairs:

- Monday 19th June – US holiday.

- Wednesday 21st June – 7 am BST – UK CPI (May). Prices forecast to rise 8.4% year-on-year from 8.7% and 0.4% from 1.2% month-on-month.

- Thursday 22nd June – 12.00 pm BST – Bank of England rate decision. Interest rates expected to rise 25bps to 4.75% as the bank reacts to strong UK wage data.

- Friday 23rd June – 9.30 am – UK PMIs (June). Analysts forecast services to fall to 54.4 and manufacturing to fall to 46.5.

EURUSD

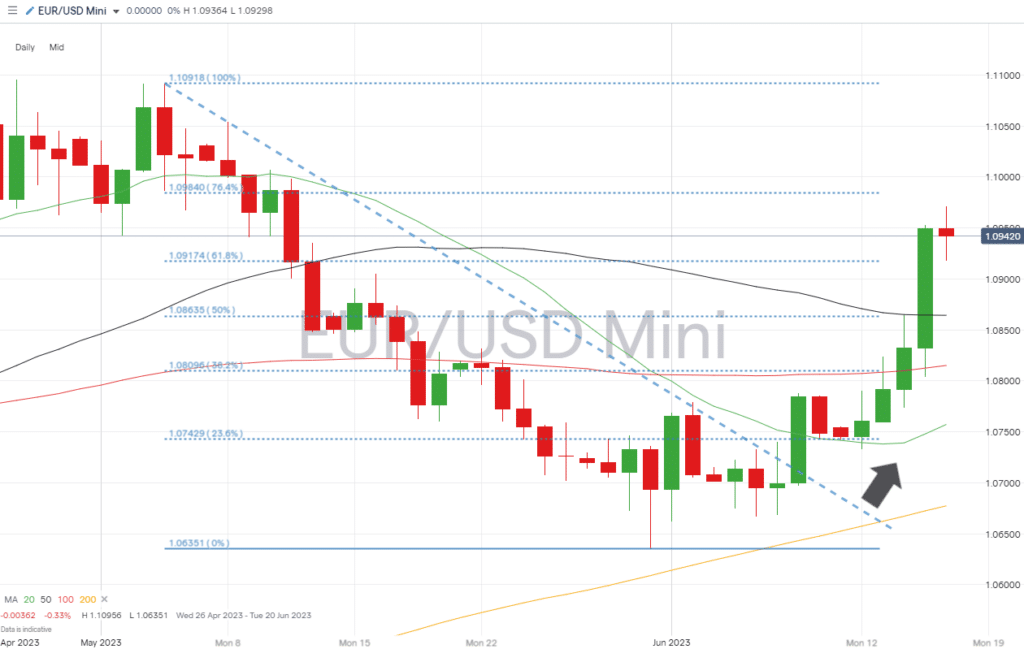

After the ECB hiked Eurozone interest rates by 25 basis points on Thursday, traders of euro pairs will have to wait until the end of the week for price-triggering data releases to come into play. Consumer sentiment and PMI reports for the Eurozone and major economies will be released on Thursday and Friday.

EURUSD Chart – Daily Price Chart – Upwards momentum after trendline break

Source: IG

EURUSD Chart – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of EUR currency pairs:

- Monday 19th June – US Holiday.

- Thursday 22nd June – 3 pm BST – Eurozone consumer confidence (June). Analysts expect a slight rise to -17.

- Friday 23rd June – 8.30 am BST – German PMIs (June). manufacturing PMI expected to fall to 43.

- 9 am BST – Eurozone PMIs (June). Manufacturing PMI estimated to rise to 45.2, and services to hold at 55.1.

Indices

S&P 500

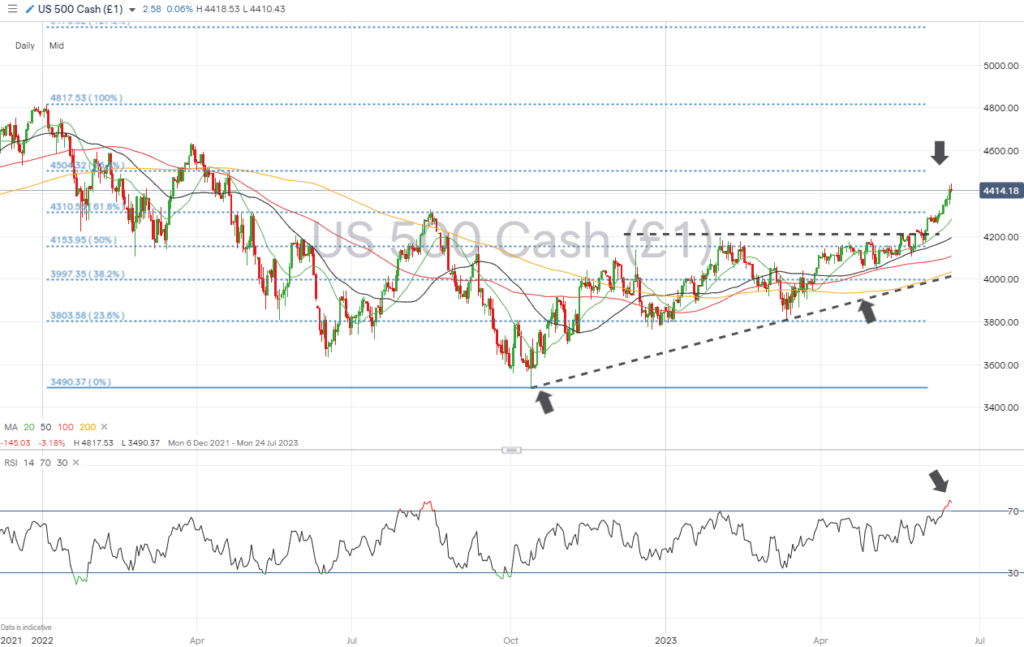

The Juneteenth holiday on Monday means markets will be closed. That sets the tone for a quiet week regarding US data releases, with the main report to look for being the release of Jerome Powell’s testimony on Thursday. That can be expected to offer further guidance on the approach the US Fed is taking toward interest rate policy in the coming months.

S&P 500 Chart – Daily Price Chart – RSI +70 and Overbought

Source: IG

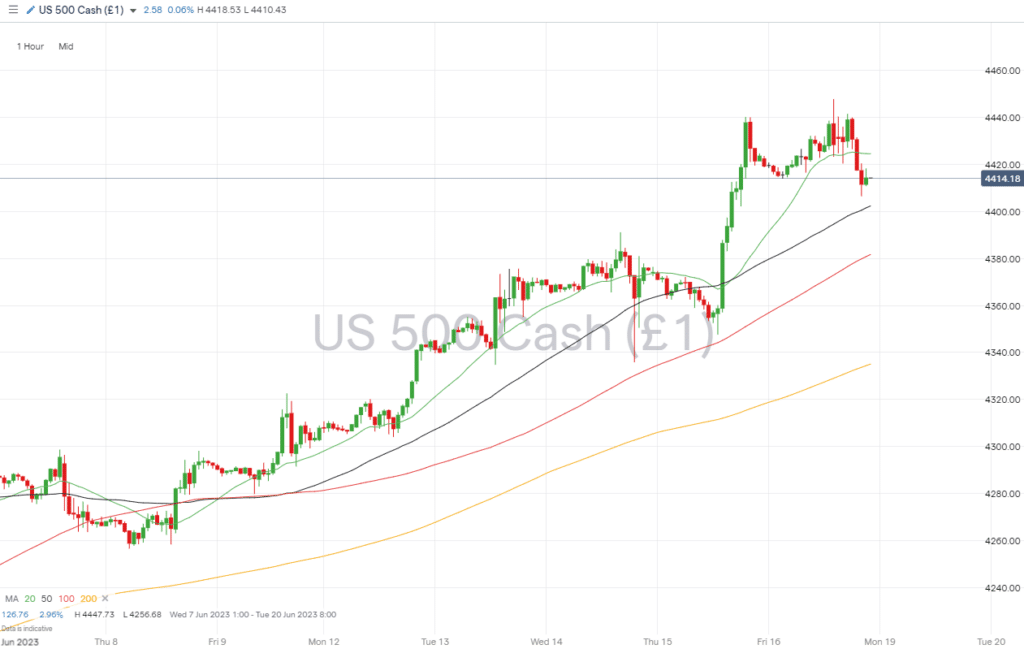

S&P 500 – Hourly Price Chart

Source: IG

Economic data report likely to influence the value of US stocks:

- Monday 19th June – US holiday.

- Thursday 22nd June – 3 pm BST – Jerome Powell testimony. The Fed chair may look to comment on the future path of US rates. Markets to watch: US indices, USD crosses

- Friday 23rd June – 2.45 pm BST – US manufacturing & services PMI (June). Manufacturing PMI forecast to rise to 49.7, and services to fall to 53.

People Also Read:

Risk Statement: Trading financial products carries a high risk to your capital, especially trading leverage products such as CFDs. They may not be suitable for everyone. Please make sure that you fully understand the risks. You should consider whether you can afford to risk losing your money.