-

By Crystal Hsu / Staff reporter

State-run Mega International Commercial Bank (兆豐銀行) yesterday ended its currency exchange settlements services for online credit cards after peers and regulators raised issues regarding legal compliance.

The termination came one day after the lender announced it would lower fees to NT$10 per currency exchange settlement valued at less than NT$500,000.

Peers and regulators voiced concern that the offer was tantamount to marketing a cash advance, in contravention of constraints on lenders.

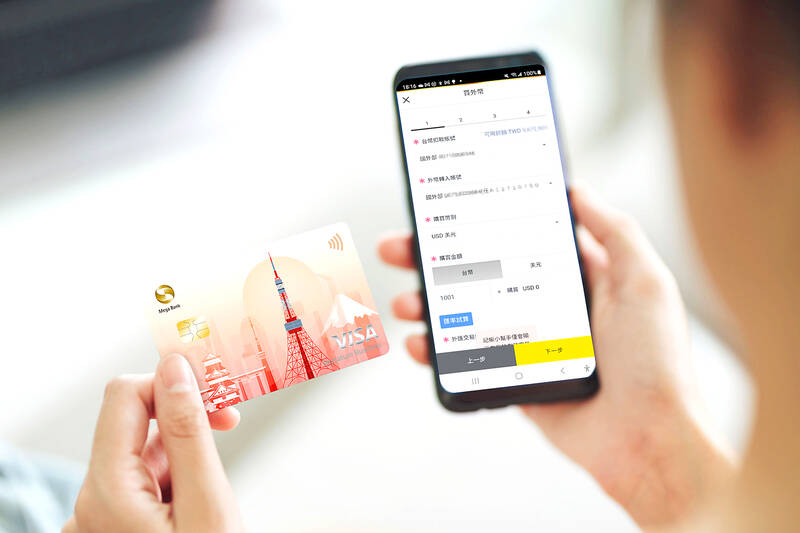

Photo courtesy of Mega International Commercial Bank

Underregulated promotion of cash advances were an issue linked to a credit card debt problem in Taiwan in 2005 and 2006.

Mega Bank said it might have misunderstandings about an exclusive regulatory permit for online credit card operations involving foreign exchange settlements and would halt the disputed service.

Demand for currency exchange settlements is escalating as overseas travel has expanded multifold after countries around the world ditched border restrictions amid the COVID-19 pandemic.

Phil Tong (童政彰), deputy director of the Financial Supervisory Commission’s Banking Bureau, said that lenders should diligently review legal compliance issues and refrain from questionable practices regardless of whether they are explicitly banned.

The market has undergone drastic changes in the 20 years since Mega Bank was granted a regulatory permit, Tong said, adding that the commission would frown on similar business propositions by other banks.

Credit cards should be used as a payment tool and should provide cash advances only in emergency cases, he said.

The central bank said that in 2005 it approved online currency exchange settlements to facilitate easy transactions, but never agreed to marketing of cash advances.

Mega Bank’s offer of currency exchange settlements to online credit card operations drew protests from peers partly because the local banking market is excessively competitive, rendering exclusive practices controversial.

Comments will be moderated. Keep comments relevant to the article. Remarks containing abusive and obscene language, personal attacks of any kind or promotion will be removed and the user banned. Final decision will be at the discretion of the Taipei Times.