On October 9, 2023, Chief Information Officer Thomas Frank sold 28,213 shares of Interactive Brokers Group Inc (NASDAQ:IBKR). This move comes amidst a year where the insider has sold a total of 651,677 shares and purchased none.

Thomas Frank is a key figure in the Interactive Brokers Group Inc, serving as the Chief Information Officer. His role involves overseeing the company’s information technology strategy, ensuring that the company’s technological resources are aligned with its business needs.

Interactive Brokers Group Inc is a leading automated global electronic broker that specializes in routing orders and executing and processing trades in securities, futures, and foreign exchange instruments on more than 135 electronic exchanges and market centers around the world. The company caters to institutional and professional traders for clients of all sizes.

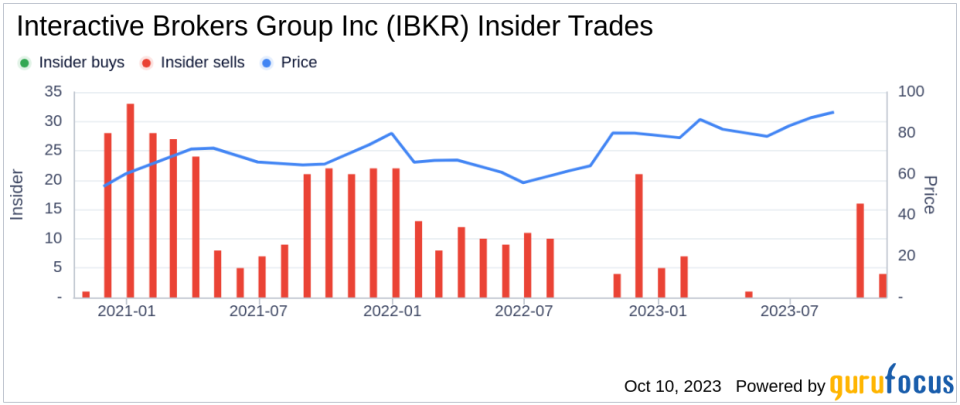

The insider’s recent sell has raised some eyebrows, especially considering the overall insider trends for Interactive Brokers Group Inc. Over the past year, there have been 59 insider sells and no insider buys. This could potentially signal a bearish sentiment among the company’s insiders.

The relationship between insider sell/buy activities and the stock price is often closely watched by investors. In this case, the stock price was $89.18 per share on the day of the insider’s recent sell, giving the company a market cap of $9.448 billion.

The price-earnings ratio of Interactive Brokers Group Inc stands at 18.03, which is lower than the industry median of 18.29 and also lower than the companys historical median price-earnings ratio. This could suggest that the stock is currently undervalued.

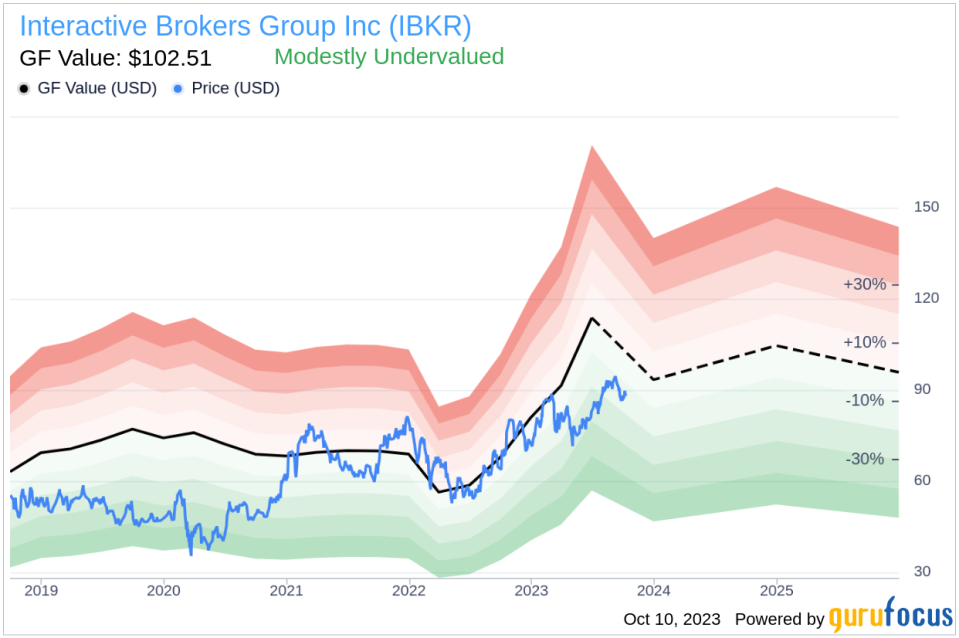

Furthermore, with a price of $89.18 and a GuruFocus Value of $102.51, Interactive Brokers Group Inc has a price-to-GF-Value ratio of 0.87. This indicates that the stock is modestly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent sell by the insider, Thomas Frank, coupled with the overall insider trends and the current valuation of Interactive Brokers Group Inc, could provide valuable insights for investors. However, as always, it is crucial for investors to conduct their own thorough research before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.