Infographic: TBS

“>

Infographic: TBS

Non-resident Bangladeshis who invested in the US Dollar Investment Bond and the US Dollar Premium Bond are getting a bait-and-switch treatment by the government when they are trying to withdraw their savings with interest as banks are paying them back in taka, not the US dollar as they are supposed to get. They are even finding it difficult to repatriate their money as officials supposedly are not sure if they can do that.

Apparently, this discouraging financial maze for the NRB investors has been caused by a wrong interpretation of the rules by an officer of the National Savings Directorate, a high official informed TBS.

Mohammad Shariful Islam, director (Policy, Audit and Law) of the National Savings Directorate, told TBS that the regulations for US dollar investment and premium bonds do not stipulate that the principal must be paid in taka if the bond is redeemed before maturity. Instead, banks were instructed to pay bondholders in foreign currency.

“Such a situation has arisen due to a wrong interpretation by an officer of the Directorate. The officer, who is now abroad on a lien, said such a thing referencing a meeting and some banks are taking advantage of this mistake,” Shariful Islam said.

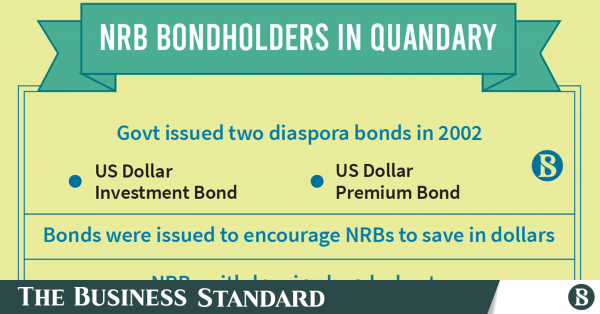

The Bangladesh government launched two diaspora bonds — the US Dollar Investment Bond and the US Dollar Premium Bond — to encourage non-resident Bangladeshis to save in dollars two decades back.

The ongoing economic uncertainty and the enduring dollar crisis are forcing the NRB to withdraw their savings even before the bonds reach maturity, worsening Bangladesh’s foreign currency crisis.

Banks are disbursing both the principal amount and interest to investors in taka, even though the regulations say that the principal amount should be repaid in foreign currency while the interest may be disbursed in local currency.

This situation, where non-resident Bangladeshis are cashing in their bond savings before maturity and receiving payments in the local currency, is likely to discourage future investments.

In response to concerns raised by many expatriates, the Internal Resources Division under the finance ministry wrote to the National Savings Directorate on October 12 to inquire about the currency in which bond investors should be paid if they withdraw before maturity and whether the investors can take their money abroad.

Confirming the matter, Internal Resources Division Joint Secretary (Savings) Md Abdul Gafur told The Business Standard, “A letter has been sent to the National Savings Directorate in this regard and the Directorate will give its opinion soon.”

According to the US Dollar Premium Bond Rules 2002 (amended up to 30 June 2012) and the US Dollar Investment Bond Rules 2002 (amended up to 30 June 2012), there are rules to pay the principal amount in foreign currency to the investors’ Foreign Currency Account after maturity.

Officials of the Savings Directorate said investors can take their bond money abroad after maturity. However, the rules for redeeming the bonds before maturity are unclear, and it is not specified whether the principal amount will be paid in foreign currency or whether it can be taken abroad.

A Savings Directorate official, on condition of anonymity, said that before the dollar crisis, banks generally followed the bond maturity rules and paid out principal in foreign currency even if the bonds had not matured. However, due to the ongoing dollar crisis, some banks are refusing to pay out principal in foreign currency, even when customers request it.

The Internal Resources Division has sought clarification on the matter, the official said, adding that US dollar bond investors are withdrawing bonds before maturity due to the recent increase in deposit rates in foreign countries and reports of foreign exchange crises at some Bangladeshi banks.

Investors’ woes

Reportedly, a few dozen Bangladeshi expatriates in Dubai and Singapore have written to the Finance Division and the National Savings Directorate, asking for help.

During Prime Minister Sheikh Hasina’s visit to Qatar last May, expatriates complained to her about this. Also, leaders of the NRB CIP Association complained about this issue to the expatriate welfare minister at an event in Dhaka on 17 September.

Following complaints from expatriates, the Ministry of Expatriates’ Welfare and Overseas Employment wrote to the Ministry of Finance and Bangladesh Bank, urging them to take action to make it easier for bond investors to withdraw their money and to improve investment facilities in bonds for expatriates, said Senior Secretary of the Ministry of Expatriates’ Welfare and Overseas Employment Dr Ahmed Munirus Saleheen.

On 10 October, the Ambassador of Bangladesh to the United Arab Emirates Md Abu Zafar also wrote to the NBR Chairman and Senior Secretary of the Internal Resources Division Abu Hena Rahmatul Muneem in this regard.

In the letter, the ambassador said Bangladeshi banks are unable to return the principal amount invested in bonds of expatriate Bangladeshis in foreign currency. As a result, expatriate investors have to accept principal in Bangladeshi taka.

Which banks are flouting regulations?

Foreign branches of state-owned Sonali Bank and Janata Bank, as well as foreign exchange houses of some private banks, are reportedly offering expatriates bond capital with interest in Bangladeshi taka.

A foreign branch of Janata Bank has recently written a letter to the remittance branch of the local office to refund the bond capital of two expatriates in Bangladeshi taka.

When asked, Janata Bank Managing Director Md Abdul Jabber told TBS that he was unaware of the matter and did not know in which currency bondholders should be paid if they withdrew their bonds before maturity.

However, an official of Sonali Bank told TBS, “If a bondholder withdraws their bond before maturity, the principal amount will be paid in Bangladeshi taka. This obligation to pay in Bangladeshi taka is reflected in the online system set up by the Savings Directorate.”

Bangladesh Bank Spokesperson Md Mezbaul Haque told TBS, “The issuance and management of these bonds are the responsibility of the Internal Resources Division and the National Savings Directorate. The policies, rules and regulations regarding the bonds are all made by the said departments.”

The Bangladesh Bank and other scheduled banks are only involved in the transaction process of the bonds. Therefore, the Internal Resources and the Savings Directorate are responsible for determining the currency in which the principal amount will be paid in the event of bond redemption, whether at the end of the term or before the end of the term, he added.

Investment in these bonds declining

As of October 15, the amount of investment by non-resident Bangladeshis in the Premium Bond stood at Tk387.61 crore and the amount of investment in the Investment Bond is Tk927.99 crore.

In FY23, Tk373 crore worth of Investment Bonds were sold and customers withdrew Tk771.98 crore by redeeming these bonds (pre and post-mature combined).

Similarly, Tk91.55 crore worth of Premium Bonds were sold in FY23 and customers withdrew Tk87.57 crore by redeeming pre-and post-mature bonds.

Both bonds have a maturity period of three years. The Investment Bond interest rates range from 2% to 6.5% depending on tenure and slab and the rate of a Premium Bond ranges from 2.50% to 7.50% depending on term and slab.

There is no investment ceiling in these bonds and maximum profit is available at maturity. However, the interest rate is lowest for investments above 5 lakh dollars.

These bonds can be bought and redeemed from the Authorized Dealer (AD) branch of any bank in Bangladesh and the foreign branches of banks, exchange houses or exchange companies.

Diaspora losing interest in investment

The NRB CIP Association, an organization representing expatriates in Bangladesh, has expressed concern that banks are not paying bondholders in foreign currency when they redeem their bonds, which is discouraging investment in bonds and leading to an increase in the use of hundi — an informal, and also illegal, money transfer channel.

Parvez Tamal, the advisor of NRB CIP Association and chairman of the board of directors of NRBC Bank, told TBS that expatriates face significant problems if the principal amount invested in bonds is paid in Bangladeshi taka, as this is also a breach of contract.

Expatriates are demanding that the principal amount invested in bonds be paid in foreign currency into their FC accounts because there are many complications and exchange rate losses associated with taking this money back abroad, Parvez said.

The Ambassador of Bangladesh to the United Arab Emirates Md Abu Zafar also agrees with Parvez Tamal.

In his letter to the NBR chairman, he said the expatriates are taking back the redeemed bond capital abroad through hundi.

Chairman of the Board of Directors of the Agrani Bank Zaid Bakhat told TBS, “If an investor purchases a bond in foreign currency, the principal amount should always be repaid in the same currency. This should be explicitly stated in the rules to prevent any ambiguity or abuse.”