EURO FORECAST – EUR/USD, EUR/GBP, EUR/JPY

- Traders are heavily betting against EUR/USD according to IG data

- Meanwhile, retail positioning is extremely bullish on EUR/GBP

- Nearly three-quarters of traders are holding short positions against EUR/JPY

Most Read: Bitcoin (BTC) and Ethereum (ETH) Rally Further – Where to Next?

Contrarian market sentiment can be a valuable tool for traders because it taps into the potential for irrational exuberance and unjustified fear in the market. Here’s why:

Imagine the market is in a slump, and everyone’s feeling pessimistic. This widespread negativity can drive prices down below an asset’s actual worth. A contrarian investor sees this as a buying opportunity, believing the negativity is overblown and the price will eventually rebound. By buying when others are fearful, they aim to profit later when the market reverses higher, and the investment regains value.

This applies the other way around too. During periods of extreme optimism, contrarians might become cautious. If everyone’s rushing to buy a particular stock or asset class, a contrarian might see this as a sign of a bubble about to burst. They might choose to sell or hold off on buying, believing the price is inflated by hype and due for a downward correction.

It’s important to remember that contrarian investing isn’t just about blindly going against the crowd. It’s about identifying situations where the crowd’s emotions have caused a temporary disconnect between price and value. By capitalizing on these market inefficiencies, contrarians aim to make profitable trades.

However, contrarian investing also comes with risks. The crowd might be right sometimes, and going against the grain can lead to losses. It requires discipline, patience, and a strong understanding of fundamental analysis to identify true value when the market disagrees.

Want to know where the euro is headed over a longer-term horizon? Explore key insights in our quarterly forecast. Request your complimentary guide today!

Recommended by Diego Colman

Get Your Free EUR Forecast

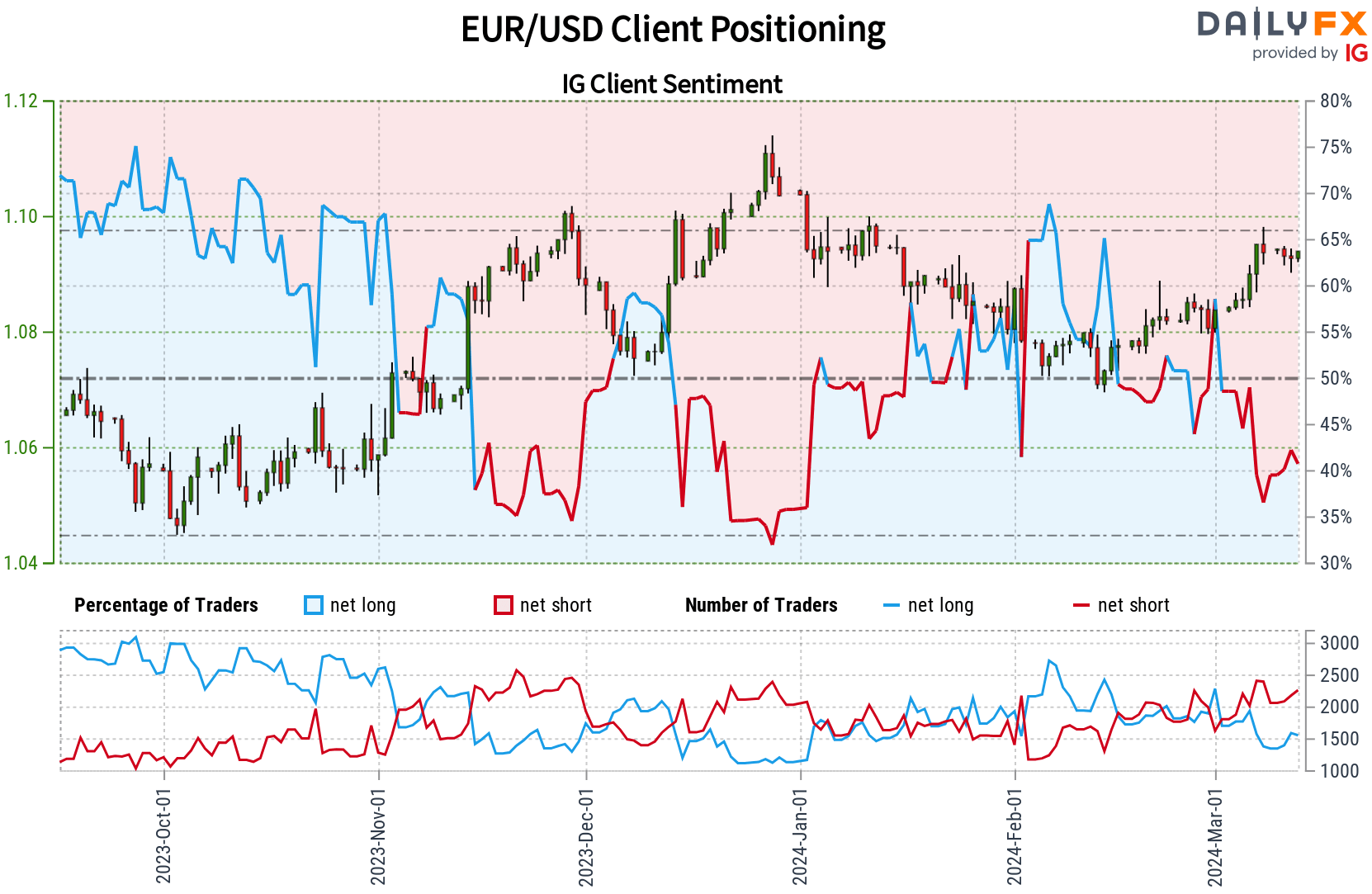

EUR/USD FORECAST – MARKET SENTIMENT

IG client data reveals a surprising dose of pessimism swirling around EUR/USD. More than 60% of the retail crowd is hunkering down with short positions, indicating they expect the euro to weaken against the U.S. dollar. This bearish tilt is further evidenced by the ratio of shorts to longs sitting at 1.59 to 1.

This negativity seems to be intensifying. Compared to yesterday, the number of traders betting against the EUR/USD has ticked upwards, and it’s even more pronounced when looking back to last week. Contrarians see this as a potentially bullish signal.

When the majority is overwhelmingly positioned one way, it can leave the market vulnerable to an unexpected reversal in the opposite direction. For instance, if news or events shift perceptions, a wave of panicked short covering could propel the EUR/USD upwards at the drop of a hat.

Delve into how crowd psychology may influence FX market dynamics. Request our sentiment analysis guide to grasp the role of retail positioning in predicting EUR/GBP’s near-term direction.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 0% | 1% |

| Weekly | -3% | -10% | -6% |

EUR/GBP FORECAST – MARKET SENTIMENT

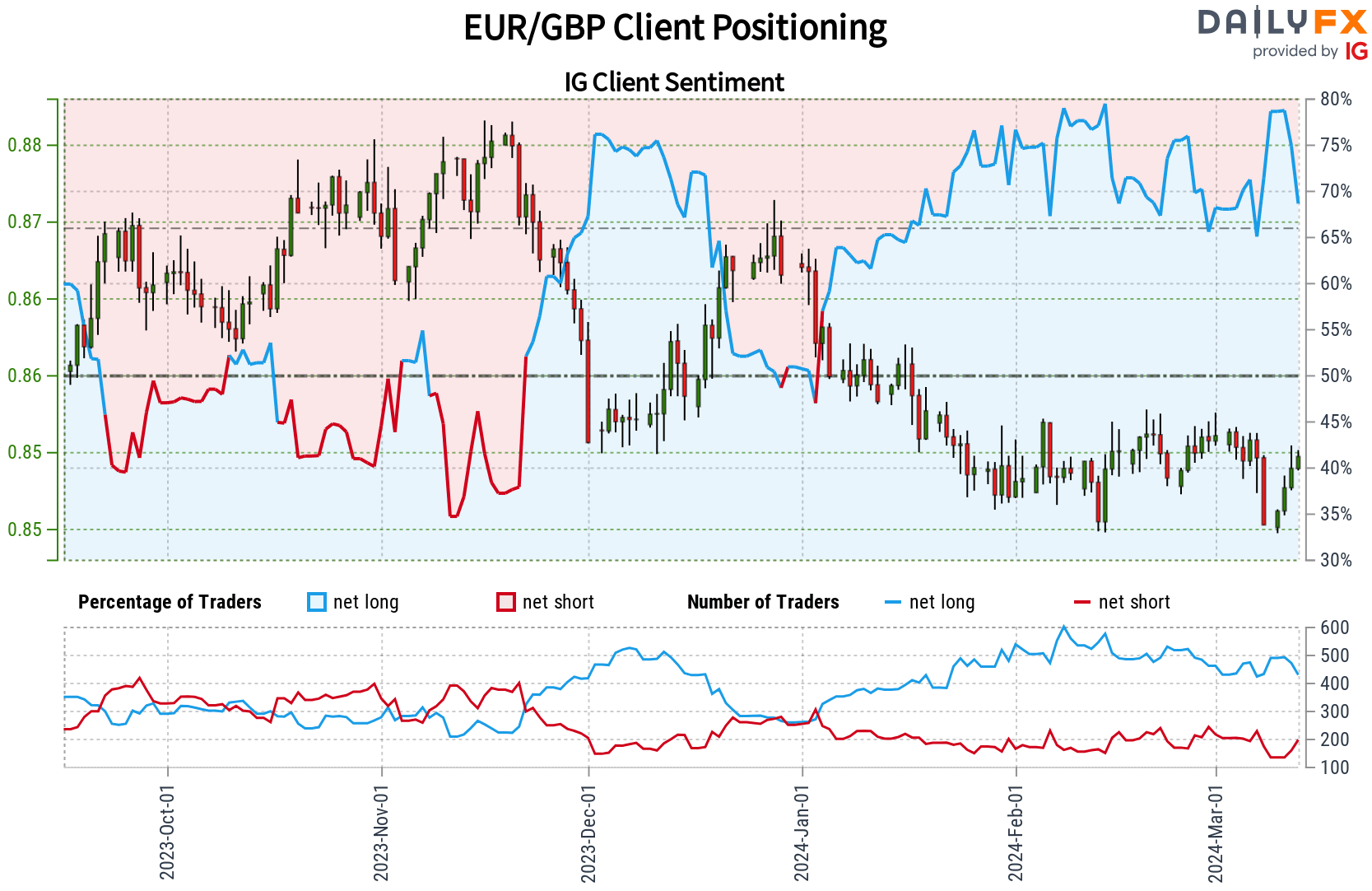

IG’s sentiment data paints a picture of widespread optimism on EUR/GBP. Over two-thirds of retail traders are betting on the euro to rise against the pound, a bullish stance reflected in the 2.15 to 1 dominance of long positions. This degree of bullishness often sets off alarm bells for contrarian investors.

The saying “the trend is your friend” is popular for a reason, but extremes in market sentiment can signal turning points. When a substantial consensus forms, the potential for a sharp reversal grows. If something shifts to spook the bulls, a rush of sell orders could quickly overwhelm the buyers, leading to a EUR/GBP decline.

Adopting a contrarian stance towards crowd sentiment, the prevailing net-long positions of traders on EUR/GBP indicate potential downside ahead for price action.

Disheartened by trading losses? Empower yourself and refine your strategy with our guide, “Traits of Successful Traders.” Gain access to crucial insights to help you avoid common pitfalls and costly errors.

Recommended by Diego Colman

Traits of Successful Traders

EUR/JPY FORECAST – MARKET SENTIMENT

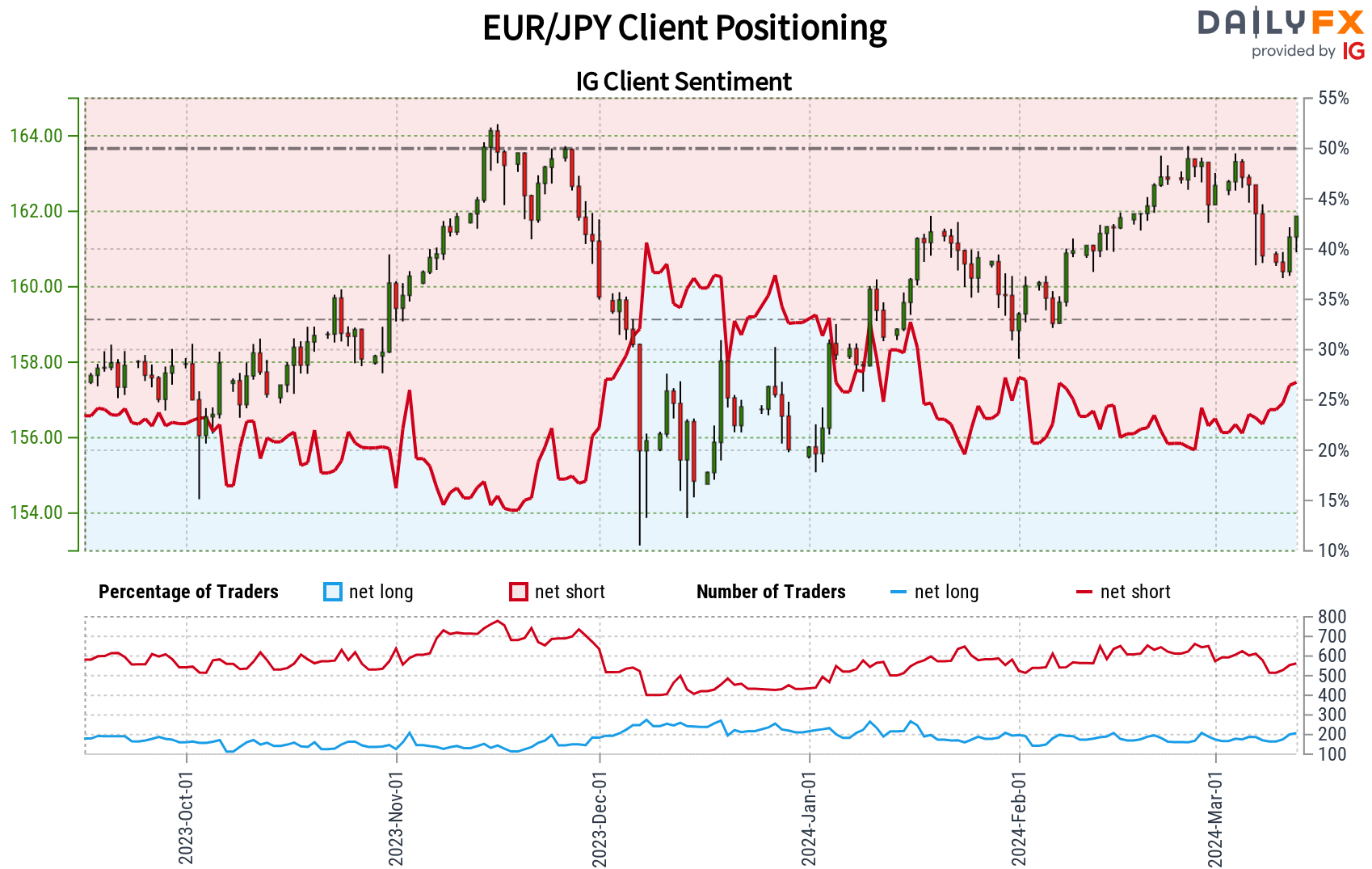

The retail crowd on IG seems convinced that EUR/JPY is headed for a pullback. Nearly three-quarters of traders are holding short positions, betting on the euro to weaken against the Japanese yen. This dominant bearish view is the kind of setup contrarian investors watch for, as it can signal a move in the opposite direction.

When a vast majority of traders pile onto one side of a trade, it sets the stage for potential reversals. A piece of good news for the euro – or negative stories about the yen – could set off a chain reaction. Traders betting against the common currency might be forced to buy back in, creating a flurry of short-covering. This could push EUR/JPY higher.

In summary, our approach diverges from prevailing crowd sentiment, and the current net-short positions of traders suggest that EUR/JPY could see further gains in the immediate future.