Forex Brokers We Recommend in Your Region

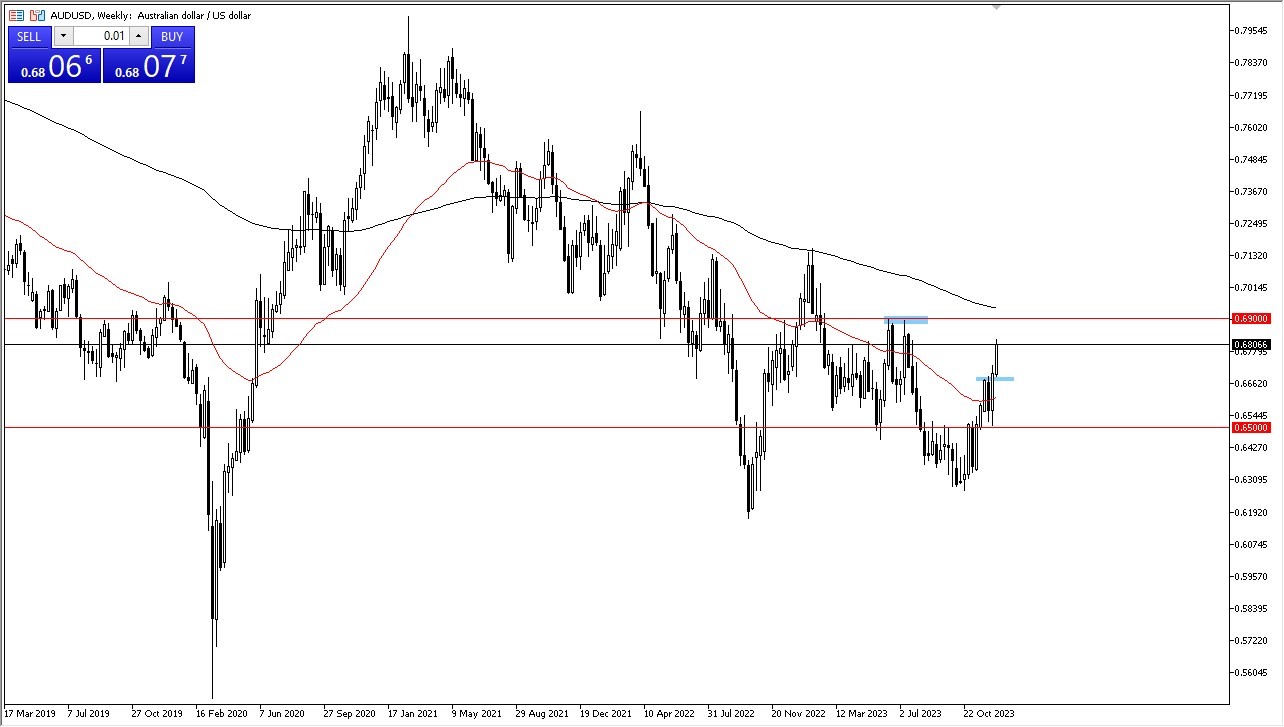

The AUD/USD had a strong rally during the past trading week, surpassing the 0.68 level. It’s likely to aim for the 0.69 level, a zone with prior resistance and the 200-Week EMA. Breaking above this could lead to a move towards 0.7150. The week’s candlestick showed significant bullishness, and with growing attention on the possibility of the Federal Reserve reducing rates in 2024, it makes sense for the AUD to keep rising.

Short-term setbacks may present buying opportunities, with support around 0.6650 and strong support at 0.65. The AUD is highly influenced by risk sentiment and global economic growth, given its status as a commodity-driven currency, linked closely to Asia’s performance, particularly China’s demand for Australian commodities.

The US dollar faces uncertainty against the Japanese yen. Key factors to watch include the recent weekly candlestick and a crucial long-term trendline. While still in an uptrend, breaking below the previous week’s candlestick low could bring significant downward pressure, possibly down to ¥130.

Conversely, a breakout above the recent week’s candlestick high, despite it being an inverted candlestick, indicates strong upward potential. Both central banks are expected to maintain loose monetary policies, creating a situation of limited clarity.

The currency pair is on the verge of a major move, but low liquidity in the upcoming week may make trading challenging. Observing this period could provide insights into 2024 market dynamics, with market sentiment largely influenced by the Federal Reserve’s interest rate decisions.

The S&P 500 experienced a minor pullback before indicating renewed momentum. It appears poised to approach the 4800 level, with potential for reaching 5000 in the long term. However, caution is warranted due to overextension, prompting a focus on buying opportunities and value.

Support may materialize around the 4600 level, and possibly down to 4500, a psychologically significant mark with historical relevance. Traders continue to assess the Federal Reserve’s monetary policy, anticipating potential liquidity injections into the stock market, as Wall Street prioritizes easy money over economic fundamentals.

Market conditions are currently overbought, necessitating a pullback to identify valuable opportunities. The forthcoming week, spanning Christmas to New Year’s, may present profit-taking prospects in this overbought market.

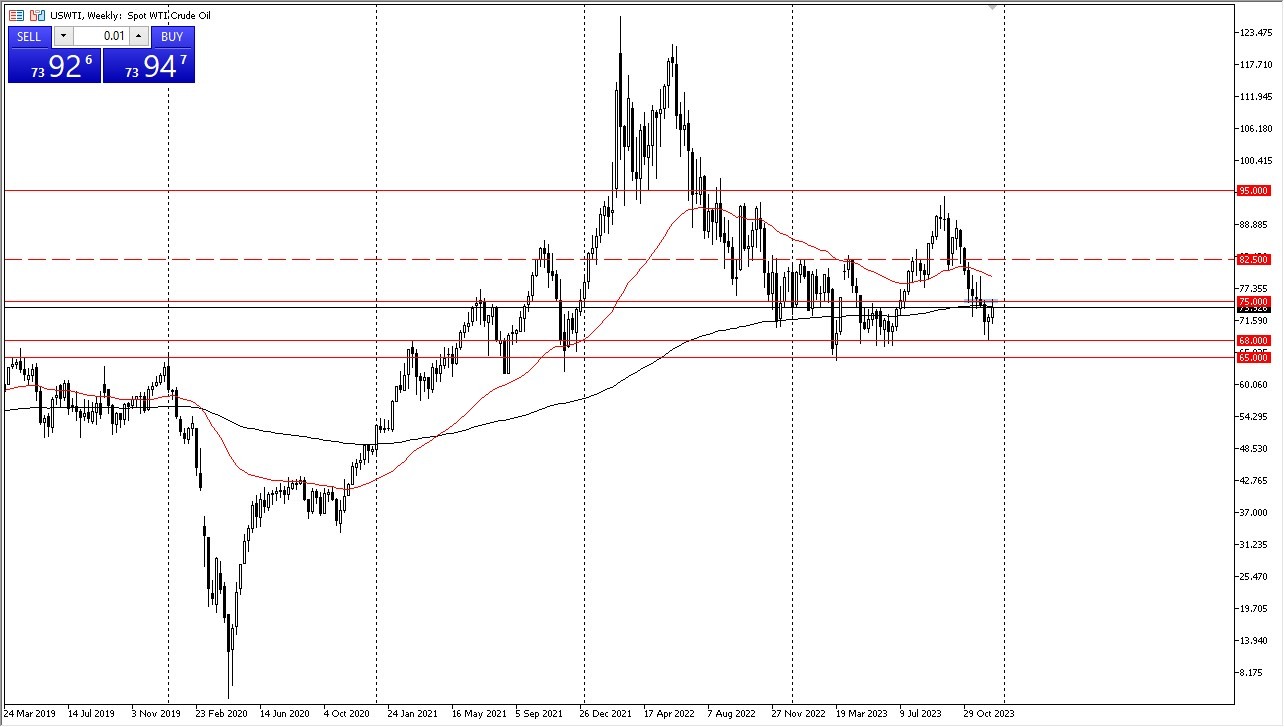

The West Texas Intermediate Crude Oil market has surged to $75, a significant psychological level with a history of support and resistance. Breaking above it could open the door to $78. Conversely, a retreat is likely to find support around $72.

Lately, traders have been factoring in extreme scenarios, but there’s a growing sense that the economy may receive substantial liquidity injections, which typically benefit crude oil. This suggests a potential recovery underway, but this will take some time.

Silver has experienced a significant rally, surpassing the $24 level, a psychologically significant mark. The next major resistance is likely to be $26. Short-term pullbacks may present buying opportunities, but caution is advised regarding position size.

The $23 level aligns with the 50-Week EMA, providing substantial support. Buyers are expected to step in whenever the market retreats. Anticipation of the Federal Reserve cutting rates in the coming year suggests continued upward momentum for precious metals, making short-term pullbacks attractive.

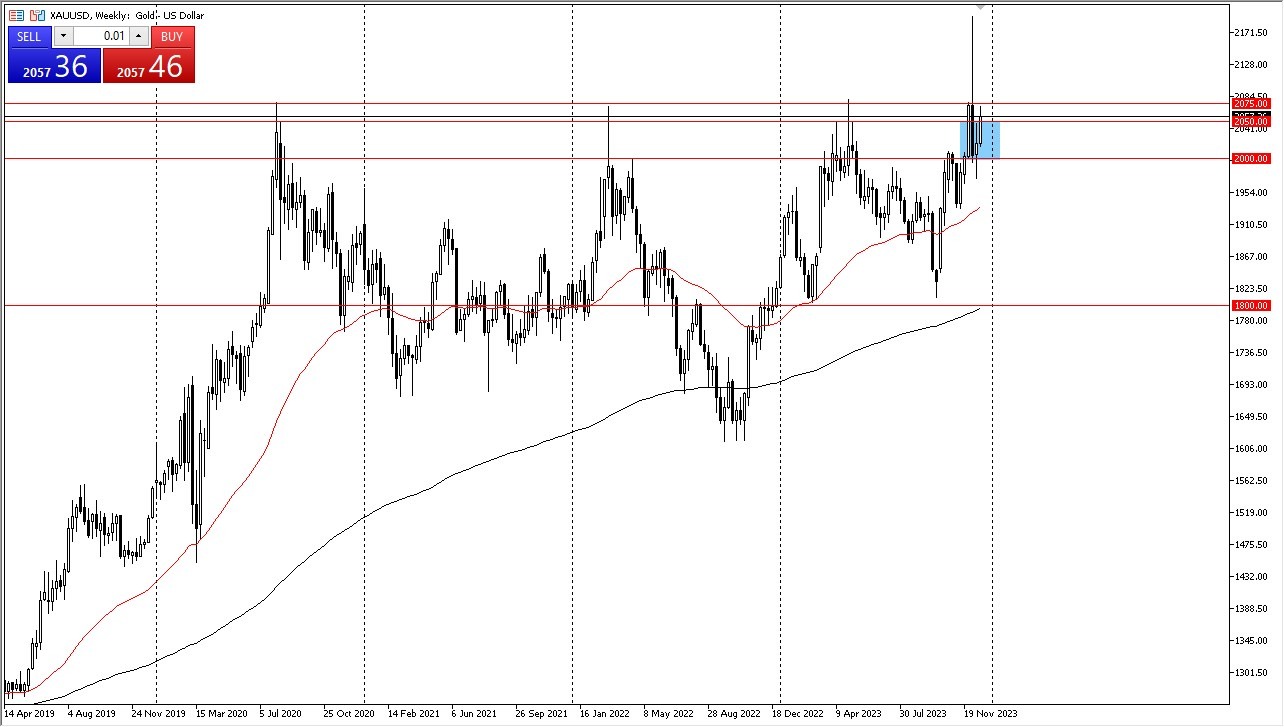

Gold has rallied above $2050 and is eyeing a potential move to $2075. Breaking above this level could propel the market even higher. Although short-term pullbacks are possible, overall sentiment remains bullish, except for a recent volatile week.

The $2000 level below acts as a crucial support level, and a breach could trigger a significant downturn. However, the market has responded positively to the Federal Reserve’s loose monetary policy, supporting gold’s outlook. Short-term dips are seen as buying opportunities, and as long as the Fed maintains its accommodative stance, gold is likely to experience buying pressure in general.

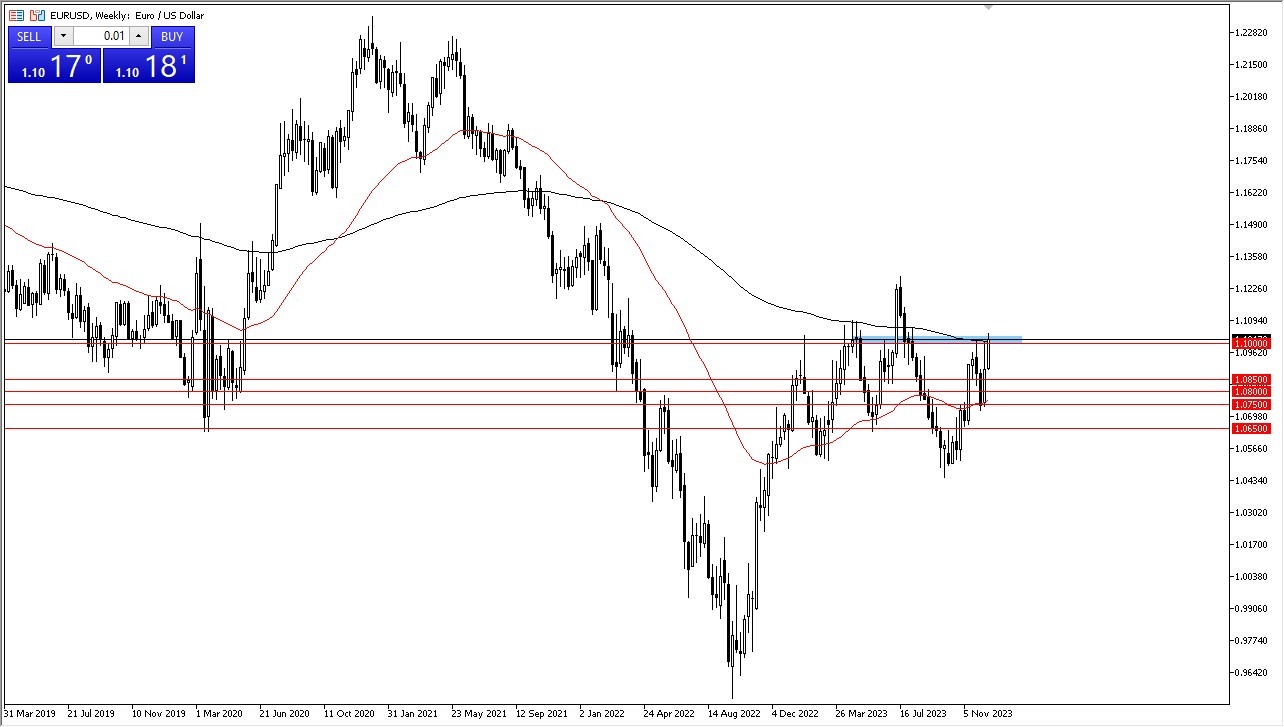

The euro has demonstrated strength throughout the week, reaching the 1.10 level, a psychologically significant mark that coincides with the 200-Week EMA. Approaching the Christmas week, liquidity concerns may arise, but it’s evident that short-term dips are seen as buying opportunities.

A break above the recent candlestick high opens the door to the 1.1250 level, which experienced a significant sell-off earlier in the year. The Federal Reserve’s indication of potential rate cuts in the coming year suggests continued weakness for the US dollar.

The Ethereum market initially dropped to $2100 during the trading week, a significant support level that previously acted as strong resistance. However, the formation of a hammer pattern for the second consecutive week suggests an eventual upward movement. Breaking above the recent candlestick highs could propel Ethereum to $2500 and potentially $2750.

A breakdown below $2000 might lead to a market decline, but Ethereum’s performance remains closely tied to Bitcoin’s movements. Buying dips is still favored, although the upcoming week between Christmas and New Year’s may exhibit odd movements.