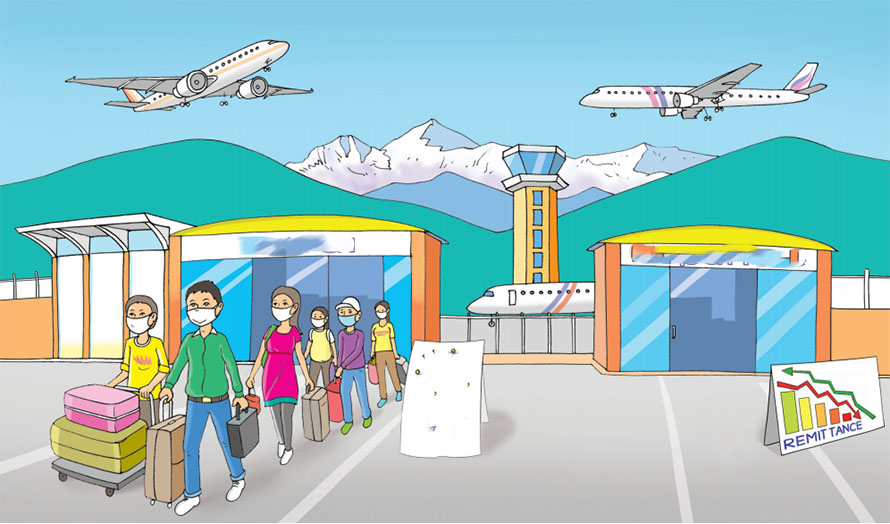

According to Nepal Rastra Bank (NRB), remittance inflows have increased by 25 per cent in the latest fiscal year, reaching over USD 10 billion. In 2022, overseas transfers were about $7 billion. This fast-growing remittance from migrant workers now accounts for almost a quarter percentage of Nepal’s USD 46 billion nominal GDP as of 2023.

The rise in remittance is playing a crucial role in stabilising Nepal’s external accounts, foreign exchange reserves, and financing imports; however, it is also causing a continuous deterioration of the trade balance due to an increased demand for imported consumable goods. As remittances go up, the trade deficits also increase in the same proportion. The primary concern is that the hard-earned remittance money is not being used for development and other productive sectors of the economy that create jobs and reduce dependence on imports.

Remittances (as a source of income and foreign exchange) are not sustainable in the long run. We must realise that over-reliance on consumption without making productive investments will cause Nepal to miss out on opportunities for industrial growth, as seen in other countries that strategically use diaspora funds. The government must devise and implement targeted policies to capitalise on migrant savings so that remittance money can help drive the country’s enterprise and technology revolution.

Present usage and economic impacts

Currently, more than 90 per cent of remittance spending in Nepal goes towards importing food, clothing, and electronics with little value addition to the larger economy. This type of spending certainly does help families in the short run; however, in the long run, it does not contribute much to economic development. Instead, investing a good portion of the remittance money in other sectors such as manufacturing, tourism, agriculture, or services could potentially transform the country’s macroeconomics.

Furthermore, the large remittances have caused Nepal’s currency to be significantly overvalued compared to India’s currency and hurt Nepal’s export competitiveness. The growing trade deficits have led to a drain of incoming dollars as the country struggles to keep up with the import surge fueled by migrant incomes.

Likewise, when the remittance money is continuously utilised only for consumption rather than investment, it creates a cycle of dependencies. It also incentivises young people to leave Nepal for work instead of pursuing education or other entrepreneurial ventures. As we have observed in Nepal for over a decade, this leads to a brain drain and a shortage of skilled labour in the labour market.

Therefore, it is crucial to use remittances for production rather than just household consumption to sustain growth and avoid external crises in the long term.

Success stories from other countries

Many developing countries have boosted their industrial growth by using diaspora bonds to fund infrastructure projects. Mexico’s famous 3×1 program is a successful initiative that has helped to develop grassroots communities. The program matches each dollar of collective hometown remittance investments into community projects with three government dollars. This has resulted in the funding of thousands of health clinics, schools, roads, and micro-enterprises across various Mexican states. The collaboration between organized diasporas and local administration was critical in enabling the success of this program.

In India, highways, power plants, and ports have been built using such capital tools, which have improved connectivity and increased private sector productivity. Similarly, telecom, aviation, pharma, and IT giants in emerging Asian economies have also been funded from non-resident community savings. The Philippines has utilized remittances in a variety of ways, such as expanding rural electricity access, which has led to job creation and growth in manufacturing in previously underdeveloped areas. Bangladesh’s government also launched many valuable projects to improve workers’ skills and channel remittance money to improve economic sustainability.

Policy ideas for Nepal

Several policy ideas can help make productive use of remittance money. The first step is introducing NRN savings bonds and dedicated equity funds to mobilise diaspora money into various sectors such as tourism, handicrafts, IT, manufacturing and farming ventures.

In this regard, easing foreign exchange controls and allowing dollar accounts could provide further incentives for investments beyond the consumption spending of remittances. The government should also encourage remittances through proper channels and discourage informal hundis. Nepal can learn from Bangladesh, which incentivises expatriates to send remittances through legal channels by offering a five per cent reward.

Secondly, the government should promote matching grant partnerships through local agencies. In this scenario, village cooperatives would receive two/three times more funding than collective remittance schemes for growth-centric projects such as eco-tourism, tea or ginger farming, and micro-hydropower, among others. This scheme can create an emotional bond between the diaspora and native communities, aiding in their upliftment.

Thirdly, aligning skills development and vocational training programs with overseas job market needs and providing entrepreneurship possibilities can significantly increase employability, family incomes, and remittances. This, in turn, can help more households achieve financial stability.

It is essential to have transparent, efficient, and accountable institutions and governance to ensure a steady flow of remittances. The Nepal government could potentially collaborate with Tribhuvan University, Kathmandu University, and NRN to share knowledge and research outcomes. Such an alliance could help develop an appropriate program focused on the best utilization of remittance money.

Looking ahead

Migration will continue to play a crucial role in Nepal’s national growth story for the next couple of decades. However, it is vital to have strategic policies that effectively utilise remittances for investment purposes. To achieve sustainable growth, Nepal should invest remittance money in the next generation of exporters, businesses, and agricultural ventures instead of using it for current consumption.

As the Nepali overseas community grows each year, it is necessary to adopt a diaspora-powered framework that facilitates contributions through institutional reforms. By seizing global opportunities and using income to promote national progress, Nepal’s landscape can be transformed significantly in just a few years. The Nepal government, political leaders, and NRN leadership, regardless of political party affiliation, need to rise above populist isolationism and create a supportive environment that encourages productivity both at home and abroad.

Nepalis have demonstrated their ability to build successful lives overseas, and now it is time to use policy innovation to direct our largest financial influx toward powering Nepal’s development transformation.