- The FOMC minutes revealed that policymakers exercised caution amid uncertainties in the economy.

- The US inflation report came in higher than expected.

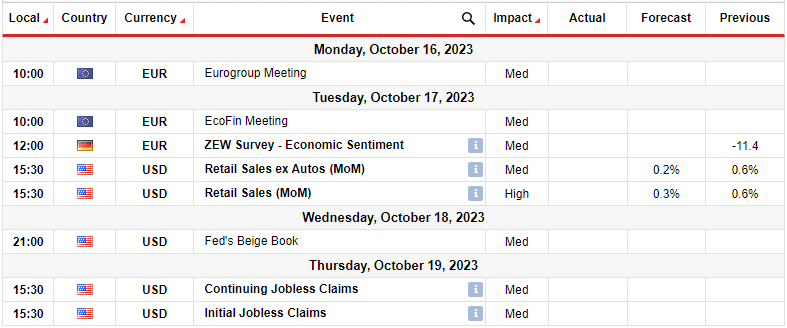

- The US will release retail sales data in the coming week.

The EUR/USD weekly forecast is bearish as higher-than-expected US inflation has revived the dollar’s strength that was lost after Fed’s minutes.

Ups and downs of EUR/USD

The euro had a bearish week driven mostly by movements in the US dollar. There were no major economic releases from the Eurozone, so inventors focused on the US. The two major reports from the US were the FOMC meeting minutes and the US inflation report.

–Are you interested in learning more about STP brokers? Check our detailed guide-

The FOMC minutes revealed that policymakers exercised caution amid uncertainties in the economy. On the other hand, the US inflation report came in higher than expected, boosting the dollar and weakening the euro. US inflation rose in September as rents soared.

Next week’s key events for EUR/USD

Next week will be relatively quiet for EUR/USD as investors are not expecting many major releases. The US will release retail sales data and the initial jobless claims report. Investors will assess the state of US consumers, as their spending significantly influences nearly two-thirds of the economy. Notably, durable consumer spending has been vital to the economy’s resilience amid higher interest rates.

Therefore, a retail sales figure exceeding expectations could raise concerns of an inflation resurgence. Conversely, a weaker retail sales figure might rekindle worries about an economic downturn.

EUR/USD weekly technical forecast: Price dips following 22-SMA rejection.

On the technical side, the EUR/USD is in a downtrend as the price trades below the 22-SMA. Moreover, the RSI trades below 50, showing solid bearish momentum. The price has been pushed lower after finding resistance at the 22-SMA. However, the bears are up against a strong support level at 1.0500.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Initially, the downtrend got to this level and paused because bears failed to keep the price below. It allowed bulls to return for a retracement to the 22-SMA, where bears pushed the price lower. However, if bears fail to go below 1.0500 this time, bulls might break above the 22-SMA to reverse the trend.

Such an occurrence would lead to a retest of the 1.0700 resistance level. On the other hand, there is a possibility that bears will break below 1.0500. This would mean a retest of the 1.0400 support and a continuation of the downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money