mars58

By Fawad Razaqzada

The most risk-sensitive currencies like the Australian dollar have outperformed this month (up nearly 6%), owing in part to the surprise rate hike by the RBA and the positive tone across global equity markets. But it is the world’s most popular trading pair, the EUR/USD, which, I reckon, has more upside potential moving forward. A rally to at least 1.1100 is now more likely.

Supporting my bullish view on the EUR/USD, we have three major themes to take into account:

- A hawkish ECB

- Fed’s (hawkish) pause

- China’s rebounding markets

- Technical momentum

I will quickly discuss these factors in that order and explain why I think the EUR/USD is likely to head above the April high of 1.1095 in the near term and potentially rise to 1.15 in the slightly longer-term outlook.

1) Hawkish ECB

There is a growing consensus among analysts and traders that central banks across the G10 outside of the US will remain hawkish for longer. Chief among them is the ECB, which has just raised rates by another 25 basis points this week.

The ECB’s upwards revision to its staff inflation forecasts supports more rate hikes. Its President Christine Lagarde has effectively pre-announced another 25 bps hike for July.

While at risk of going too far, which may end up hurting the EUR/USD in the longer-term outlook, the single currency is likely to benefit from a widening of the yield spread between the Eurozone and German debt as the ECB tightens its belt further while the Fed pauses for a breather.

2) Fed On Pause

The Fed was hawkish this week, but markets barely priced in one final 25 bps point hike after the US central bank decided to pause for a breather as it held rates unchanged.

The US dollar initially rose but has since given back all its gains and some (except against JPY), thanks to the rest of the major central banks being more hawkish than the Fed (except the BOJ).

The recent softening of ISM PMIs and a jump in jobless claims has also left investors wondering whether the US economy is now finally starting to cool sufficiently enough to bring inflation back down to the target range and lift the unemployment rate further, and thus discourage the hawks at the FOMC to push for another hike.

For this reason, we have also seen gold rebound and equity markets hit fresh 2023 highs after the FOMC meeting. In today’s US economic calendar, look out for UoM’s inflation survey and a couple of Fed speakers.

3) Chinese Markets Rebound

While China’s economic recovery has stalled, we have seen the PBOC inject lots of liquidity into the market in recent weeks. This has helped to lift the local stock markets, and we have seen a sharp recovery in the yuan.

There’s a growing feeling that the Chinese government will top up the ongoing monetary support with some fiscal measures. Together, the looser monetary and fiscal policies should help revive growth in the world’s second-largest economy and thus provide additional support for the China-sensitive risk assets.

With China being one of Europe’s largest export destinations, this should help support the euro, all else being equal. There’s also a feeling among market watchers that instead of a big recession, we will see a soft landing in the global economy, which is also why we have seen a very stable equity market and reduced demand for the safe-haven US dollar.

4) Technical Momentum

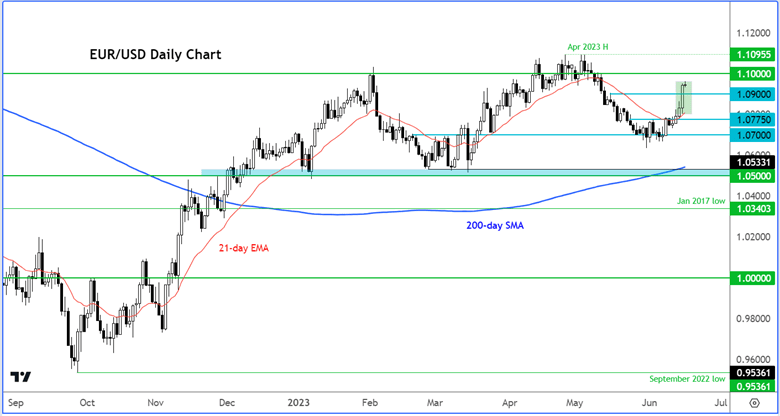

Finally, the chart of the EUR/USD is looking bullish, which, by default, would keep many bears away. Among other things, you have higher lows, while both the 21- and 200-day averages are pointing more elevated, and the price is holding above these MAs. There’s nothing bearish on this chart.

Source: TradingView.com

Bullish traders will thus be looking to take advantage of the momentum and drive rates to levels where trapped traders’ stops would be resting. Remember, the market is a function of liquidity; it continually moves from one area of liquidity to the next, generally in the direction of the underlying fundamental trend. In this case, I think, to the upside.

With that in mind, if you take a quick look at the chart of the EUR/USD, you will notice a double top pattern at just shy of the 1.11 handle. That’s bearish you might say. But that’s precisely where the next big pool of liquidity also lies. Trapped sellers would try to defend that level as much as possible, but they will also likely have stops resting above that area in case of a bullish breakout.

Now, given that the EUR/USD’s technical indicators mostly point higher (thanks to a bullish macro-outlook), the bulls are ready to pounce and drive rates to that area in the not-too-distant future. Where the EUR/USD would go from there is a topic for another day, but if it were to arrive at 1.11, then why not rise to 1.12, 1.13, or even higher?

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.