Above: File image of ECB President Lagarde. Image Copyrights: Angela Morant/ European Central Bank

Strategists see limited upside potential for the Euro to Dollar exchange rate stemming from today’s European Central Bank (ECB) policy decision and guidance.

The ECB is expected to cut interest rates by 25 basis points, a decision that has been for some time a foregone conclusion. This will leave currency market participants focussed on the guidance and latest economic projections.

“We see a lot of good news baked into the EUR cake,” says Mark McCormick, Global Head of FX and EM Strategy at TD Securities.

TD Securities expects the ECB to cut rates but remain vague on further moves, messaging that the data will ultimately decide when cuts will come.

“The tone is one where there is no urgency to follow up with a quick second cut,” says TD Securities, whose base-case scenario envisages a 0.25% decline in Euro-Dollar on the day.

ING Bank also expects the ECB to emphasise that no date is in mind for future rate cuts and that it will depend on the data. All eyes will be on ECB President Christine Lagarde during the press conference, where she will have the opportunity to address the timing of future rate cuts.

“She will not give any major hints on the further interest rate trend but will instead refer to the future data situation,” says Antje Praefcke, FX Analyst at Commerzbank. “This could disappoint some market participants who are expecting hints of further interest rate cuts and give the euro a helping hand.”

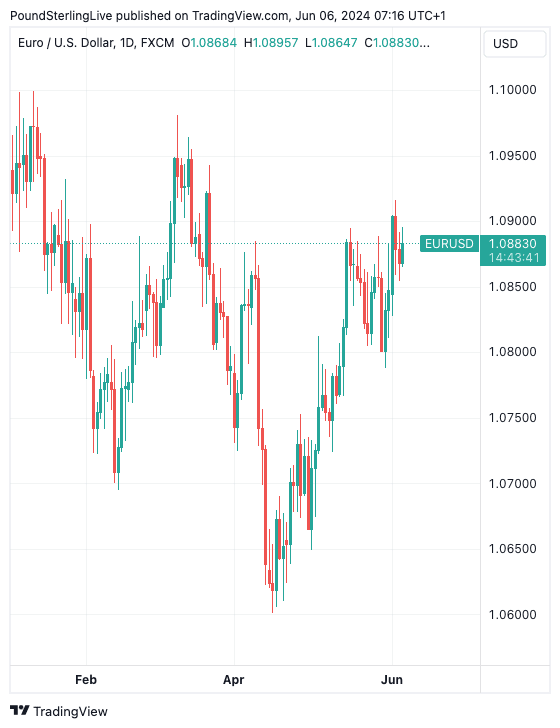

Above: EUR/USD at daily intervals. Track EUR/USD with your own custom rate alerts. Set Up Here

Such a stance is a reaction to firming Eurozone economic data and April’s above-consensus inflation print. The ECB will be wary of cutting interest rates too soon, as this risks stoking inflationary spirits in the economy.

“Lack of guidance by the ECB can be read as a hawkish signal and give some support to the euro short term,” says Francesco Pesole, FX Strategist at ING.

TD Securities sees a potential 0.30% gain by the Euro against the Dollar in the event of the ECB making a decisive push against bets for further rate cuts, attaching a 35% chance to such an outcome.

Here, “Lagarde pushes back against a July cut by implying a quarterly (or less) cutting pace is warranted. For example, by saying that the GC will get ‘a bit more data in July’ but ‘a lot more by September’ — echoing the guidance given in March,” says TD Securities.

A downside scenario for the Euro would involve the ECB opening the door to consecutive rate cuts, but this is given a mere 10% chance.

In such a scenario, Lagarde would confirm that there is scope for a more rapid pace of cuts early in the cycle.

Here, the Euro-Dollar exchange rate could fall by as much as 0.75%.