CULLEN HIGH DIVIDEND EQUITY FUND

CULLEN INTERNATIONAL HIGH DIVIDEND FUND

CULLEN SMALL CAP VALUE FUND

CULLEN VALUE FUND

CULLEN EMERGING MARKETS HIGH DIVIDEND FUND

CULLEN ENHANCED EQUITY INCOME FUND

| Retail Class |

Class I | Class C | Class R1 | Class R2 | |

| CULLEN HIGH DIVIDEND EQUITY FUND | |||||

| CULLEN INTERNATIONAL HIGH DIVIDEND FUND | |||||

| CULLEN SMALL CAP VALUE FUND | |||||

| CULLEN VALUE FUND | |||||

| CULLEN EMERGING MARKETS HIGH DIVIDEND FUND | |||||

| CULLEN ENHANCED EQUITY INCOME FUND |

PROSPECTUS

This Prospectus contains information you should know before investing,

including information about risks. Please read it before you invest and keep it for future reference.

The U.S. Securities and Exchange Commission (“SEC”)

has not approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

* The offering of Cullen Small Cap Value Fund Class R1 shares

and Class R2 shares has not yet commenced as of the date of this prospectus.

Table of Contents

Fund

The investment objective of the Cullen High Dividend Equity Fund (the

“High Dividend Fund” or the “Fund”) is to seek long-term capital appreciation and current income.

This table describes the fees and expenses that you may pay if you

buy and hold shares of the High Dividend Fund.

| Retail Class | Class C | Class I | Class R1 | Class R2 | |

| Redemption Fee (as a percentage of amount | |||||

| redeemed)a | |||||

as a percentage of the value of your investment):

| Retail Class | Class C | Class I | Class R1 | Class R2 | |

| Management Fee | |||||

| Distribution and Service (12b-1) Fees | |||||

| Other Expensesb | |||||

| Acquired Fund Fees & Expenses | |||||

| Total Annual Fund Operating Expensesc | |||||

| Less Expense Reduction/Reimbursementd | – |

– |

– |

– |

– |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

| d | Cullen Capital Management LLC (the “Adviser”) has contractually agreed to limit the Net Annual Fund Operating Expenses (excluding Acquired Fund Fees and Expenses, interest, taxes and extraordinary expenses) to not more than 1.00% for Retail Class shares, 1.75% for Class C shares, 0.75% for Class I shares, 1.50% for Class R1 shares and 1.25% for Class R2 shares, through |

either the High Dividend Fund or the Adviser prior to the Termination

Date.

This example is intended to help you compare the cost of investing

in the High Dividend Fund with the cost of investing in other mutual funds. This example assumes that you invest $10,000 in the High

Dividend Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes

your investment has a 5% return each year and that the High Dividend Fund’s operating expenses remain the same. Although your actual

costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years* | 5 Years* | 10 Years* | |

| Retail Class | $ |

$ |

$ |

$ |

| Class C | $ |

$ |

$ |

$ |

| Class I | $ |

$ |

$ |

$ |

| Class R1 | $ |

$ |

$ |

$ |

| Class R2 | $ |

$ |

$ |

$ |

The High Dividend Fund pays transaction costs, such as commissions,

when it buys and sells securities (“portfolio turnover”). A higher portfolio turnover rate will result in higher transaction

costs and may result in higher taxes when High Dividend Fund shares are held in a taxable account. These costs, which are not reflected

in annual fund operating expenses or in the example, affect the High Dividend Fund’s performance. During the most recent fiscal

year, the High Dividend Fund’s portfolio turnover rate was

80% of its net assets, plus borrowings for investment purposes, in dividend paying common stocks of medium-capitalization companies (which

are companies with a typical capitalization range of between $5 billion and $12 billion at the time of investment) and large-capitalization

companies (which are companies with a typical capitalization range greater than $12 billion at the time of investment).

comparison, a high dividend common stock that the High Dividend Fund would invest in would generally have a dividend yield greater than

the average dividend yield of the equity securities in the S&P 500® Index.

The High Dividend Fund invests roughly similar amounts of its assets

in each stock in the portfolio at the time of original purchase, although the portfolio is not systematically rebalanced. This approach

avoids the overweighting of any individual security being purchased. The Adviser may sell portfolio stocks when they are no longer attractive

based on their growth potential, dividend yield or price.

As part of its strategy, the High Dividend Fund, in order to generate

additional income, may selectively write covered call options when it is deemed to be in the Fund’s best interest. A call option

is a short-term contract entitling the purchaser, in return for a premium paid, the right to buy the underlying equity security at a

specified price upon exercise of the option at any time prior to its expiration. Writing a covered call option allows the High Dividend

Fund to receive a premium. A call option gives the holder the right, but not the obligation, to buy the underlying equity stock from

the writer of the option at a given price during a specific period.

The High Dividend Fund may invest up to 30% of its assets in foreign

securities. These investments are generally made in American Depositary Receipts (“ADRs”), which are depositary receipts

for foreign securities denominated in U.S. dollars and traded in U.S. securities markets or available through a U.S. broker or dealer.

ADRs may be purchased through “sponsored” or “unsponsored” facilities. A sponsored facility is established jointly

by the issuer of the underlying security and a depositary, whereas a depositary may establish an unsponsored facility without participation

by the issuer of the depositary security. Holders of unsponsored depositary receipts generally bear all the costs of such facilities

and the depositary of an unsponsored facility frequently is under no obligation to distribute shareholder communications received from

the issuer of the deposited security or to pass through voting rights to the holders of such receipts.

The High Dividend Fund generally invests substantially all of its

assets in common stocks and ADRs but may invest in other equity securities, which can include convertible debt, exchange-traded funds

(“ETFs”) that invest primarily in equity securities, warrants, rights, equity interests in real estate investment trusts

(“REITs”), equity interests in master limited partnerships (“MLPs”), and preferred stocks.

The Fund will not engage in derivatives except to the extent that

the writing of covered call options is deemed to involve derivatives.

risks, including the risk that you may lose part or all of the money you invest.

Stock Risks. The High Dividend Fund’s major risks are those of investing in the stock market, which can mean that the

High Dividend Fund may experience sudden, unpredictable declines in value, as well as periods of poor performance. Periods of poor performance

and declines in value of the High Dividend Fund’s underlying equity investments can be caused, and also be further prolonged, by

many circumstances that can confront the global economy such as declining consumer and business confidence, malfunctioning credit markets,

increased unemployment, reduced levels of capital expenditure, fluctuating commodity prices, bankruptcies, and other circumstances, all

of which can individually and collectively have direct effects on the valuation and/or earnings power of the companies in which the High

Dividend Fund invests. Stock markets worldwide experience volatility as a result of market participants reacting to economic data and

market indicators that contradict previous assumptions and estimates. At times, these reactions have created scenarios where investors

and traders have redeemed their investments/holdings en masse, thereby creating additional and often significant downward price

pressure than might be experienced in less volatile periods. In the future, market participants’ views on the valuation and/or

earnings power of a company and the overall state of the economy can cause similar significant short-term and long-term volatility in

the value of the High Dividend Fund’s shares. As a result, you could lose money investing in the High Dividend Fund.

Companies Risk. The High Dividend Fund may invest in the stocks of medium-capitalization companies. Medium-capitalization

companies often have narrower markets and limited managerial and financial resources compared to those of larger, more established companies.

As a result, their performance can be more volatile and they face greater risk of business reversals, which could increase the volatility

of the High Dividend Fund’s portfolio.

Companies Risk. The Fund may invest in the stocks of large-capitalization companies. Securities issued by large-capitalization

companies tend to be less volatile than securities issued by smaller companies. However, larger companies may not be able to attain the

high growth rates of successful smaller companies, especially during strong economic periods, and may be unable to respond as quickly

to competitive challenges.

Style Investing Risk. Different types of equity investment strategies tend to shift in and out of favor depending on market

and economic conditions, and the performance resulting from the High Dividend Fund’s “value” investment style may sometimes

be lower than that of equity funds following other styles of investment.

Securities Risk. Foreign investments involve additional risks, which include currency exchange-rate fluctuations, political

and economic instability, differences in financial reporting standards, and less-strict regulation of securities markets. More specific

risks include:

Fund if any of the following occur:

by investing in emerging markets. Emerging markets have been more volatile than the markets of developed countries with more mature economies.

ADRs are subject to the risks of foreign investments and may not always track the price of the underlying foreign security. Even when

denominated in U.S. currency, the depositary receipts are subject to currency risk if the underlying security is denominated in a foreign

currency.

or Covered Call Writing Risk. The Fund may write (i.e., sell) covered call options on the securities or instruments in which

it may invest and to enter into closing purchase transactions with respect to certain of such options. The market price of the call will,

in most instances, move in conjunction with the price of the underlying equity security. However, if the security rises in value and

the call is exercised, the High Dividend Fund may not participate fully in the market appreciation of the security, which may negatively

affect your investment return. The Fund’s writing of covered call options is also subject to counterparty risk, which is the risk

that the other party in the transaction will not fulfill its contractual obligation.

(the “1940 Act”), governs the use of certain derivatives by registered investment companies. The Fund has implemented policies

and procedures to comply with Rule 18f-4. Rule 18f-4 imposes limits on the amount of certain derivatives a fund can enter into,

eliminated the asset segregation framework previously used by funds to comply with Section 18 of the 1940 Act, treats derivatives

as senior securities and requires funds whose use of derivatives (including for purposes of Rule 18f- 4, covered call options) is

more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint

a derivatives risk manager.

additional regulations governing derivatives markets, which new regulations may impact options or covered call writing, including mandatory

clearing of certain derivatives, margin, reporting and registration requirements. The ultimate impact of the regulations remains unclear.

Additional U.S. or other regulations may make derivatives more costly, impose reporting and other obligations on the Fund in connection

with its investments in derivatives, may limit the availability of derivatives, or may otherwise adversely affect the value or performance

of derivatives. Future regulatory developments may impact the Fund’s ability to invest or remain invested in certain derivatives.

The Adviser cannot predict the effects of any new governmental regulation that may be implemented on the ability of the Fund to use derivative

products, including options or covered calls, and there can be no assurance that any new governmental regulation will not adversely affect

the Fund’s ability to achieve its investment objectives.

Disruptions Risk; Sovereign Debt Crises Risks. The global financial markets have in recent years undergone pervasive and fundamental

disruptions. This global market turmoil has led to increased market volatility. Consumer and business confidence remains fragile and

subject to possible reversal for a variety of

levels by many consumers, business institutions and governments in the United States, certain countries in Europe and elsewhere around

the world,. The securities of the United States, as well as several countries across Europe and Asia, have in recent years been, or are

at risk of being, downgraded, and sovereign debt crises have persisted in certain countries in those regions. Local, regional or global

events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions,

or other events could have a significant impact on the Fund and its investments. These events and circumstances could result in further

market disruptions that could adversely affect financial markets on a global basis.

pandemic that resulted in numerous disruptions in the market and had significant economic impact leaving general concern and uncertainty.

This coronavirus could continue to affect, and other epidemics and pandemics that may arise in the future could affect, the economies

of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

Intervention Risk. The global financial markets have in the past few years gone through pervasive and fundamental disruptions

which have led to extensive and unprecedented governmental intervention. Such intervention has in certain cases been implemented on an

“emergency” basis, suddenly and substantially eliminating market participants’ ability to continue to implement certain

strategies or manage the risk of their outstanding positions. In addition, these interventions have typically been unclear in scope and

application, resulting in confusion and uncertainty which in itself has been materially detrimental to the efficient functioning of the

markets as well as previously successful investment strategies.

forwards and non-deliverable forwards, are subject to regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act

(the “Dodd-Frank Act”). Under the Dodd-Frank Act, certain derivatives are subject to margin requirements. Implementation

of regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of swaps and other derivatives may increase

the costs to the Funds of trading in these instruments and, as a result, may affect returns to investors in the Fund.

in Other Investment Companies Risk. As with other investments, investments in other investment companies, including ETFs, are subject to market and selection risk. In addition, if the Fund acquires shares of investment companies, including ones

affiliated with the Fund, shareholders bear both their proportionate share of expenses in the Fund (including management and advisory

fees) and, indirectly, the expenses of the investment companies (to the extent not offset by waivers).

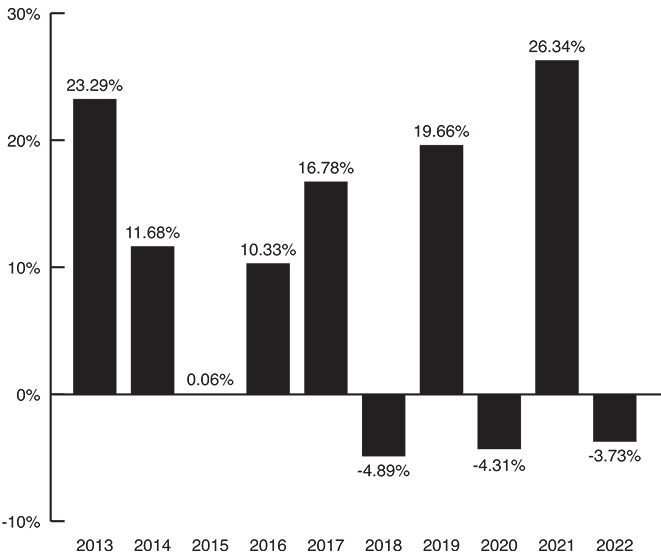

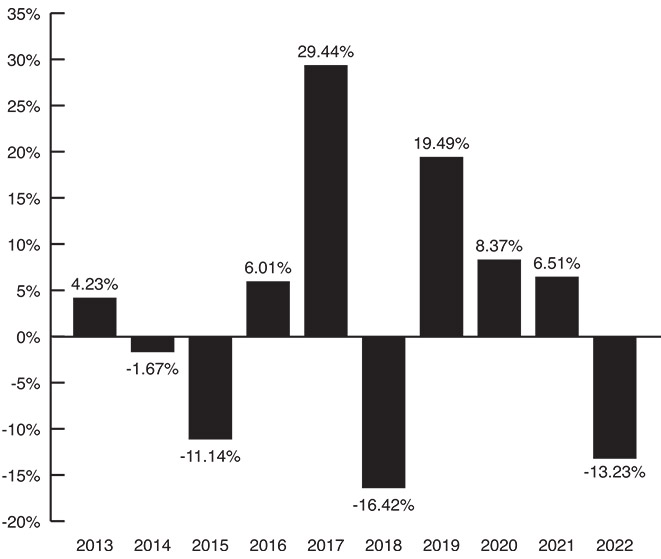

of investing in the shares of the High Dividend Fund by showing the variability of the Retail Class’s returns (the class with the

longest period of annual returns).

Dividend Fund’s performance from year to year (on a calendar year basis). The table shows the High Dividend Fund’s average annual

total return over time compared with a broad-based market index. Both the bar chart and table assume that all dividends and distributions

are reinvested in the High Dividend Fund.

an indication of how the High Dividend Fund will perform in the future.

Updated performance information, including its current net asset value,

is available at

2022

| Best and Worst Quarter Returns (for the period reflected in the bar chart above) | |||

| Return | Quarter/Year | ||

| Q4/2022 | |||

| – |

|||

| High Dividend Fund, Retail Class | 1 Year | 5 Year | 10 Year |

| Returns before taxes | – |

||

| Returns after taxes on distributions1 | – |

||

| Returns after taxes on distributions and sale of Fund shares | – |

||

| High Dividend Fund, Class I | |||

| Returns before taxes | – |

||

| High Dividend Fund, Class C | |||

| Returns before taxes | – |

||

| High Dividend Fund, Class R1 |

| Returns before taxes | – |

||

| High Dividend Fund, Class R2 | |||

| Returns before taxes | – |

||

| S&P 500® Index |

– |

Investment Adviser

Cullen Capital Management LLC serves as the investment adviser to

the High Dividend Fund.

Portfolio Managers

James P. Cullen, the Adviser’s Chairman, Chief Executive Officer

and controlling member, has been a portfolio manager of the High Dividend Fund since the Fund’s inception on August 1, 2003.

He is also a founder of Schafer Cullen Capital Management, Inc., a registered investment adviser, and has been its Chairman and

Chief Executive Officer since December 1982.

Jennifer Chang has served as a co-portfolio manager of the High Dividend

Fund since April 14, 2014. Ms. Chang currently serves as Portfolio Manager and Executive Director at the Adviser and has worked

there since 2006.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the High Dividend Fund on days

the New York Stock Exchange (NYSE) is open for trading by written request to the addresses below, by wire transfer, by telephone at 1-877-485-8586

or through any broker/dealer organization that has a sales agreement with the Fund’s distributor. Purchases and redemptions by

telephone are only permitted if you previously established these options on your account.

Regular mail: Cullen Funds, PO Box 2170, Denver, Colorado 80201

Overnight mail: Cullen Funds c/o Paralel Technologies, 1700 Broadway,

Suite 1850, Denver, Colorado 80290

The High Dividend Fund accepts investment in the following minimum

amounts:

| Share Class: |

Initial | Additional |

| Retail Class-Regular Accounts |

$1,000 | $100 |

| Retail Class-IRAs and UGMA/UTMA Accounts, Simple IRA, SEP-IRA, 403(b)(7), Keogh, Pension Plan and Profit Sharing Plan Accounts |

$250 | $50 |

| Class C-Regular Accounts |

$1,000 | $100 |

| Class C-IRAs and UGMA/UTMA Accounts, Simple IRA, SEP-IRA, 403(b)(7), Keogh, Pension Plan and Profit Sharing Plan Accounts |

$250 | $50 |

| Class I | $1,000,000 | $100 |

| Class R1 | none | none |

| Class R2 | none | none |

| ● | A registered investment adviser may aggregate all client accounts investing in Class I shares of the High Dividend Fund to meet the investment minimum. |

| ● | If you use an Automatic Investment Plan (“AIP”) for a regular account for the Retail Class or Class C shares, the initial investment minimum to open an account is $50 and the additional investment minimum is $50. |

| ● | If you use an AIP for a custodial or retirement plan account for the Retail Class or Class C shares, the initial investment minimum to open an account as well as the monthly additional investment amount is $25. |

Tax Information

The High Dividend Fund’s distributions to you are taxable,

and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan

or an IRA, in which case such distributions can be subject to U.S. federal income tax as ordinary income when distributed to, or received

by, you from such tax-deferred arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the High Dividend Fund through a broker-dealer or

other financial intermediary (such as a bank or financial adviser), the High Dividend Fund and/or its Adviser may pay the intermediary

for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or

other financial intermediary and your salesperson to recommend the High Dividend Fund over another investment. Ask your salesperson or

visit your financial intermediary’s website for more information.

Fund

The Cullen International High Dividend Fund (the “International

High Dividend Fund” or the “Fund”) seeks long-term capital appreciation and current income.

This table describes the fees and expenses that you may pay if you

buy and hold shares of the International High Dividend Fund.

| Retail Class | Class C | Class I | Class R1 | Class R2 | |

| Redemption Fee (as a percentage of amount redeemed)a | |||||

|

|

|||||

| Retail Class | Class C | Class I | Class R1 | Class R2 | |

| Management Fee | |||||

| Distribution and Service (12b-1) Fees | |||||

| Other Expensesb | |||||

| Acquired Fund Fees & Expenses | |||||

| Total Annual Fund Operating Expensesc | |||||

| Less Expense Reduction/Reimbursementd | – |

– |

– |

– |

|

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | |||||

This example is intended to help you compare the cost of investing

in the International High Dividend Fund with the cost of investing in other mutual funds. This example assumes that you invest $10,000

in the International High Dividend Fund for the time periods indicated and then redeem all of your shares at the end of those periods.

The example also assumes your investment has a 5% return each year and that the International High Dividend Fund’s operating expenses

remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years* | 5 Years* | 10 Years* | |

| Retail Class | $ |

$ |

$ |

$ |

| Class C | $ |

$ |

$ |

$ |

| Class I | $ |

$ |

$ |

$ |

| Class R1 | $ |

$ |

$ |

$ |

| Class R2 | $ |

$ |

$ |

$ |

The International High Dividend Fund pays transaction costs, such

as commissions, when it buys and sells securities (“portfolio turnover”). A higher portfolio turnover rate will result in

higher transaction costs and may result in higher taxes when International High Dividend Fund shares are held in a taxable account. These

costs, which are not reflected in annual fund operating expenses or in the example, affect the International High Dividend Fund’s

performance. During the most recent fiscal year, the International High Dividend Fund’s portfolio turnover rate was

average value of its portfolio.

at least 80% of its net assets, plus borrowings for investment purposes, in high dividend paying common stocks of medium-capitalization

companies (which are companies with a typical capitalization range of between $5 billion and $12 billion at the time of investment) and

large-capitalization companies (which are companies with a typical capitalization range greater than $12 billion at the time of investment)

headquartered outside the United States in common stocks traded on exchanges not located in the United States and in American Depositary

Receipts (“ADRs”).

would invest in would generally have a dividend yield greater than the average dividend yield of the equity securities in the MSCI EAFE

Stock Index.

ADRs are depositary receipts for foreign securities denominated in

U.S. dollars and traded on U.S. securities markets or available through a U.S. broker or dealer. ADRs may be purchased through “sponsored”

or “unsponsored” facilities. A sponsored facility is established jointly by the issuer of the underlying security and a depositary,

whereas a depositary may establish an unsponsored facility without participation by the issuer of the depositary security. Holders of

unsponsored depositary receipts generally bear all the costs of such facilities and the depositary of an unsponsored facility frequently

is under no obligation to distribute shareholder communications received from the issuer of the deposited security or to pass through

voting rights to the holders of such receipts.

The International High Dividend Fund intends to diversify its investments

across different countries, and the percentage of the International High Dividend Fund’s assets invested in particular countries

or regions will change from time to time based on the Adviser’s judgment. The International High Dividend Fund intends to invest

in the securities of companies located in developed countries and, to a lesser extent, those located in emerging markets. The International

High Dividend Fund may consider investments in companies in any of the world’s developed stock markets, such as the United Kingdom

and stock markets in the European Union. The International High Dividend Fund also may consider investments in developed and emerging

stock markets in Asia, such as Hong Kong, China, Singapore, Korea, Taiwan, Malaysia and Thailand. Other developed and emerging stock

markets such as Australia, New Zealand, South Africa, Canada and Mexico also may be considered.

The International High Dividend Fund generally invests substantially

all of its assets in common stocks and ADRs but may invest in other equity securities, which can include European Depositary Receipts

(“EDRs”), Global Depositary Receipts (“GDRs”), convertible debt, exchange-traded funds (“ETFs”) that

invest primarily in equity securities, warrants, rights, equity interests in real estate investment trusts (“REITs”), equity

interests in master limited partnerships (“MLPs”), and preferred stocks. The International High Dividend Fund invests roughly

similar amounts of its assets in each position in the portfolio at the time of original purchase, although the portfolio is not systematically

rebalanced. This approach avoids the overweighting of any individual security being purchased. The Adviser may sell portfolio stocks

when they are no longer attractive based on their growth potential, dividend yield or price.

As part of its strategy, the International High Dividend Fund, in

order to generate additional income, may selectively write covered call options when it is deemed to be in the Fund’s best interest.

A call option is a short-term contract entitling the purchaser, in return for a premium paid, the right to buy the underlying equity

security at a specified price upon exercise of the option at any time prior to its expiration. Writing a covered call option allows the

International High Dividend Fund to receive a premium. A call option gives the holder the right, but not the obligation, to buy the underlying

equity stock from the writer of the option at a given price during a specific period.

The Fund will not engage in derivatives except to the extent that

the writing of covered call options is deemed to involve derivatives.

Fund involves risks, including the risk that you may lose part or all of the money you invest.

Stock Risks. The International High Dividend Fund’s major risks are those of investing in the stock market, which can

mean that the International High Dividend Fund may experience sudden, unpredictable declines in value, as well as periods of poor performance.

Periods of poor performance and declines in value of the International High Dividend Fund’s underlying equity investments can be

caused, and also be further prolonged, by many circumstances that can confront the global economy such as declining consumer and business

confidence, malfunctioning credit markets, increased unemployment, reduced levels of capital expenditure, fluctuating commodity prices,

bankruptcies, and other circumstances, all of which can individually and collectively have direct effects on the valuation and/or earnings

power of the companies in which the International High Dividend Fund invests. Stock markets worldwide have experienced significant volatility

in recent periods as a result of market participants reacting to economic data and market indicators that have contradicted previous

assumptions and estimates. At times, these reactions have created scenarios where investors and traders have redeemed their investments/holdings

en masse, thereby creating additional and often significant downward price pressure than might be experienced in less volatile

periods. In the future, market participants’ views on the valuation and/or

cause similar significant short-term and long-term volatility in the value of the International High Dividend Fund’s shares. As

a result, you could lose money investing in the International High Dividend Fund.

Securities Risks. Foreign investments involve additional risks, which include currency exchange-rate fluctuations, political

and economic instability, differences in financial reporting standards, and less-strict regulation of securities markets. More specific

risks include:

Fund if any of the following occur:

by investing in emerging markets. Emerging markets have been more volatile than the markets of developed countries with more mature economies.

ADRs are subject to the risks of foreign investments and may not always track the price of the underlying foreign security. Even when

denominated in U.S. currency, the depositary receipts are subject to currency risk if the underlying security is denominated in a foreign

currency.

Companies Risk. The Fund may invest in the stocks of large-capitalization companies. Securities issued by large-capitalization

companies tend to be less volatile than securities issued by smaller companies. However, larger companies may not be able to attain the

high growth rates of successful smaller companies, especially during strong economic periods, and may be unable to respond as quickly

to competitive challenges.

Companies Risks. The International High Dividend Fund may invest in the stocks of medium-capitalization companies. Medium-

capitalization companies often have narrower markets and limited managerial and financial resources compared to those of larger, more

established companies. As a result, their performance can be more volatile and they face greater risk of business reversals, which could

increase the volatility of the International High Dividend Fund’s portfolio.

Style Investing Risks. Different types of equity investment strategies tend to shift in and out of favor depending on market

and economic conditions, and the performance resulting from the International High Dividend Fund’s “value” investment

style may sometimes be lower than that of equity funds following other styles of investment.

Securities Risk. The European financial markets have recently experienced volatility and adverse trends due to concerns about

economic downturns in, or rising government debt levels of, several European countries as well as acts of war in the region. These events

may spread to other countries in Europe and may affect the value and liquidity of certain of the Fund’s investments. Responses

to the financial problems by European governments, central banks and others, including austerity measures and reforms, may not work,

may result in social unrest and may limit future growth and economic recovery or have other unintended consequences. Further defaults

or restructurings by governments and others of their debt could have additional adverse effects on economies, financial markets and asset

valuations around the world.

The extent and duration of the military action, resulting sanctions and resulting future market disruptions in the region are impossible

to predict, but could be significant and have a severe adverse effect on the region, including significant negative impacts on the economy

and the markets for certain securities and commodities, such as oil and natural gas, as well as other sectors.

Focus Risk. From time to time the

Fund may invest a substantial amount of its assets in issuers located in a single country or region or a limited number of countries.

If the Fund concentrates its investments in this manner, it assumes the risk that economic, political and social conditions in those

countries will have a significant impact on its investment performance. The Fund’s investment performance may also be more volatile

if it concentrates its investments in certain countries, especially emerging market countries.

Currency Risk. Investments in foreign currencies are subject to the risk that those currencies will decline in value relative

to the U.S. dollar, which will reduce the value of investments denominated in those currencies held by the International High Dividend

Fund.

or Covered Call Writing Risk. The Fund may write (i.e., sell) covered call options

on the securities or instruments in which it may invest and to enter into closing purchase transactions with respect to certain of such

options. The market price of the call will, in most instances, move in conjunction with the price of the underlying equity security.

However, if the security rises in value and the call is exercised, the International High Dividend Fund may not participate fully in

the market appreciation of the security, which may negatively affect your investment return. The Fund’s writing of covered call

options is also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual

obligation.

(the “1940 Act”), governs the use of certain derivatives by registered investment companies. The Fund has implemented policies

and procedures to comply with Rule 18f-4. Rule 18f-4 imposes limits on the amount of certain derivatives a fund can enter into,

eliminated the asset segregation framework previously used by funds to comply with Section 18 of the 1940 Act, treats derivatives

as senior securities and requires funds whose use of derivatives (including for purposes of Rule 18f- 4, covered call options) is

more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint

a derivatives risk manager.

additional regulations governing derivatives markets, which new regulations may impact options or covered call writing, including mandatory

clearing of certain derivatives, margin, reporting and registration requirements. The ultimate impact of the regulations remains unclear.

Additional U.S. or other regulations may make derivatives more costly, impose reporting and other obligations on the Fund in connection

with its investments in derivatives, may limit the availability of derivatives, or may otherwise adversely affect the value or performance

of derivatives. Future regulatory developments may impact the Fund’s ability to invest or remain invested in certain derivatives.

The Adviser cannot predict the effects of any new governmental regulation that may be implemented on the ability of the Fund to use derivative

products, including options or covered calls, and there can be no assurance that any new governmental regulation will not adversely affect

the Fund’s ability to achieve its investment objectives.

Disruptions Risk; Sovereign Debt Crises Risks. The global financial markets have in recent years undergone pervasive and fundamental

disruptions. This global market turmoil has led to increased market volatility. Consumer and business confidence remains fragile and

subject to possible reversal for a variety of reasons, including political uncertainty, and high and growing debt levels by many consumers,

business institutions and governments in the United States, certain countries in Europe and elsewhere around the world. The securities

of the United States, as well as several countries across Europe and Asia, have in recent years been, or are at risk of being, downgraded,

and sovereign debt crises have persisted in certain countries in those regions. Local, regional or global events such as war, acts of

terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could

have a significant impact on the Fund and its investments. These events and circumstances could result in further market disruptions

that could adversely affect financial markets on a global basis.

pandemic that resulted in numerous disruptions in the market and had significant economic impact leaving general concern and uncertainty.

This coronavirus could continue to affect, and other epidemics and pandemics that may arise in the future could affect, the economies

of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

Intervention Risk. The global financial markets have in the past few years gone through pervasive and fundamental disruptions

which have led to extensive and unprecedented governmental intervention. Such intervention has in certain cases been implemented on an

“emergency” basis, suddenly and substantially eliminating market participants’ ability to continue to implement certain

strategies or manage the risk of their outstanding positions. In addition, these interventions have typically been unclear in scope and

application, resulting in confusion and uncertainty which in itself has been materially detrimental to the efficient functioning of the

markets as well as previously successful investment strategies.

forwards and non-deliverable forwards, are subject to regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act

(the “Dodd-Frank Act”). Under the Dodd-Frank Act, certain derivatives are subject to margin requirements. Implementation

of regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of swaps and other derivatives may increase

the costs to the Funds of trading in these instruments and, as a result, may affect returns to investors in the Fund.

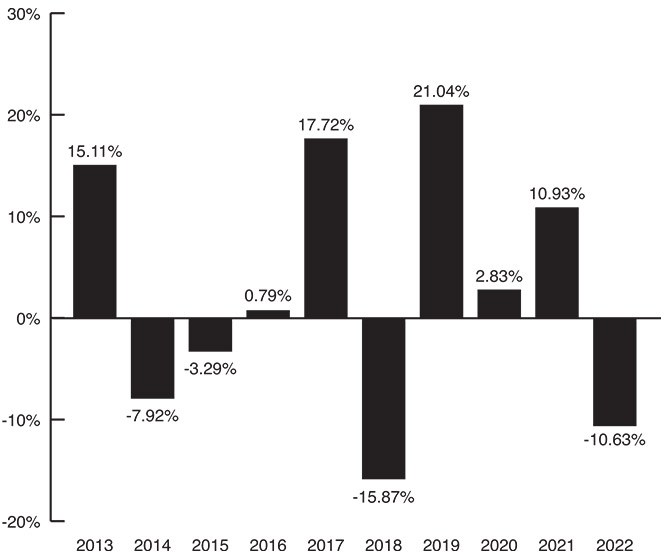

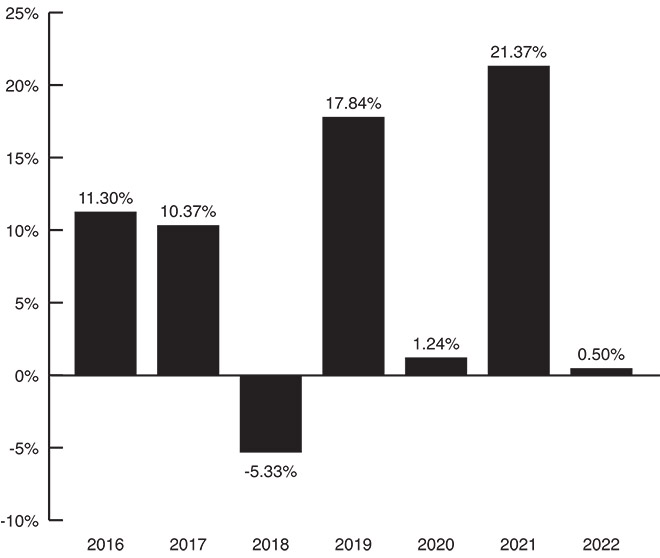

of investing in the shares of the International High Dividend Fund by showing the variability of the Retail Class’s returns (the

class with the longest period of annual returns).

the changes in the Fund’s performance from year to year (on a calendar year basis). The table shows the International High Dividend

Fund’s average annual total return over time compared with a broad-based market index. Both the bar chart and table assume that all dividends

and distributions are reinvested in the International High Dividend Fund.

performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

Updated performance information is available at

or by calling

2022

total return through

| Best and Worst Quarter Returns (for the period reflected in the bar chart above) | |||

| Return | Quarter/Year | ||

| Q4/2022 | |||

| – |

|||

|

International High Dividend Fund, Retail Class |

1 Year |

5 Year |

10 Year |

|

| Returns before taxes | – |

|||

| Returns after taxes on distributions1 | – |

|||

| Returns after taxes on distributions and sale of Fund shares | – |

|||

| International High Dividend Fund, Class I | ||||

| Returns before taxes | – |

|||

| International High Dividend Fund, Class C | ||||

| Returns before taxes | – |

– |

||

| International High Dividend Fund, Class R1 | ||||

| Returns before taxes2 | ||||

| International High Dividend Fund, Class R2 | ||||

| Returns before taxes | – |

|||

| MSCI EAFE Index |

– |

| 1 |

| 2 | The International High Dividend Fund Class R1 returns before taxes are shown through November 14, 2021, the last date the share class had shareholders. |

Investment Adviser

Cullen Capital Management LLC serves as the investment adviser to

the International High Dividend Fund.

Portfolio Managers

James P. Cullen, the Adviser’s Chairman, Chief Executive Officer

and controlling member, has been a portfolio manager of the International High Dividend Fund since the Fund’s inception on December 15,

2005. He is also a founder of Schafer Cullen Capital Management, Inc., a registered investment adviser, and has been its Chairman

and Chief Executive Officer since December 1982.

Rahul D. Sharma has served as a co-portfolio manager for the International

High Dividend Fund since October 31, 2007. Mr. Sharma currently serves as Portfolio Manager and Executive Director at the Adviser

and has worked there since May 2000.

Pravir Singh has served as a co-portfolio manager for the International

High Dividend Fund since May 2019. Mr. Singh currently serves as Portfolio Manager and Managing Director at the Adviser and

has worked there since 2005.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the International High Dividend

Fund on days the New York Stock Exchange (NYSE) is open for trading by written request to the addresses below, by wire transfer, by telephone

at 1-877-485-8586 or through any broker/dealer organization that has a sales agreement with the Fund’s distributor. Purchases and

redemptions by telephone are only permitted if you previously established these options on your account.

Regular mail: Cullen Funds, PO Box 2170, Denver, Colorado 80201

Overnight mail: Cullen Funds c/o Paralel Technologies, 1700 Broadway,

Suite 1850, Denver, Colorado 80290

The International High Dividend Fund accepts investment in the following

minimum amounts:

| Share Class: | Initial | Additional |

| Retail Class-Regular Accounts | $1,000 | $100 |

| Retail Class-IRAs and UGMA/UTMA Accounts, Simple IRA, SEP-IRA, 403(b)(7), Keogh, Pension Plan and Profit Sharing Plan Accounts | $250 | $50 |

| Class C-Regular Accounts | $1,000 | $100 |

| Class C-IRAs and UGMA/UTMA Accounts, Simple IRA, SEP-IRA, 403(b)(7), Keogh, Pension Plan and Profit Sharing Plan Accounts | $250 | $50 |

| Class I | $1,000,000 | $100 |

| Class R1 | none | none |

| Class R2 | none | none |

| ● | A registered investment adviser may aggregate all client accounts investing in Class I shares of the International High Dividend Fund to meet the investment minimum. |

| ● | If you use an Automatic Investment Plan (“AIP”) for a regular account for the Retail Class or Class C shares, the initial investment minimum to open an account is $50 and the additional investment minimum is $50. |

|

| ● | If you use an AIP for a custodial or retirement plan account for the Retail Class or Class C shares, the initial investment minimum to open an account as well as the monthly additional investment amount is $25. |

Tax Information

The International High Dividend Fund’s distributions to you

are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such

as a 401(k) plan or an IRA, in which case such distributions can be subject to U.S. federal income tax as ordinary income when distributed

to, or received by, you from such tax-deferred arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the International High Dividend Fund through a broker-dealer

or other financial intermediary (such as a bank or financial adviser), the International High Dividend Fund and/or its Adviser may pay

the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the

broker-dealer or other financial intermediary and your salesperson to recommend the International High Dividend Fund over another investment.

Ask your salesperson or visit your financial intermediary’s website for more information.

| YOUR INVESTMENT |

| Summary Information |

The Cullen Small Cap Value Fund (the “Small Cap Value Fund”

or the “Fund”) seeks long-term capital appreciation.

This table describes the fees and expenses that you may pay if you

buy and hold shares of the Small Cap Value Fund.

| Retail Class | Class C | Class I | Class R1 | Class R2 | |

| Redemption Fee (as a percentage of amount redeemed)a |

as a percentage of the value of your investment):

| Retail Class | Class C | Class I | Class R1e | Class R2e | |

| Management Fee | |||||

| Distribution and Service (12b-1) Fees | |||||

| Other Expensesb | |||||

| Acquired Fund Fees & Expenses | |||||

| Total Annual Fund Operating Expensesc | |||||

| Less Expense Reduction/Reimbursementd | – |

– |

– |

– |

– |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

| d | Cullen Capital Management LLC (the “Adviser”) has contractually agreed to limit the Net Annual Fund Operating Expenses (excluding Acquired Fund Fees and Expenses, interest, taxes and extraordinary expenses) |

to not more than 1.25% for Retail Class shares,

2.00% for Class C shares, 1.00% for Class I shares, 1.75% for Class R1 shares and 1.50% for Class R2 shares, through

expense reimbursement agreement (the “Agreement”), recapture any expenses or fees it has reduced or reimbursed within a three-year

period from the date of reimbursement, provided that recapture does not cause the Small Cap Value Fund to exceed existing expense limitations.

The Agreement to limit the Net Annual Operating Expenses may not be terminated by either the Small Cap Value Fund or the Adviser prior

to the Termination Date.

This example is intended to help you compare the cost of investing

in the Small Cap Value Fund with the cost of investing in other mutual funds. This example assumes that you invest $10,000 in the Small

Cap Value Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes

your investment has a 5% return each year and that the Small Cap Value Fund’s operating expenses remain the same. Although your

actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years* | 5 Years* | 10 Years* | |

| Retail Class | $ |

$ |

$ |

$ |

| Class C | $ |

$ |

$ |

$ |

| Class I | $ |

$ |

$ |

$ |

| Class R1 | $ |

$ |

$ |

$ |

| Class R2 | $ |

$ |

$ |

$ |

The Small Cap Value Fund pays transaction costs, such as commissions,

when it buys and sells securities (“portfolio turnover”). A higher portfolio turnover rate will result in higher transaction

costs and may result in higher taxes when Small Cap Value Fund shares are held in a taxable account. These costs, which are not reflected

in annual fund operating expenses or in the example, affect the Small Cap Value Fund’s performance. During the most recent fiscal

year, the Small Cap Value Fund’s portfolio turnover rate was

80% of its net assets, plus borrowings for investment purposes, in small-capitalization companies, which the Fund defines as those companies

with market capitalizations below $5 billion at the time of original purchase.

have the following characteristics:

| ● | a below average price/earnings ratio as compared with the average price/earnings ratio of the equity securities in the Russell 2000 Value Stock Index; |

| ● | above average projected earnings growth as compared to the average projected earnings growth of the equity securities in the Russell 2000 Value Stock Index. |

The Small Cap Value Fund generally invests substantially all of

its assets in common stocks and other equity securities, which can include convertible debt, exchange-traded funds (“ETFs”)

that invest primarily in equity securities, depositary receipts, warrants, rights, equity interests in real estate investment trusts

(“REITs”), master limited partnerships (“MLPs”), and preferred stocks. The Small Cap Value Fund invests roughly

similar amounts of its assets in each security in the portfolio at the time of original purchase, although the portfolio is not systematically

rebalanced. This approach avoids the overweighting of any individual security being purchased. The Adviser may sell portfolio stocks

when they are no longer attractive based on their price or earnings growth potential.

The Small Cap Value Fund may invest up to 30% of its assets in securities

of companies headquartered outside the United States. These investments will be made in securities traded on exchanges outside the United

States and/or American Depositary Receipts (“ADRs”), which are depositary receipts for foreign securities denominated in

U.S. dollars and traded on U.S. securities markets or available through a U.S. broker or dealer. ADRs may be purchased through “sponsored”

or “unsponsored” facilities. A sponsored facility is established jointly by the issuer of the underlying security and a depositary,

whereas a depositary may establish an unsponsored facility without participation by the issuer of the depositary security. Holders of

unsponsored depositary receipts generally bear all the costs of such facilities and the depositary of an unsponsored facility frequently

is under no obligation to distribute shareholder communications received from the issuer of the deposited security or to pass through

voting rights to the holders of such receipts.

The Small Cap Value Fund intends to diversify its investments in securities

of companies headquartered outside the United States across different countries, and the percentage of the Small Cap Value Fund’s

assets invested in particular countries or regions will change from time to time based on the Adviser’s judgment, subject to other

restrictions described herein. The Small Cap Value Fund intends to invest in the securities of companies located in developed countries

and, to a lesser extent, those located in emerging markets. The Fund may consider investments in companies in any of the world’s

developed or emerging stock markets.

As part of its strategy, the Small Cap Value Fund, in order to generate

additional income, may selectively write covered call options when it is deemed to be in the Fund’s best interest. A call option

is a short-term contract entitling the purchaser, in return for a premium paid, the right to buy the underlying equity security at a

specified price upon exercise of the option at any time prior to its expiration. Writing a covered call option allows the Small Cap Value

Fund to receive a premium. A call option gives the holder the right, but not the obligation, to buy the underlying equity stock from

the writer of the option at a given price during a specific period.

The Small Cap Value Fund will not engage in derivatives except to

the extent that the writing of covered call options is deemed to involve derivatives.

risks, including the risk that you may lose part or all of the money you invest.

Stock Risks. The Small Cap Value Fund’s major risks are those of investing in the stock market, which can mean the Small

Cap Value Fund may experience sudden, unpredictable declines in value, as well as periods of poor performance. Periods of poor performance

and declines in value of the Small Cap Value Fund’s underlying equity investments can be caused, and also be further prolonged,

by many circumstances that can confront the global economy such as declining consumer and business confidence, malfunctioning credit

markets, increased unemployment, reduced levels of capital expenditure, fluctuating commodity prices, bankruptcies, and other circumstances,

all of which can individually and collectively have direct effects on the valuation and/or earnings power of the companies in which the

Small Cap Value Fund invests. Stock markets worldwide have experienced significant volatility in recent periods as a result of market

participants reacting to economic data and market indicators that have contradicted previous assumptions and estimates. At times, these

reactions have created scenarios where investors and traders have redeemed their investments/holdings en masse, thereby creating

additional and often significant downward price pressure than might be experienced in less volatile periods. In the future, market participants’

views on the valuation and/or earnings power of a company and the overall state of the economy can cause similar significant short-term

and long-term volatility in the value of the Small Cap Value Fund’s shares. As a result, you could lose money investing in the

Small Cap Value Fund.

Companies Risks. The Small Cap Value Fund invests in the stocks of small-capitalization companies. Small-capitalization companies

often have narrower markets and limited managerial and financial resources compared to those of larger, more established companies. As

a result, their performance can be more volatile, and they face greater risk of business reversals, which could increase the volatility

of the Small Cap Value Fund’s portfolio. Further, due to thin trading in some such companies, an investment may be more illiquid

(i.e. harder to sell) than that of larger capitalization stocks.

Style Investing Risks. Different types of equity investment strategies tend to shift in and out of favor depending on market

and economic conditions, and the performance resulting from the Small Cap Value Fund’s “value” investment style may

sometimes be lower than that of other types of equity funds.

Securities Risks. Foreign investments involve additional risks, which include currency exchange-rate fluctuations, political

and economic instability, differences in financial reporting standards, and less-strict regulation of securities markets. More specific

risks include:

of the following occur:

by investing in emerging markets. Emerging markets have been more volatile than the markets of developed countries with more mature economies.

ADRs are subject to the risks of foreign investments and may not always track the price of the underlying foreign security. Even when

denominated in U.S. currency, the depositary receipts are subject to currency risk if the underlying security is denominated in a foreign

currency.

or Covered Call Writing Risk. The Fund may write (i.e., sell) covered call options on the securities or instruments in which

it may invest and to enter into closing purchase transactions with respect to certain of such options. The market price of the call will,

in most instances, move in conjunction with the price of the underlying equity security. However, if the security rises in value and

the call is exercised, the Small Cap Value Fund may not participate fully in the market appreciation of the security, which may negatively

affect your investment return. The Fund’s writing of covered call options is also subject to counterparty risk, which is the risk

that the other party in the transaction will not fulfill its contractual obligation.

(the “1940 Act”), governs the use of certain derivatives by registered investment companies. The Fund has implemented policies

and procedures to comply with Rule 18f-4. Rule 18f-4 imposes limits on the amount of certain derivatives a fund can enter into,

eliminated the asset segregation framework previously used by funds to comply with Section 18 of the 1940 Act, treats derivatives

as senior securities and requires funds whose use of derivatives (including for purposes of Rule 18f- 4, covered call options) is

more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint

a derivatives risk manager.

additional regulations governing derivatives markets, which new regulations may impact options or covered call writing, including mandatory

clearing of certain derivatives, margin, reporting and registration requirements. The ultimate impact of the regulations remains unclear.

Additional U.S. or other regulations may make derivatives more costly, impose reporting and other obligations on the Fund in connection

with its investments in derivatives, may limit the availability of derivatives, or may otherwise adversely affect the value or performance

of derivatives. Future regulatory developments may impact the Fund’s ability to invest or remain invested in certain derivatives.

The Adviser cannot predict the effects of any new governmental regulation that may be implemented on the ability of the Fund to use derivative

products, including options or covered calls, and there can be no assurance that any new governmental regulation will not adversely affect

the Fund’s ability to achieve its investment objectives.

Sector Risk. Companies in the industrials sector may be adversely affected by changes in the supply of and demand for products

and services, product obsolescence, claims for environmental damage or product liability and changes in general economic conditions,

among other factors.

Shareholder Risk. Certain large shareholders, the Adviser or an affiliate of the Adviser, or another entity, may from time

to time own a substantial amount of the Fund’s shares. The actions by one shareholder or multiple shareholders may have an impact

on the Fund and, therefore, indirectly on other shareholders. Shareholder purchase and redemption activity may affect the per share amount

of the Fund’s distributions of its net investment income and net realized capital gains, if any, thereby affecting the tax burden

on the Fund’s shareholders subject to federal income tax. To the extent a larger shareholder is permitted to invest in the Fund,

the Fund may experience large inflows or outflows of cash from time to time. This activity could magnify these adverse effects on the

Fund.

Disruptions Risk; Sovereign Debt Crises Risks. The global financial markets have in recent years undergone pervasive and fundamental

disruptions. This global market turmoil has led to increased market volatility. Consumer and business confidence remains fragile and

subject to possible reversal for a variety of reasons, including political uncertainty, and high and growing debt levels by many consumers,

business institutions and governments in the United States, certain countries in Europe and elsewhere around the world. The securities

of the United States, as well as several countries across Europe and Asia, have in recent years been, or are at risk of being, downgraded,

and sovereign debt crises have persisted in certain countries in those regions. Local, regional or global events such as war, acts of

terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could

have a significant impact on the Fund and its investments. These events and circumstances could result in further market disruptions

that could adversely affect financial markets on a global basis.

pandemic that resulted in numerous disruptions in the market and had significant economic impact leaving general concern and uncertainty.

This coronavirus could continue to affect, and other epidemics and pandemics that may arise in the future, could affect the economies

of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

Intervention Risk. The global financial markets have in the past few years gone through pervasive and fundamental disruptions

which have led to extensive and unprecedented governmental intervention. Such intervention has in certain cases been implemented on an

“emergency” basis, suddenly and substantially eliminating market participants’ ability to continue to implement certain

strategies or manage the risk of their outstanding positions. In addition, these interventions have typically been unclear in scope and

application, resulting in confusion and uncertainty which in itself has been materially detrimental to the efficient functioning of the

markets as well as previously successful investment strategies.

forwards and non-deliverable forwards, are subject to regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act

(the “Dodd-Frank Act”). Under the Dodd-Frank Act, certain derivatives are subject to margin requirements. Implementation

of regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of swaps and other derivatives may increase

the costs to the Funds of trading in these instruments and, as a result, may affect returns to investors in the Fund.

Portfolio Turnover Risk. The Fund may engage in active and frequent trading of its portfolio securities. High portfolio turnover

(more than 100%) may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction

costs on the sale of the securities and on reinvestment in other securities. The sale of Fund portfolio securities may result in the

realization and/or distribution to shareholders of higher capital gains or losses as compared to a fund with less active trading policies.

These effects of higher than normal portfolio turnover may adversely affect Fund performance.

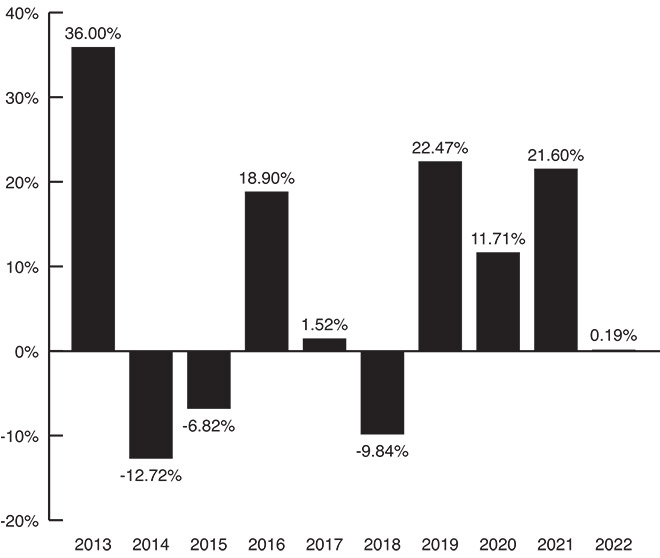

Retail Class’s returns (the class with the longest period of annual returns) and demonstrates some of the risks of investing in

the shares of the Small Cap Value Fund.

Small Cap Value Fund’s performance from year to year (on a calendar year basis). The table shows the Small Cap Value Fund’s

average annual total return over time compared with a broad-based market index. Both the bar chart and table assume that all dividends

and distributions are reinvested in the Small Cap Value Fund.

is not necessarily an indication of how the Fund will perform in the future.

Updated performance information is available

at

2022

through

Best and Worst Quarter Returns

(for the period reflected in the bar chart above)

|

Return |

Quarter/Year |

|

| – |

|

|

|||

|

Small Cap Value Fund, Retail Class |

1 Year |

5 Year |

10 Year |

| Returns before taxes | |||

| Returns after taxes on distributions1 | – |

||

| Returns after taxes on distributions and sale of Fund shares | |||

| Small Cap Value Fund, Class I | |||

| Returns before taxes | |||

| Small Cap Value Fund, Class C | |||

| Returns before taxes | – |

||

| Russell 2000 Value Index |

– |

| 1 |

Investment Adviser

Cullen Capital Management LLC serves as the investment adviser to the

Small Cap Value Fund.

Portfolio Managers

James P. Cullen, the Adviser’s Chairman, Chief Executive Officer

and controlling member, is a portfolio manager of the Small Cap Value Fund since the Fund’s inception on October 1, 2009. He

is also a founder of Schafer Cullen Capital Management, Inc., a registered investment adviser, and has been its Chairman and Chief

Executive Officer since December 1982.

Brooks H. Cullen is co-portfolio manager of the Small Cap Value Fund

since its inception on October 1, 2009. Mr. Cullen currently serves as Portfolio Manager and Vice Chairman at the Adviser and

has worked there since May 2000.

Brian Drubetsky is co-portfolio manager of the Small Cap Value Fund

since October 28, 2016. Mr. Drubetsky currently serves as Portfolio Manager and Vice President at the Adviser and has worked

there since 2013.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Small Cap Value Fund on days

the New York Stock Exchange (NYSE) is open for trading by written request to the addresses below, by wire transfer, by telephone at 1-877-485-8586

or through any broker/dealer organization that has a sales agreement with the Fund’s distributor. Purchases and redemptions by telephone

are only permitted if you previously established these options on your account.

Regular mail: Cullen Funds, PO Box 2170, Denver, Colorado 80201

Overnight mail: Cullen Funds c/o Paralel Technologies, 1700 Broadway,

Suite 1850, Denver, Colorado 80290

The Small Cap Value Fund accepts investment in the following minimum

amounts:

| Share Class: | Initial | Additional |

| Retail Class-Regular Accounts | $1,000 | $100 |

| Retail Class-IRAs and UGMA/UTMA Accounts, Simple IRA, SEP-IRA, 403(b)(7), Keogh, Pension Plan and Profit Sharing Plan Accounts |

$250 | $50 |

| Class C-Regular Accounts | $1,000 | $100 |

| Class C-IRAs and UGMA/UTMA Accounts, Simple IRA, SEP-IRA, 403(b)(7), Keogh, Pension Plan and Profit Sharing Plan Accounts |

$250 | $50 |

| Class I | $1,000,000 | $100 |

| Class R1 | none | none |

| Class R2 | none | none |

| ● | A registered investment adviser may aggregate all client accounts investing in Class I shares of the Small Cap Value Fund to meet the investment minimum. | |

| ● | If you use an Automatic Investment Plan (“AIP”) for a regular account for the Retail Class or Class C shares, the initial investment minimum to open an account is $50 and the additional investment minimum is $50. | |

| ● | If you use an AIP for a custodial or retirement plan account for the Retail Class or Class C shares, the initial investment minimum to open an account as well as the monthly additional investment amount is $25. |

Tax Information

The Small Cap Value Fund’s distributions to you are taxable,

and will be taxed as ordinary income or capital gains, unless you are investing through a tax- deferred arrangement, such as a 401(k) plan

or an IRA, in which case such distributions can be subject to U.S. federal income tax as ordinary income when distributed to, or received

by, you from such tax-deferred arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Small Cap Value Fund through a broker-dealer or

other financial intermediary (such as a bank or financial adviser), the Fund and/or its Adviser may pay the intermediary for the sale

of Fund shares and related services. These payments may create a conflict of interest by influencing the broker- dealer or other financial

intermediary and your salesperson to recommend the Small Cap Value Fund over another investment. Ask your salesperson or visit your financial

intermediary’s website for more information.

| YOUR INVESTMENT |

| Summary Information |

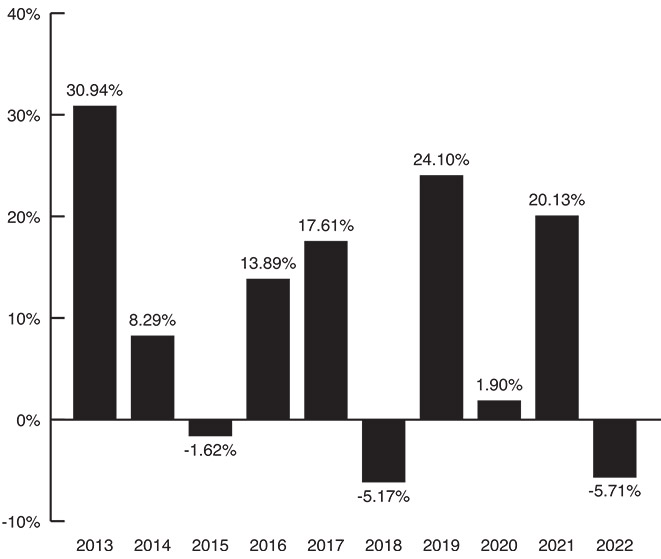

The Cullen Value Fund (the “Value Fund” or the “Fund”)

seeks long-term capital appreciation and current income.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Value Fund. |

| Retail Class | Class C | Class I | |

| Redemption Fee (as a percentage of amount redeemed)a |

as a percentage of the value of your investment):

| Retail Class | Class C | Class I | |

| Management Fee | |||

| Distribution and Service (12b-1) Fees | |||

| Other Expensesb | |||

| Acquired Fund Fees & Expenses | |||

| Total Annual Fund Operating Expensesc | |||

| Less Expense Reduction/Reimbursementd | – |

– |

– |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

This example is intended to help you compare the cost of investing

in the Value Fund with the cost of investing in other mutual funds. This example assumes that you invest $10,000 in the Value Fund for

the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes your investment has

a 5% return each year and that the Value Fund’s operating expenses remain the same. Although your actual costs may be higher or

lower, based on these assumptions your costs would be:

| 1 Year | 3 Years* | 5 Years* | 10 Years* | |

| Retail Class | $ |

$ |

$ |

$ |

| Class C | $ |

$ |

$ |

$ |

| Class I | $ |

$ |

$ |

$ |

The Value Fund pays transaction costs, such as commissions, when

it buys and sells securities (“portfolio turnover”). A higher portfolio turnover rate will result in higher transaction costs

and may result in higher taxes when Value Fund shares are held in a taxable account. These costs, which are not reflected in annual fund

operating expenses or in the example, affect the Value Fund’s performance. During the most recent fiscal year, the Value Fund’s

portfolio turnover rate was

its net assets, plus borrowings for investment purposes, in common stocks of companies across all market capitalizations.

The Value Fund invests roughly the same amount in each stock in the

portfolio at the time of original purchase, although the portfolio is not systematically rebalanced. This approach avoids the overweighting

of any individual security being purchased. The Adviser may sell portfolio stocks when they are no longer attractive based on their growth

potential, dividend yield or price.

The Value Fund may invest up to 30% of its assets in foreign securities,

including up to 10% of its assets in securities of emerging market issuers. These investments are generally made in American Depositary

Receipts (“ADRs”), which are depositary receipts for foreign securities denominated in U.S. dollars and traded on U.S. securities

markets or available through a U.S. broker or dealer. ADRs may be purchased through “sponsored” or “unsponsored”

facilities. A sponsored facility is established jointly by the issuer of the underlying security and a depositary, whereas a depositary

may establish an unsponsored facility without participation by the issuer of the depositary security. Holders of unsponsored depositary

receipts generally bear all the costs of such facilities and the depositary of an unsponsored facility frequently is under no obligation

to distribute shareholder communications received from the issuer of the deposited security or to pass through voting rights to the holders

of such receipts.

The Value Fund generally invests substantially

all of its assets in common stocks and ADRs but may invest in other equity securities, which can include convertible debt, exchange-traded

funds (“ETFs”) that invest primarily in equity securities, warrants, rights, equity interests in real estate investment trusts

(“REITs”), equity interests in master limited partnerships (“MLPs”), and preferred stocks.

As part of its strategy, the Value Fund, in order to generate additional

income, may selectively write covered call options when it is deemed to be in the Fund’s best interest. A call option is a short-term

contract entitling the purchaser, in return for a premium paid, the right to buy the underlying equity security at a specified price upon

exercise of the option at any time prior to its expiration. Writing a covered call option allows the Value Fund to

receive a premium. A call option gives the holder the right, but not

the obligation, to buy the underlying equity stock from the writer of the option at a given price during a specific period.

The Value Fund will not engage in derivatives except to the extent

that the writing of covered call options is deemed to involve derivatives.

the risk that you may lose part or all of the money you invest.

Stock Risks. The Value Fund may experience sudden, unpredictable declines in value, as well as periods of poor performance

through its investments in the stock market. Periods of poor performance and declines in value of the Value Fund’s underlying equity

investments can be caused, and also be further prolonged, by other factors confronting the global economy such as declining consumer and

business confidence, malfunctioning credit markets, increased unemployment, reduced levels of capital expenditure, fluctuating commodity

prices, bankruptcies, and other circumstances, all of which can individually and collectively have direct effects on the valuation and/or

earnings power of the companies in which the Value Fund invests. Stock markets worldwide have experienced significant volatility in recent

periods as a result of market participants reacting to economic data and market indicators that have contradicted previous assumptions

and estimates. At times, these reactions have created scenarios where investors and traders have redeemed their investments/holdings en

masse, thereby creating additional and often significant downward price pressure than might be experienced in less volatile periods.

Market participants’ views on the valuation and/or earnings power of a company and the overall state of the economy can cause similar

significant short-term and long-term volatility in the value of the Value Fund’s shares. As a result, you could lose money investing

in the Value Fund.

Disruptions Risk; Sovereign Debt Crises Risks. The global financial markets have in recent years undergone pervasive and fundamental

disruptions. This global market turmoil has led to increased market volatility. Consumer and business confidence remains fragile and subject

to possible reversal for a variety of reasons, including political uncertainty, high and growing debt levels by many consumers, and business

institutions and governments in the United States, certain countries in Europe and elsewhere around the world. The securities of the United

States, as well as several countries across Europe and Asia, have in recent years been, or are at risk of being, downgraded, and sovereign

debt crises have persisted in certain countries in those regions. Local, regional or global events such as war, acts of terrorism, the

spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant

impact on the Fund and its investments. These events and circumstances could result in further market disruptions that could adversely

affect financial markets on a global basis.

that resulted in numerous disruptions in the market and had significant economic impact leaving general concern and uncertainty. This

coronavirus could continue to affect, and other epidemics and pandemics that may arise in the future could affect, the economies of many

nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

Companies Risks. The Value Fund invests in the stocks of small-capitalization companies. Small-capitalization companies often

have narrower markets and limited managerial and financial resources compared to those of larger, more established companies. As a result,

their performance can be more volatile, and they face greater risk of business reversals, which could increase the volatility of the Value

Fund’s portfolio. Further, due to thin trading in some such companies, an investment may be more illiquid (i.e. harder to

sell) than that of larger capitalization stocks.

Companies Risk. The Value Fund may invest in the stocks of medium-capitalization companies. Medium-capitalization companies

often have narrower markets and limited managerial and financial resources compared to those of larger, more established companies. As

a result, their performance can be more volatile and they face greater risk of business reversals, which could increase the volatility

of the Value Fund’s portfolio.

Companies Risk. The Value Fund may invest in the stocks of large-capitalization companies. Securities issued by large-capitalization