The US dollar price for remittances has seen a decline of Tk 6-8 per dollar over the last 10 days till 15 March, following a period of volatility spanning 20 months. Bankers attributed this decline to a decrease in demand coupled with an uptick in inflows.

On Thursday and Friday last, the selling rate per dollar of remittance ranged from Tk114 to Tk114.50, down from Tk120 or higher in the previous week, which began with a fall.

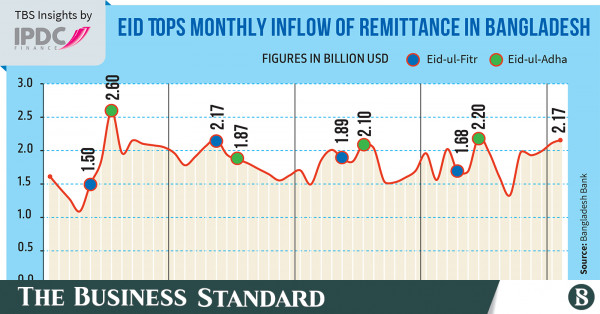

With March being the month of Ramadan and Eid-ul-Fitr, bankers anticipate at least an additional $500 million in inward remittances compared to February’s $2.16 billion, a trend that could further help stabilise the foreign exchange markets.

Selim RF Hussain, managing director of BRAC Bank and chairman of the Association of Bankers Bangladesh (ABB), described the recent decline in remittance rates as a significant positive development.

He attributed this trend to the balance between demand and supply. Importers have already stocked up on products primarily used during Ramadan and settled sight letters of credit (LCs), anticipating a potential rise in the dollar price.

“It seems the dark, stormy clouds have passed, and a glimmer of hope shines through,” Selim expressed optimism.

However, he cautioned that true stability may require another six to nine months to fully materialise.

Businesses in Bangladesh had enjoyed a decade of stable exchange rates until March 2022, when the onset of the Russia-Ukraine conflict triggered a swift depreciation of the taka against the US dollar riding on a spike in global commodity prices.

Within a span of just a few months, the taka plummeted from Tk85/86 to over Tk100 per dollar. Despite the central bank’s implementation of multiple exchange rates for various sectors such as exporters, importers, and remitters, the decline of the taka against the dollar persisted. For instance, while the remittance rate is currently fixed at Tk109.50, banks were unable to acquire US dollars at this price due to significantly higher rates – Tk120 plus prevailing in the informal market.

By June 2022, the dollar price for remittances surged to Tk110, maintaining a range within Tk115 until September 2023.

However, in October of the same year, the remittance rate spiked to Tk122 per dollar or higher due to the volatility stemming from the Bangladesh Bank’s imposition of fines amounting to Tk10 lakh each on the heads of treasury departments of 10 banks for selling US dollars at rates higher than the official rate.

Consequently, inflow of remittances in September stood at $1.33 billion, lowest in 41 months.

“The final quarter of 2023 witnessed unprecedented volatility in the country’s exchange rate market, particularly due to the national elections on 7 January. Following the elections, as the market returned to a semblance of normalcy, stakeholders regained confidence,” remarked the head of the treasury department of a leading private commercial bank.

According to Mirza Elias Uddin Ahmed, managing director of Jamuna Bank, many banks are forgoing dollars purchase at elevated prices due to the decrease in overall demand.

“Those who have accumulated dollars, including expatriate Bangladeshis, have begun offloading them into the market as the value of the taka is increasing,” said Mirza Elias.

Syed Mohammad Kamal, country head of Mastercard Bangladesh, said inflow of dollars is high compared to the demand. “It’s a good signal for the economy,” he commented. Mastercard alone channels around 20% of Bangladesh’s inward remittances.

Demand and supply trends of US dollars

A recent surge in inward remittances, exceeding $2 billion per month and increasing export earnings surpassing the $5 billion mark for the last three consecutive months until February pumped optimism to the market.

Inward remittances were $2.16 billion in February and it is expected to swell to over $2.5 billion at the end of March because of the Eid festival when expatriates send home more money to meet additional expenses of their families, according to bankers.

Central bank data shows Bangladesh received $15.08 billion in remittances during July-February of the current fiscal year, up by 7.6% compared to the same period a year ago.

On the other hand, export earnings, the other key source for foreign currency, surged by 3.71% to $38.45 billion during July-February of the current fiscal year from the corresponding period a year ago.

In contrast, available data show Bangladesh’s settlement of LCs stood at $33.68 billion during July-December compared to $41.17 billion in the same period a year earlier.

Also, in terms of opening of LCs Bangladesh’s overall import orders during the period declined by 5.33% to $32.93 billion.

Opening sight LCs reduces future payment pressure

The opening of more sight LCs occurred in recent months has also helped cool down the exchange rates as businesses settled their import payments sensing that the dollar price may go up further like the previous months.

Sight LCs provide assurance to the seller that payment will be received upon presentation of compliant documents, such as shipping documents, to the issuing bank.

Currency swap helps stability in forex markets

The recent introduction of a currency swap guideline by the Bangladesh Bank marks a significant step towards stabilising the exchange rate market, according to bankers.

Under this initiative, the central bank will purchase dollars from banks at the prevailing spot rate in exchange for taka. This move is designed to achieve two primary objectives: rebuilding foreign exchange reserves and alleviating liquidity pressures on the local currency.

With the interbank reference rate currently standing at Tk110 per dollar, it serves as the benchmark for determining the spot rate in this arrangement. Banks participating in the swap will receive taka liquidity in exchange for their dollars, thereby bolstering the central bank’s foreign reserves.

Also, when banks opt to retrieve their dollars at a later date, they will incur an interest rate, which is set to be lower than the prevailing repo rate. This incentivises banks to engage in the swap mechanism, as it provides them with a cost-effective means of managing their liquidity needs while simultaneously contributing to the stability of the exchange rate market.

Is it time to introduce a floating exchange rate?

Syed Mohammad Kamal, country head of Mastercard, noted that with the decrease in demand for the dollar, exchange rates have followed suit. He suggested that this trend indicates a potential shift towards market-based exchange rates.

“This is the opportune moment to consider allowing the taka to float,” he said.

Mirza Elias of Jamuna Bank echoed this sentiment, suggesting that the time is approaching to implement a crawling peg system for exchange rates, given the declining value of the dollar against the taka.