The usage limit of credit cards in foreign currency plummeted by around 30% due to the substantial devaluation of taka amid a dollar crisis in Bangladesh.

Moreover, foreign currency spending using credit cards increased significantly abroad because the dollar is cheaper when spent through cards compared to the market exchange rate.

In this context, banks have moved to adjust the foreign currency usage limit for cardholders to align with the new dollar price.

For instance, Prime Bank has announced an adjustment of credit card dollar usage limits through advertising.

According to industry insiders, some banks with insufficient foreign currency inflows that could not afford to spend dollars at a lower price on cards are limiting access to foreign currency usage.

Many credit card users are already encountering these usage limits. Sharing her experience, a private bank’s cardholder mentioned that she was unable to make payments above $70 during her recent trip abroad, but she could still spend smaller amounts like $10 or $20.

When contacted, a senior executive in the card division at Prime Bank said they announced the limit adjustment due to the reduction in the dollar spending limit following the devaluation of taka. Consequently, the credit limit in the taka will remain the same, but the foreign currency limit will be reduced.

Providing an example of the change in usage limits, he explained that when the dollar rate was below Tk85, a customer could spend $1,200 against a Tk1 lakh limit. However, with the dollar price now at Tk110.50, the dollar usage limit has decreased to $900 against the same Tk1 lakh limit.

The banker explained that banks establish credit card limits in the local currency, and customers receive a foreign currency limit by converting it based on the prevailing dollar rate.

At present, the significant rate difference is a major incentive for credit card users, as they can acquire dollars at Tk110.50, whereas the market rate is above Tk115, he added.

As a result, foreign currency spending through credit cards has increased, as travellers prefer using cards instead of buying cash dollars from the market at rates exceeding Tk115, said the Prime Bank official.

In this situation, he mentioned that some banks with limited forex inflow are restricting access to spending foreign currency on credit cards.

Many banks are also contemplating reducing their customers’ annual travel quota from the authorised limit of $12,000 to $5,000, said a senior executive from another private bank.

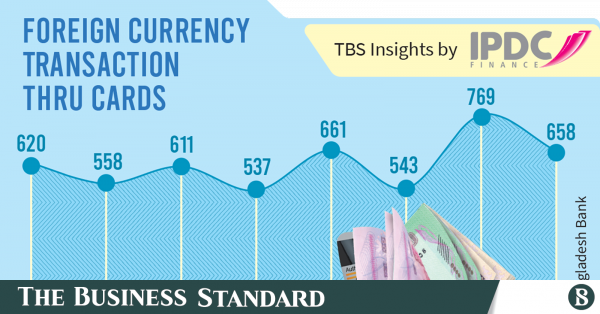

Due to the limited access imposed by some banks, foreign currency transactions on credit cards declined by 14% to Tk658 crore in August after reaching an all-time high of Tk769 crore in July, as per central bank data. In June, the transactions stood at Tk543 crore.

The number of foreign currency transactions surged by over 26% to 9.65 lakh in July compared to the previous month. In August, the number of transactions declined again to 9.43 lakh.

The usage and issuance of new credit cards continue to rise, even in the face of increasing dollar prices and inflation.

According to central bank data, the number of credit cardholders reached 43.56 lakh by the end of August.

The Bangladesh Bank has set the maximum credit card limit for an individual at Tk10 lakh for unsecured loans and Tk25 lakh for secured loans.

Consumers can spend foreign currency equivalent to the set limits. However, exporters enjoy a special benefit in using foreign currency, as there is no limit for them, and they can use the entire amount of their export retention quota on their credit cards.

The central bank has also set the highest limit for foreign currency spending through e-commerce at $300.

When contacted, a senior executive in the card division of City Bank, which holds nearly a 14% share in the card market, mentioned that they are experiencing losses in credit card usage due to rate differences.

He explained that in credit card transactions, the bank is incurring losses ranging from Tk2 to Tk4 per dollar, as the market rate is significantly higher than the official rate.

However, he added that City Bank has not restricted access to credit card usage, given that the bank is leading the card market.

He said due to the decline in the usage limit of credit cards in foreign currency caused by the taka devaluation, customers have to repay a certain portion to the bank to maintain their spending access.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said the usage limit for customers was automatically reduced due to the taka devaluation.

“However, the Bangladesh Bank has kept the travel quota unchanged at $12,000, and banks are still permitting customers to use that limit,” he added.

Although most Bangladeshi banks are allowing customers to spend foreign currency on credit cards even after the dollar shortage worsened, some other countries are suspending the use of cards in foreign currency to prevent the drain of dollars.

For instance, Egyptian banks have suspended the use of debit cards in foreign currency to prevent a drain on foreign currency reserves as the country’s currency shortage worsens.