These UK companies are attractively valued and well positioned to benefit from long-term trends in healthcare, resource efficiency and financial resilience.

Environmental, social and governance (ESG) investing has been through several waves of interest in recent years, booming post-Covid but easing off over the past year or so.

Although investors’ interest can come and go, companies looking to change the future over the long term have remained consistent in their bid to improve the planet.

Some may assume that ESG investing is for those with a global mandate – after all, most innovation tends to come from either the US or China. But there are some domestic names that cannot be ignored, according to Mike Appleby, investment manager at Liontrust Asset Management.

Despite its ‘old economy’ nametag, the UK hosts a plethora of companies with international revenue streams, innovative strategies and products or services that contribute to the environment or society – if you know where to look.

Appleby’s first selection is healthcare giant GSK, which has been proactive in providing emerging market countries with affordable medicine. A fifth of its sales now come from emerging markets and it leads the Access to Medicine index, a biennial report ranking pharma companies on their ability to make affordable drugs available to lower-income countries.

Vaccines, which account for 27% of its sales, are the second biggest life saver in developing countries (after access to clean water) and are a cost-effective way of curing a variety of diseases.

Total return of GSK versus the FTSE 100 over 5yrs

Source: FE Analytics

Appleby said the firm looks for four elements in a stock and GSK – the eighth largest company in the FTSE 100 – ticks all of these boxes.

First, a company needs to be on the right side of a positive trend, helping to solve a problem. “It’s going to grow by selling its products or services because we really need them,” Appleby explained.

Second, the company needs to be well managed. Third, the business must be profitable and hard for competitors to emulate: “How much confidence do we have in their margins?”

And finally, valuation is always a factor. “Will it be worth more in five years’ time?” Appleby asked. GSK is attractively valued, he said, trading at 10-11x next year’s earnings.

Liontrust’s sustainable investment team looks at 20 investment themes which it has grouped into three broad buckets: improved health (encompassing affordable medicine, better patient outcomes and healthier lifestyles); better resource efficiency (including environmental technology and the circular economy); and greater safety and resilience (cyber security, financial resilience and the systems upon which we rely).

Financial services are part of the third bucket because borrowing will be crucial to finance the energy transition and insurance is an important component of managing climate risk.

Liontrust owns money transfer app Wise, which offers cost-effective and safe international money transfer services involving foreign exchange (FX). Rates can be prohibitively expensive, with migrant labourers who want to send money abroad to their families having to pay charges of about 6%.

Wise can reduce these costs by 60% on average and recently launched a service in China to enable expatriates to send money home.

“It’s hard to find companies catering to the bottom third of the pyramid [by] spending power,” Appleby noted.

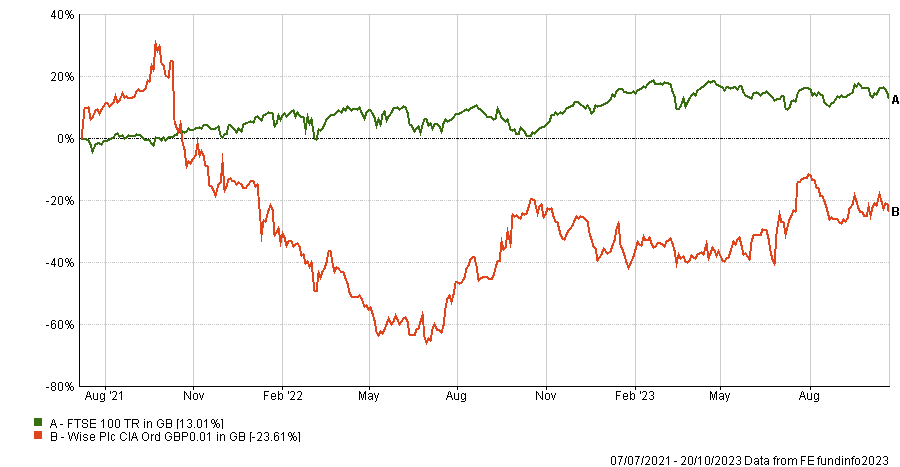

Wise was London’s largest ever tech listing when its IPO took place on 7 July 2021. Its shares opened at £8 each, valuing the company at £8bn. The share price closed at £6.72 on 20 October 2023.

Total return of Wise since its IPO

Source: FE Analytics

Lastly, under the umbrella of better resource efficiency, Smart Metering Systems (SMS) is working on energy use pilot projects that should be running at scale in about 10 years’ time. One initiative involves programming electric vehicles (EVs) to charge at a higher volume when electricity is plentifully available on the grid and at a lower volume, or not at all, when electricity is scarce. EVs can even pump electricity back into the grid, reducing electricity bills.

SMS is installing smart meters in the UK as well as battery grid storage. One of the barriers to the energy transition is capital, so SMS is researching ways to obtain funding from third-party institutional investors to help consumers purchase heat pumps or EV chargers and pay in instalments.

“We think the market is overlooking the profitable growth opportunity for this business,” Appleby said.

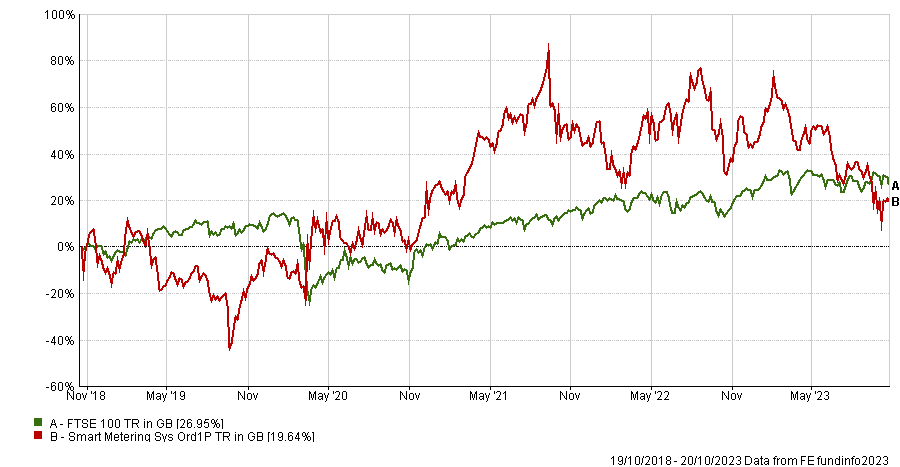

Total return of SMS versus the FTSE 100 over 5yrs

Source: FE Analytics, data to 20 Oct 2023