- The dollar had its worst week in over two months.

- Poor employment figures from the US increased the likelihood that the Fed will cut rates in September.

- The Reserve Bank of Australia will make its rate decision on Tuesday.

The AUD/USD weekly forecast leans bullish as the likelihood of a Fed rate cut in September increases due to weaker US data.

Ups and downs of AUD/USD

The Aussie ended the week up due to dollar weakness. With no key economic reports from Australia, the Australian dollar was at the mercy of the US dollar. Meanwhile, the dollar had its worst week in over two months.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

Dollar bears returned to the market after Powell maintained that the Fed would eventually cut rates. Moreover, poor employment figures from the US increased the likelihood that the Fed will cut rates in September. Additionally, the ISM released dismal US services PMI figures, further supporting bets for a September cut.

Next week’s key events for AUD/USD

Investors will only focus on one major event next week. The Reserve Bank of Australia will make its rate decision on Tuesday. According to a Reuters poll of economists, the central bank will keep rates unchanged as it works to lower inflation. However, investors will look for rate-cut clues from policymakers’ statements after the meeting.

Moreover, economists changed their outlook for rate cuts and now only expect one from the previous two in 2024. This change follows recent data showing a smaller drop in inflation in Q1 than expected.

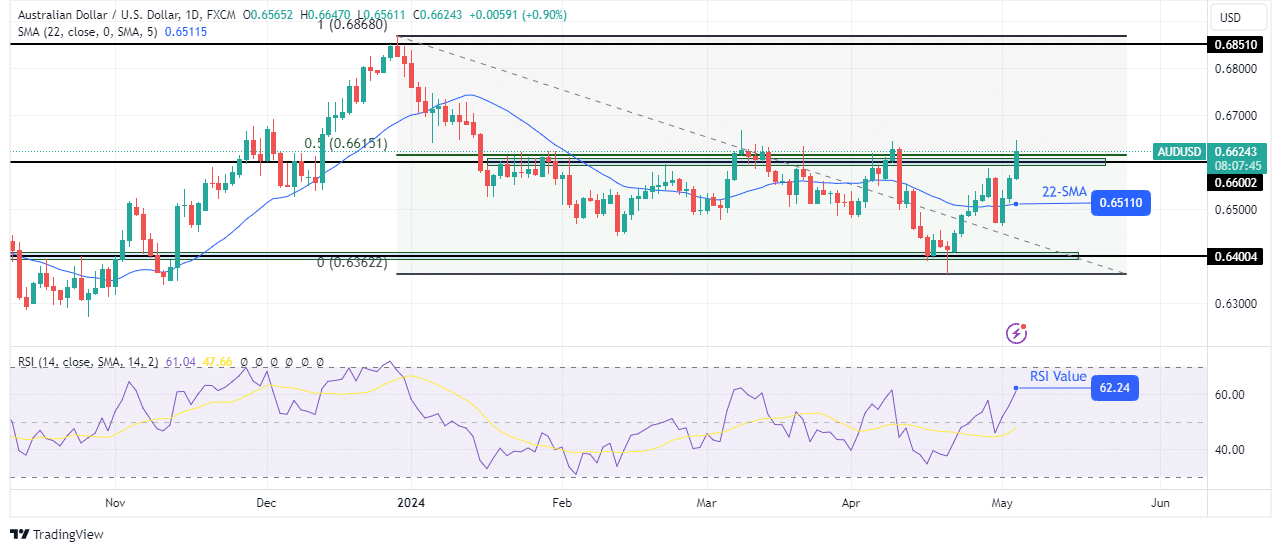

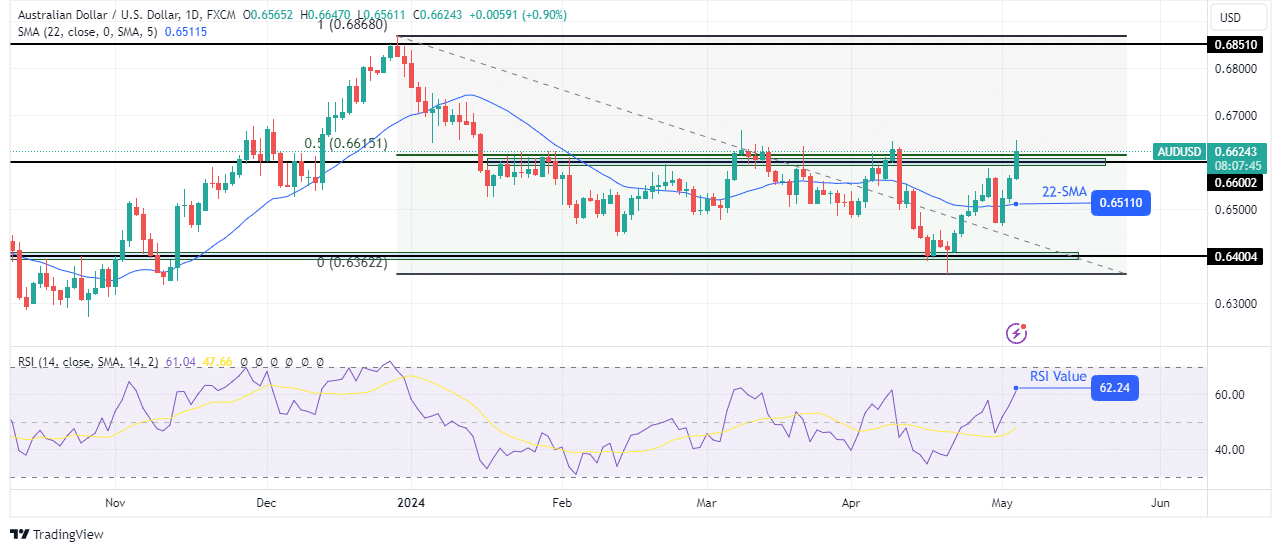

AUD/USD weekly technical forecast: Bulls make another attempt at breaking key resistance zone

On the technical side, the AUD/USD price has returned to the resistance zone comprising the 0.6600 key psychological level and the 0.5 Fib level. Bulls have struggled to break above this zone for a long time but have failed.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

Consequently, the price has mostly moved sideways. A recent surge in bullish momentum at the 0.6400 support level has pushed the price to retest this resistance zone. The bullish bias is strong, with the price well above the 22-SMA and the RSI heading for the overbought region.

However, bulls must close well above this zone and make another bullish candle to confirm a break above the zone. Otherwise, the price will fall back below the SMA. If bulls succeed in breaching the resistance, the price will likely retest the 0.6851 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money