- Traders pushed back bets for rate cuts in the UK and the US.

- US GDP figures came in higher than expected, indicating strong economic performance.

- Market participants expect the BoE to maintain rates next week.

The GBP/USD weekly forecast is neutral as the resilience of both the US and UK economies creates a level playing field for the currency.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Ups and downs of GBP/USD

The pound ended the week flat, with the UK and the US economies showing resilience. Business activity in the manufacturing and services sectors for both countries rose. As a result, traders pushed back bets for rate cuts in the UK and the US.

More data from the US supported the view that Fed rate cuts will not start in March. GDP figures came in higher than expected, indicating strong economic performance. Meanwhile, the Fed’s preferred inflation measure came in line with expectations.

Next week’s key events for GBP/USD

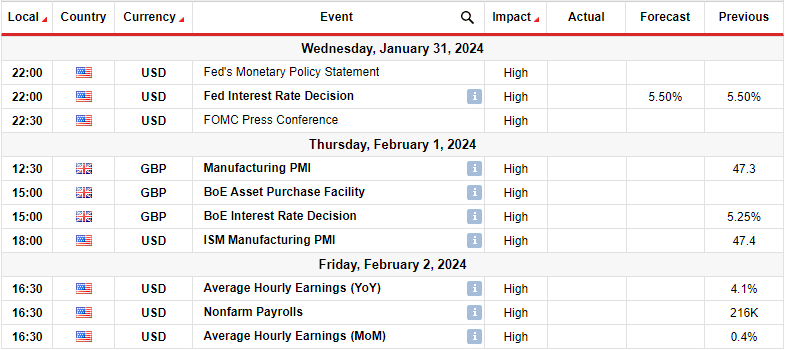

Next week, major reports from the US will include the FOMC meeting minutes, the ISM manufacturing PMI, and the employment report. Meanwhile, traders will pay close attention to the Bank of England policy meeting in the UK. On February 1, the BoE will likely maintain interest rates at 5.25%. At the same time, investors will closely monitor any indications regarding the timing of potential rate cuts.

Meanwhile, there will be clues on possible Fed rate cuts in the FOMC meeting minutes and the NFP report. Another upbeat employment report could further reduce rate-cut bets, leading to a decline in the pair. The opposite is also true.

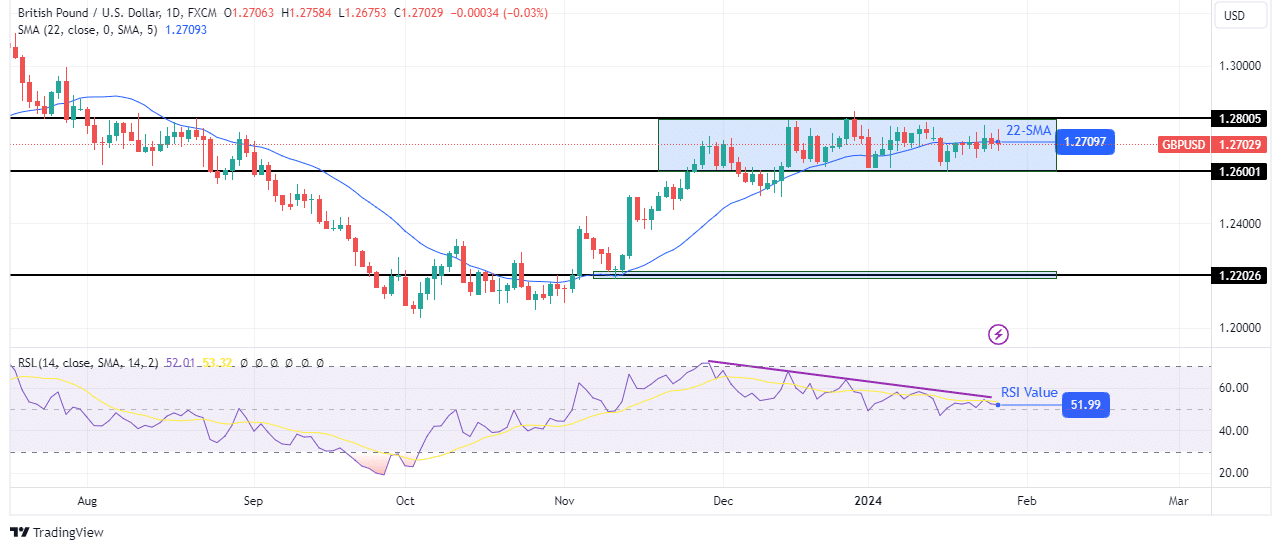

GBP/USD weekly technical forecast: Bullish momentum weakens near 1.2800

The pound is consolidating in a tight range with support at 1.2600 and resistance at 1.2800. The bullish trend slowly weakened when the price neared 1.2800. The price started sticking close to the 22-SMA until it started chopping through the line. This indicates a shift from a trending to a ranging market.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

If this is a pause in the bullish trend, the price will eventually break above the range resistance to continue higher. However, there are indications that bears might take over. The RSI has made a bearish divergence with the price, showing weaker bullish momentum. Therefore, if bulls fail to regain momentum, bears might break below the range support to start a new downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money