Japanese Yen is trading on a softer note in Asian session as the rebound witnessed yesterday begins to lose steam. A notable comment from Japan’s Finance Minister Shunichi Suzuki raised some interest among market observers. Suzuki attributed the ongoing weakening of Yen partly to interest rate differentials, steering away from the customary practice of solely pointing fingers at speculative trading. The markets are now awaiting to see if this expanded rhetoric will hold over time. More significantly, the change in tone could potentially hint at BoJ mulling over the idea of moving away from its negative interest rate regime or could even suggest an acceptance of a further decrease in Yen’s exchange range.

In contrast, Swiss Franc stands strong, buoyed by safe-haven demands stirred by escalating conflicts in the Middle East. Canadian Dollar follows suit, finding support from the buoyancy in oil prices. Australian Dollar’s resilience, however, presents a puzzling scenario, given the prevailing market sentiment and uninspiring consumer and business confidence data. A plausible explanation for Aussie’s performance can be linked to the rebound observed in Chinese Yuan and Hong Kong stock markets. Dollar finds itself on the weaker end of the spectrum, alongside British Pound, while Euro’s performance remains mixed.

Technically, USD/CNH dips to as low as 7.2694 but quickly recovered. A head and shoulder top could be in the making (ls: 7.3491, h: 7.3679, rs: 7.3311). Further decline in USD/CNH and decisive break of 7.2593 could mark the start of reversal to the whole up trend from 6.6971 (Jan low). If materializes, the subsequent selloff could be steep and extra support could be give to AUD/USD for a take on 0.6500 near term resistance. Should this materialize, we could see a precipitous sell-off, potentially lending additional support to the AUD/USD, setting the stage for a challenge of the 0.6500 resistance in the near term.

In Asia, at the time of writing, Nikkei is up 2.31%. Hong Kong HSI is up 1.29%. China Shanghai SSE is down -0.50%. Singapore Strait Times is up 0.82%. Japan 10-year JGB yield is down -0.0339 at 0.769. Overnight, DOW rose 0.59%. S&P 500 rose 0.63%. NASDAQ rose 0.39%. 10-year yield rose 0.013 to 4.797.

Fed’s Jefferson on the balance between rising yields and monetary policy

Fed Vice Chair Philip Jefferson shared in a speech overnight the insights on challenges posed by rising real long-term Treasury yields. He pointed out the complexities faced by policymakers when determining the direction of monetary policy amidst such changes.

Jefferson stated, “In part, the upward movement in real yields may reflect investors’ assessment that the underlying momentum of the economy is stronger than previously recognized and, as a result, a restrictive stance of monetary policy may be needed for longer than previously thought.”

However, he was quick to add a caveat, underscoring the nuances associated with interpreting yield movements. Jefferson added, “But I am also mindful that increases in real yields can arise from changes in investor’s attitudes toward risk and uncertainty.”

Jefferson assured his approach would be comprehensive and adaptive. “I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy,” he noted.

The Vice Chair will weight the “totality of incoming data in assessing the economic outlook and the risks surrounding the outlook”.

Highlighting the delicate equilibrium that is to be maintained, Jefferson encapsulated the current scenario as a “sensitive period of risk management.” Here, the dichotomy lies in “balance the risk of not having tightened enough, against the risk of policy being too restrictive.”

BoE’s Mann highlights concerns over extended inflation duration

BoE MPC Catherine Mann emphasized the significance of the duration of inflation in guiding her future policy decisions.

Mann pointedly remarked, “Going forward, a very important ingredient for my decision-making is the duration of inflation, and how long it is exceeding target.”

The MPC member expressed concerns that prolonged inflation above the target could lead to a “drift” in medium-term expectations. Monetary policy “has to be more aggressive, because it has to address both a drift in expectations as well as the actual inflation above target,” Mann further elaborated.

Mann also warned of the challenges that could arise if inflation remains persistently above the target. “If inflation gets embedded for longer above target, then getting it to target is going to require more policy action for longer and that I’d rather not have to do because people become backward looking,” she said.

In the context of future economic shocks, Mann anticipates an “upward bias” in inflation, suggesting that a higher neutral rate of interest is “a very plausible outcome.”

Australian consumer sentiment ticks up to 82, but interest rates concerns linger

Australia’s Westpac Consumer Sentiment Index showed a positive move, climbing 2.9% from 79.7 to 82 in October. Despite the uptick, a score of 82 still paints a subdued picture, correlating with a decline in per capita spending.

One of the more pressing concerns for consumers remains the prospective upward movement in mortgage interest rates. The post-October RBA decision survey indicated that 63% of consumers anticipate mortgage interest rates to climb in the forthcoming year. This figure marks a substantial rise from 52.3% in September. N

Notably, however, these numbers don’t match the heightened concerns recorded when RBA was in an active rate-hiking mode, where readings ranged between 70-80%. Meanwhile, optimism for a rate cut next year has dwindled; only 7% of consumers now hold that expectation, down from 15% the previous month.

The upcoming November 7 meeting of RBA is earmarked as a significant event, with a revised set of forecasts to accompany the Statement on Monetary Policy.

Westpac shared their viewpoint on the evolving situation: “While the RBA may need to revise its near-term forecasts for headline inflation up, on its own this will probably not be enough to trigger a further rate rise.”

The September quarter CPI, slated for release on October 25, is now in sharp focus. Westpac added, “If, however, there are further surprises in the September quarter CPI, due October 25, the next few meetings could be a little more live than the one in October.”

Australian NAB business confidence unchanged at 1, declining conditions and easing price pressures

Australia NAB Business Confidence for September remained stable at a level of 1. Meanwhile, a decline was observed in Business Conditions, which slid from 14 to 11. A deeper dive into the components reveals trading conditions receding from 19 to 16, profitability conditions from 14 to 8, and employment conditions registering a dip from 10 to 8.

Notably, growth in labor costs saw a deceleration, moving from a 3.2% quarterly rate down to 2.0%. Additionally, purchase costs experienced a slowdown from 2.9% to 1.8%. Both final product prices and retail prices exhibited moderated growth rates, with the former decelerating from 1.7% to 1.0% while the latter remained unchanged at 1.8%.

NAB Chief Economist Alan Oster remarked, “the economy has remained in reasonable shape through the middle of the year.” He went on to note the +1 index points underscores that firms are somewhat ambivalent regarding their future prospects, with views split evenly regarding the outlook.

However, there was a silver lining in the inflation scenario. Oster highlighted that “the survey showed some positive signs for inflation with cost pressures and price growth easing in the month.”

Even though the imminent Q3 CPI release is anticipated to reflect strong inflation for the quarter, Oster noted, “the September survey results suggest the momentum of some of the key cost pressures driving inflation may have started to step back in a welcome sign for the broader inflation outlook.”

Looking ahead

Italy industrial production will be featured in European session. US will release NFIB business optimism index later in the day.

USD/JPY Daily Outlook

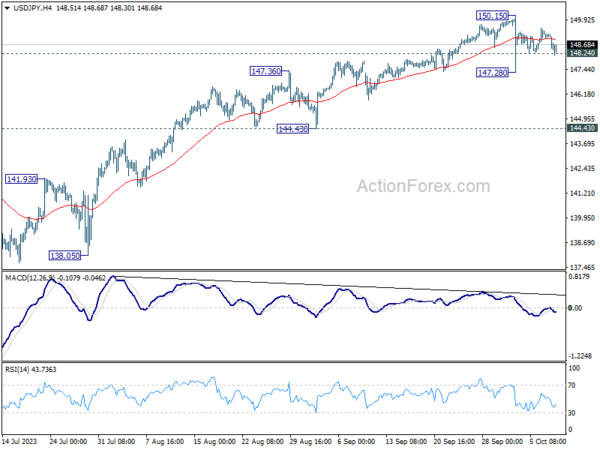

Daily Pivots: (S1) 148.22; (P) 148.73; (R1) 149.02; More…

USD/JPY recovers after breaching 148.24 minor support and intraday bias stays neutral. Consolidation from 150.15 is still extending. On the downside, below 148.24 minor support will turn bias to the downside for another down leg through 147.28. But there is no confirmation of bearish trend reversal before firm break of 144.43 support. Another rally remains mildly in favor through 150.15 to retest 151.93 high.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will be the first sign that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Oct | 2.90% | -1.50% | ||

| 23:50 | JPY | Current Account (JPY) Aug | 1.63T | 2.41T | 2.77T | |

| 00:30 | AUD | NAB Business Conditions Sep | 11 | 13 | ||

| 00:30 | AUD | NAB Business Confidence Sep | 1 | 2 | ||

| 05:00 | JPY | Eco Watchers Survey: Current Sep | 53.2 | 53.6 | ||

| 08:00 | EUR | Italy Industrial Output M/M Aug | -0.60% | -0.70% | ||

| 10:00 | USD | NFIB Business Optimism Index Sep | 91.5 | 91.3 | ||

| 14:00 | USD | Wholesale Inventories Aug F | -0.10% | -0.10% |