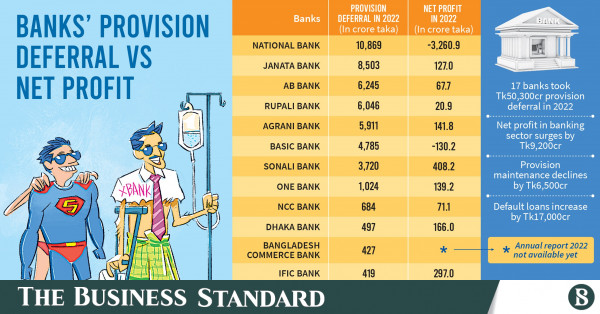

16 commercial banks exhibit inflated profits last year by availing themselves of provision deferral amounting to Tk50,000cr. A lion’s share of these special deferral facilities was taken by state-owned banks

The banking sector in Bangladesh witnessed an astonishing surge of 183% in net profit in 2022 as compared to the preceding year even as business activities remained stagnant in the face of a severe dollar crisis. However, this high growth in profit is attributable to window-dressing in the balance sheets of banks through the practice of provision deferral.

Last year, 16 commercial banks availed themselves of provision deferral amounting to Tk50,000 crore from the Bangladesh Bank. This approach was taken to exhibit inflated profits while concealing their weak financial health.

These banks include National, Janata, AB, Rupali, Agrani, BASIC, Sonali, One, NCC, Dhaka, Bangladesh Commerce, IFIC, Standard, First Security Islami, Southeast, and South Bangla Agriculture banks.

Provisioning refers to the allocation of specific funds from the profit to mitigate potential losses stemming from loans. The necessity for provisioning amplifies in response to the increase in default loans, with banks being obligated to maintain a particular provision against such defaults.

Of the 16 banks that were given the provision forbearance facility, some were given exemption from maintaining the required provision from one year to nine years, according to the Bangladesh Bank report.

A lion’s share of these special deferral facilities was taken by state-owned banks.

However, some bank directors took out dividends, showing higher profits last year even amid the ongoing economic crisis, thanks to provision forbearance awarded by the central bank.

For example, the net profit of private commercial One Bank grew by 84.5% to Tk139 crore in 2022 compared to the previous year.

The provision forbearance of Tk1,024 crore helped the bank to show the high profit, enabling it to declare a 5% stock dividend for investors in 2022. However, had the provision amount been deducted from the profit, the bank would have incurred a loss and would not have been able to declare any profit.

Despite the dividend declaration, the bank’s share price remained below its face value in the stock market as investors lost confidence due to inflated profits. On Monday, each share of the bank was traded at Tk9.5, while the face value stands at Tk10.

Similarly, National Bank, another private commercial bank, incurred a loss of Tk3,260 crore last year despite taking the highest provision deferral of Tk10,869 crore. Had the deferred amount been adjusted, the bank would have faced a severe capital shortfall, which would ultimately make the bank unable to lend.

First Security Islami Bank, which managed to declare cash dividends even in 2021, found itself resorting to provision forbearance amounting to Tk170 crore in 2022, as per data from the Bangladesh Bank.

Cash dividends are typically approved when a bank meets specific financial indicator criteria established by the central bank.

The net profit of the bank declined by 12% to Tk296 crore last year even after taking provision forbearance. However, the bank was allowed to declare a 10% stock dividend with the help of provision deferral.

State-owned Janata Bank reported a net profit of Tk127 crore after availing a provision deferral of Tk8,503 crore. Had the deferred amount been factored in, the bank would have registered a loss in 2022.

Similarly, the majority of the 16 banks would have experienced losses or capital erosion if they had not been granted provision deferral.

The relaxation in the requirement to maintain substantial provisions played a pivotal role in showing higher profitability in the banking sector.

As per the Bangladesh Bank’s Financial Stability Report 2022, the net profit within the banking sector increased to Tk14,226 crore in 2022 from Tk5,022 crore in the previous year. Additionally, the cumulative provisions allocated for bad debts witnessed a decline of 42.66%, dwindling to Tk8,767 crore from Tk15,290 crore.

Despite a rise of Tk17,000 crore in default loans last year, the practice of provision maintenance declined within the banking industry.

The aggregate default loans in banks reached Tk1,20,000 crore at the close of December last year, which was Tk103,000 crore in the corresponding period of the preceding year.

Banks with provision forbearance

Janata Bank emerged at the forefront among public sector lenders, availing a provision deferral facility amounting to Tk8,503 crore, which it will have to adjust within the next nine years. Meanwhile, Rupali Bank secured a deferral facility of Tk6,047 crore until the preparation of the financial report for 2023.

Among other government banks, Agrani Bank secured a deferral facility of Tk5,911 crore for four years, BASIC Bank Tk4,785 crore for nine years, and Sonali Bank Tk3,721 crore for four years, according to the Bangladesh Bank.

Nonetheless, private-sector lender National Bank was at the top among all banks by obtaining a deferral facility of the highest Tk10,870 crore until the finalisation of the financial report for 2023.

AB Bank secured a deferral of Tk6,246 crore until 2029, One Bank Tk1,024 crore for five years, while NCC Bank and Dhaka Bank secured provision deferral facilities of Tk685 crore and Tk498 crore, respectively, until the completion of their financial reports for 2023.

The other private banks securing the deferral facility until the finalisation of their financial reports for 2023 include Bangladesh Commerce Bank (Tk428 crore), IFIC Bank (Tk420 crore), Standard Bank (Tk299 crore), First Security Islami Bank (Tk170 crore), Southeast Bank (Tk121 crore), and South Bangla Agriculture Bank (Tk37 crore).

Moreover, sources reveal that Padma Bank was granted a provision forbearance facility under the special provisions of the central bank.

A senior official from the central bank indicated that the actual provision shortfall in the banking sector is considerably higher; however, it appears lower due to the various facilities offered by the central bank.

The official emphasised that without the provision deferral facility, banks would experience an increase in their capital shortfall. This, in turn, would result in additional costs for international trade, as foreign banks operate based on capital standards. A dearth of capital leads to elevated trade financing rates.

A former managing director and CEO of a state-owned bank told TBS that banks must do provisioning before declaring their profits. “And if full provisioning is done, many banks will not be profitable. Besides, a negative impact will be created on the market, even though banks are doing a lot of work for the country at free cost or low-interest rates.”

He highlighted the vital role played by banks in providing various services at nominal charges, such as for government oil, gas, and other imports. State-owned banks also facilitate government social safety net programmes at very low-interest rates.

“If the charges for these services were high, banks would not have suffered from provision deficits. Therefore, in consideration of these, banks are given some concessions in provisioning.”

However, he underscored the need for banks to exercise care in loan disbursal, which can reduce bad loans and provisioning requirements.

He suggested that an active approach in recovering dues from defaulting customers and settling cases against defaulters would decrease the burden of defaulting debt.

Mezbaul Haque, spokesperson of the Bangladesh Bank, told TBS that some banks have been allowed to defer provisioning as their provision shortfall increased. This is to avoid confronting various problems of the banks and putting pressure on their other assets.

However, a specific timeline has been set to reduce their provisioning shortfalls, he noted.

Speaking on this matter, Dr Salehuddin Ahmed, former governor of the Bangladesh Bank, told TBS that if there is a provision shortfall in a bank, it cannot declare dividends. “If a bank fails to make the necessary provisions, it remains at risk of falling into a capital shortfall. This has a significant impact on the bank. Deposits become risky.”

To address these problems, the noted economist has advised the formation of a bank commission. Such commissions previously solved various problems, he concluded.