The EUR/USD made a harsh reversal last week as geopolitical risks rose.

Forex Brokers We Recommend in Your Region

- Sell the EUR/USD pair and set a take-profit at 1.0400.

- Add a stop-loss at 1.055.

- Timeline: 1 day.

- Set a buy-stop at 1.0545 and a take-profit at 1.0650.

- Add a stop-loss at 1.0445.

The EUR/USD retreated on Monday as geopolitical risks continued rising and as US bond yields continued retreating. The pair dropped to the psychologically-important level of 1.0500, the lowest level since October 6th. It has dropped from last week’s high of 1.0641.

The EUR/USD exchange rate drifted downwards as risks of a prolonged war in the Middle East continued. In a statement at the United Nations, Iran warned Israel against a ground invasion in Gaza. Israel has hinted that it will launch a ground invasion in the enclave as it seeks to revenge the recent killings.

The risk of all this is that the situation could worsen if Iran and other Arab countries intervene. As a result, the price of crude oil would jump, leading to major fears of inflation in the US and around the world.

Data published on Thursday revealed that America’s inflation remained above the Federal Reserve target of 2.0% in September. The headline CPI dropped from 3.7% in August to 3.6% in September while core CPI fell to 4.1%. There are signs that inflation will drift downwards as gasoline prices have dropped sharply in the past few weeks.

There will be no major economic data scheduled from the US and Europe on Monday. The next crucial data to watch will be the upcoming US retail sales numbers scheduled for Tuesday. Economists polled by Reuters expect the data to reveal that retail sales rose by 0.2% while core sales improved by 0.1%, signaling that consumers are still healthy.

The US will also release the latest industrial and manufacturing production data on Tuesday. Several Federal Reserve officials like Tom Barkin, Michele Bowman, and Patrick Harker will also speak.

Their statements will come a few days after the Fed published minutes of its September meeting. These minutes showed that most officials believe that rates should remain restrictive until inflation continues falling.

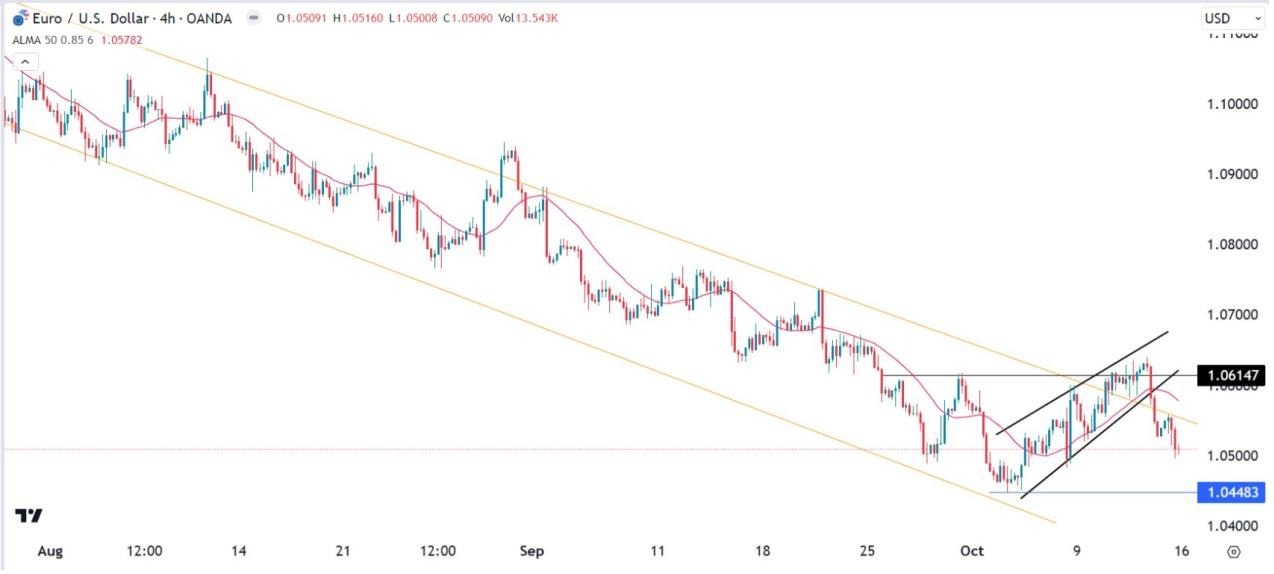

The EUR/USD made a harsh reversal last week as geopolitical risks rose. This reversal happened after the pair made a rising wedge pattern that is shown in black. In price action analysis, this pattern is usually a bearish signs. Now, it has moved below the lower side of the wedge and the 50-period Arnaud Legoux Moving Average (ALMA).

The two lines of the MACD have moved below the neutral point while the Relative Strength Index (RSI) has drifted downwards. Therefore, the pair will likely continue falling as sellers target the key support level at 1.0448, the lowest level this month. The stop-loss of this trade will be at 1.0560.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.