Image © Adobe Images

The Federal Reserve launched the Euro-Dollar higher, only to splatter it into a strong technical glass ceiling.

There’s more frustration for those hoping for a stronger Euro-Dollar exchange rate on Thursday after the Federal Reserve’s slingshot failed to clear Euro-Dollar above the key 1.0725 barrier.

The exchange rate rose after Federal Reserve Chair Jerome Powell told journalists on Wednesday that he was not minded to raise interest rates again as he was confident inflation would trend lower over the coming months.

Addressing rising market expectations that the Fed’s next move would be a hike, Powell said, “I think it’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely.”

“Treasury bond yields and the U.S. dollar fell following Fed Chair Powell’s comments after policy interest rates were left unchanged. The 10-year Treasury yield declined to around 4.60%, while the pound and the euro have risen up through 1.25 and 1.07, respectively,” says Hann-Ju Ho, an economist at Lloyds Bank.

The Euro to Dollar exchange rate rallied to a high of 1.0732 following the comments, but the gains have since faded because the U.S. interest rate landscape remains ultimately unchanged. Sure, market odds for the next move being a rate hike had risen to ~20% ahead of the May FOMC, but the base case expectation was the first cut would come in December.

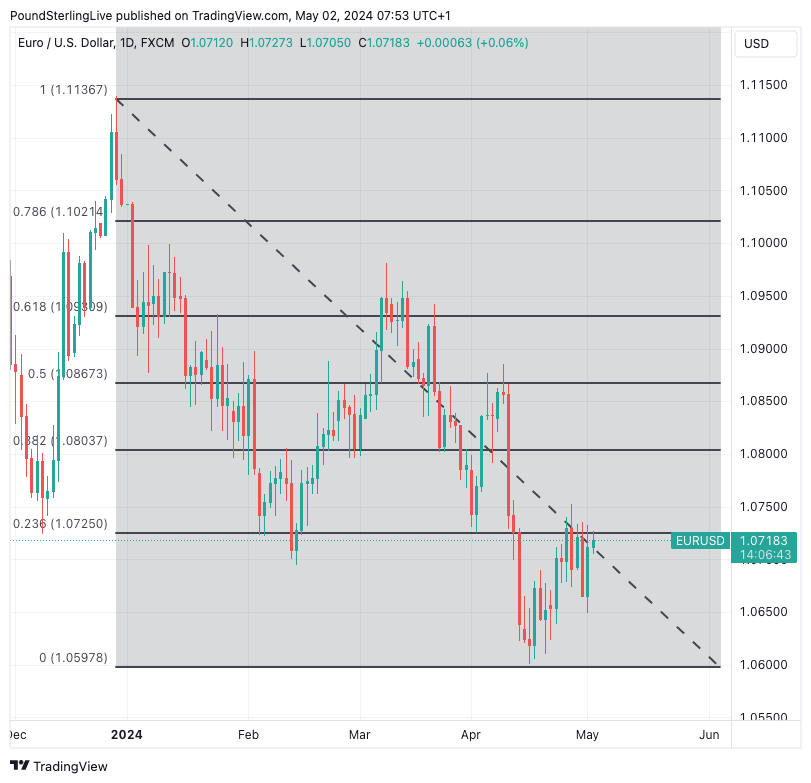

This base case assumption remains intact on Thursday, which limits Dollar weakness and frustrates Euro-Dollar at the 23.6% Fibonacci retracement of the 2024 selloff:

Above: EUR/USD at daily intervals. Track EUR/USD with your own custom rate alerts. Set Up Here

To be sure, the Dollar’s 2024 rally is firmly on pause, but the market will hesitate to bid the Euro higher ahead of tomorrow’s U.S. job report, which has taken on an air of importance following the Federal Reserve’s latest guidance, which puts the focus squarely back on the data.

“It was clear that the Powell Fed would love to cut rates given half a chance,” says Chris Turner, head of foreign exchange research at ING. “This has taken the steam out of the stronger dollar and puts the ball fairly back into the court of the U.S. data calendar – especially tomorrow’s jobs report.”

Bigger picture, Turner says talk of a Euro-Dollar decline to parity looks less fashionable following recent events that include signs the European Central Bank won’t cut too aggressively this year and falling odds of another Fed rate hike.

“We have several measures of EUR/USD medium-term fair value near 1.08, and factors calling for a significant deviation from that are weakening. One of those factors is energy prices, where the relative calm in the Middle East has allowed crude to settle back to mid-March levels,” says Turner.

Track EUR/USD with your own custom rate alerts. Set Up Here

Economists at Goldman Sachs say they are keeping their previous forecasts for U.S. interest rates following the May FOMC, saying the first cut will come in July, followed by a second in November.

Powell provided no new clues about the timing of a rate cut but struck a consistently dovish tone on inflation, according to David Mericle, an economist at Goldman Sachs.

He appears unflustered by the inflation uptick of Q1 and highlighted the consistent progress on wage growth, and noted that he did not see signs of reheating as inflation expectations remain anchored.

He emphasised that inflation was always likely to lag the rate hikes the Fed has already delivered and expressed confidence that further disinflation was coming.

“We maintain our base case for two 25-basis-point Fed rate cuts in 2024, likely starting in September,” says Mark Haefele, Chief Investment Officer at UBS Global Wealth Management. “In our view, current economic conditions are consistent with a soft landing this year, even if this outcome isn’t without an occasional speed bump, as has occurred in April.”

If this assessment proves correct, market pricing must ultimately row against Dollar strength by bringing forward rate cut expectations.

But for this to happen, May’s data prints must undershoot consensus estimates. The first test comes on Friday with the U.S. labour market report.