Forex Brokers We Recommend in Your Region

The S&P 500 has rallied yet again during the last week of the year, but quite frankly we are struggling at what was the previous high. At this point, I think we do get a little bit of a pullback, but we will likely see buyers underneath, especially near the 4700 level. Breaking down below level then opens up a move down to the 4500 level, but I don’t know if we correct that deeply. Regardless, this is a scenario that is a bit overdone, and therefore a pullback is probably necessary.

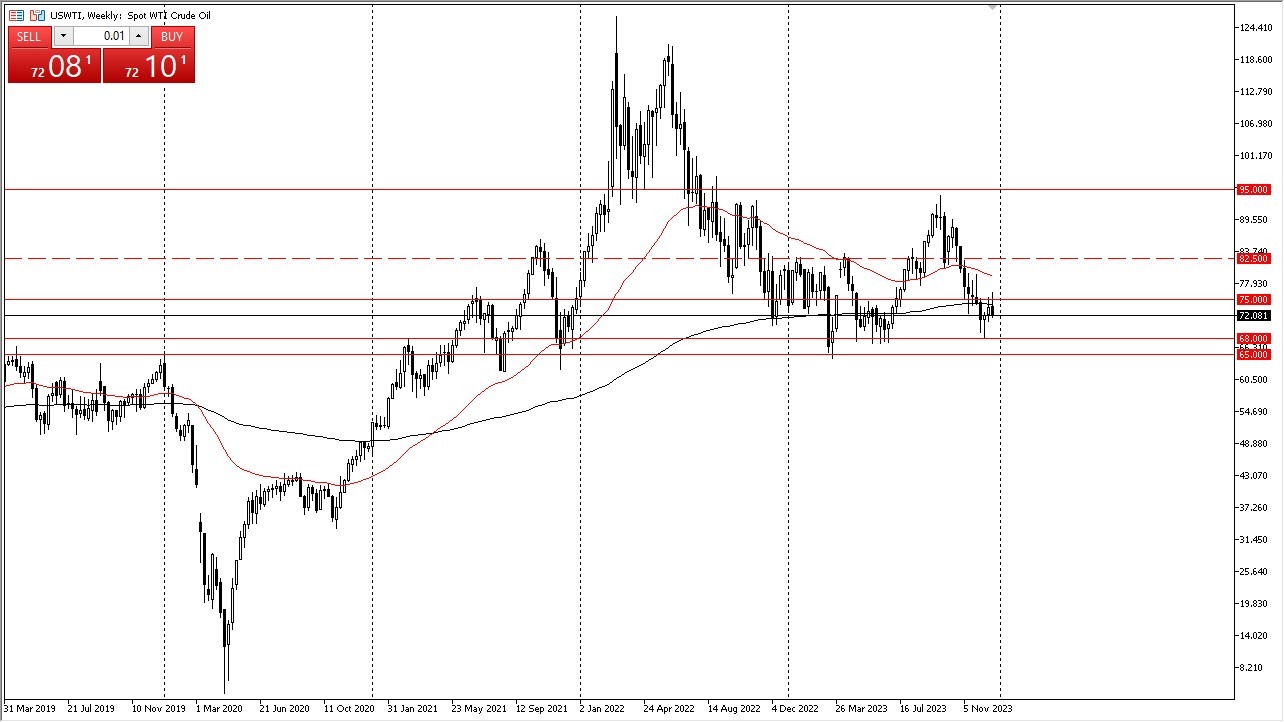

The West Texas Intermediate Crude Oil market initially tried to rally during the week but found the area above the $75 level to be a bit too much to overcome. If we can break above the top of the candlestick, that would be a very bullish sign and it could send the market looking toward the 50-Week EMA which sits just below the $80 level. Underneath, if we were to break down below the bottom of the candlestick, we could retest the $70 level, and then eventually the $68 level which is a major bottom in the market.

The Australian dollar initially tried to rally during the week but gave back gains near the 0.69 level. The 0.69 level is an area that has previously been very resistive, and of course, we have the 200-Week EMA in the picture as well, so I think it all lights up quite nicely for a pullback. At this point, if we break down below the bottom of the candlestick the Australian dollar could very well drop down to the 0.6650 level. On the other hand, we turn around and take out the 0.69 level on a weekly close, then it opens up a move to the 0.7150 level.

Bitcoin pulled back just a bit during the trading week, only to turn around and bounce a bit. At this point, the $40,000 level is a major support level, and therefore I think this is a situation where you will have to deal with a lot of sideways consolidation more than anything else but it’s obvious that bitcoin is in the bullish phase right now over the longer term. Working off the excess froth makes a certain amount of sense, but if we break above the top of the last couple of candlesticks, then it opens up the possibility of a move to the $47,500 level, an area that has been major resistance previously.

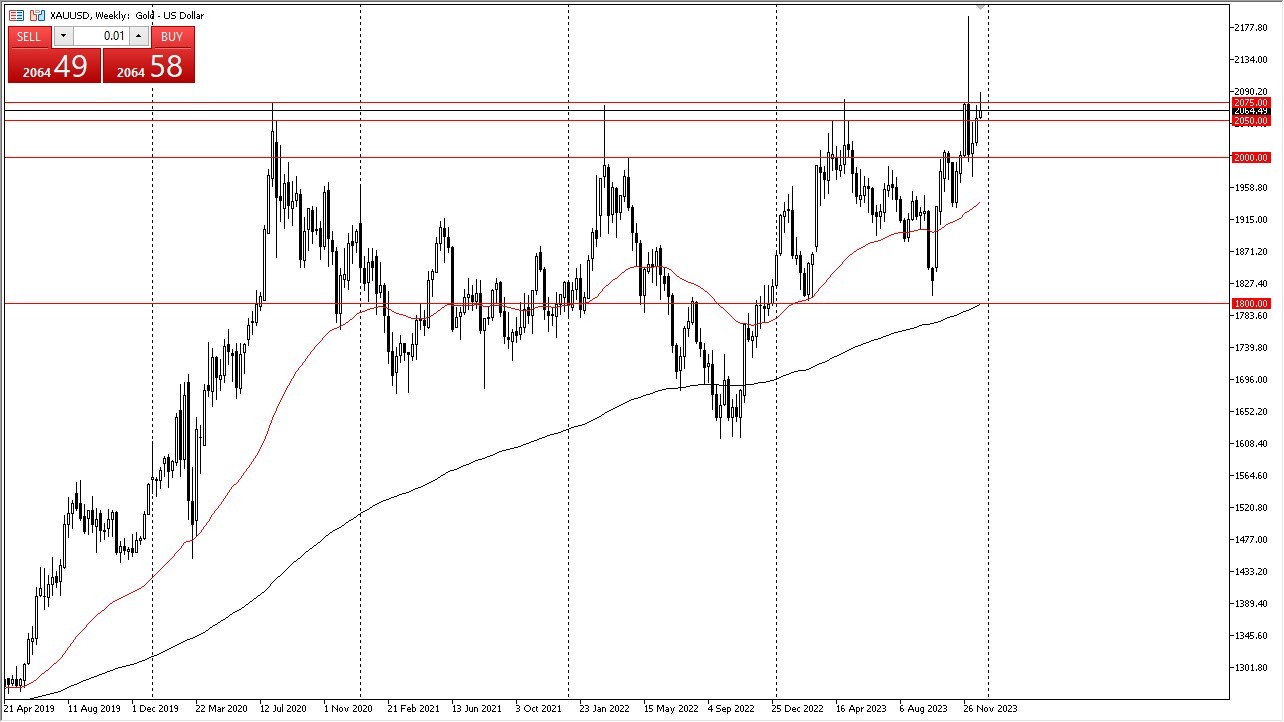

Good markets rallied a bit during the week but gave back most of the gains as we broke above the $2075 level, only to turn around to start falling. Ultimately, this is a shooting star that suggests that we are going to see a lot of resistance just above, so if we break down below the $2050 level, then it’s likely that we could drop down to the $2000 level. If we can break above the top the candlestick for the week, then it’s likely that we could go looking to the $2125 level. Pay close attention to the interest rate markets in America, because if the 10-year rates start to drop, that could help gold.

The NASDAQ 100 rallied again during the trading week but did give back some of the gains. All things being equal, this is a market that is overextended so I do expect a significant pullback. The smartest move that you can probably make in this market is simply to let it do its thing, and then turn around and start buying at the first signs of a significant stabilization and bounce. I would be especially interested in the 16,000 level, but right now the buyers have been very aggressive. Chasing the trade up here is very dangerous.

The British pound broke above the 1.2750 level during the week but gave back the gains above there to show signs of hesitation. This is an area that has been resistant before, so it’s not a huge surprise to see a struggle here now. Underneath, we have the 1.25 level offering significant support, and of course we are right out the 200-week EMA, which causes even more noise. If we can break above the top of the weekly candlestick, then it’s possible that the British pound could go looking to the 1.3150 level.

The euro has rallied during the bulk of the week, as we continue to see the euro try to take out the 1.11 level above. Underneath, the 1.10 level of course is a major support level, and I do think that the euro will eventually try to target the 1.1250 level. The 1.1250 level is the 61.8% Fibonacci level, and an area that has been very difficult to overcome in the past.