Forex trading in Asian session today was relatively muted, with market participants holding off on major moves in anticipation of impending key events. The spotlight is on BoC, with traders eagerly awaiting its rate decision. There is considerable speculation on whether the central bank will opt for an interest rate cut at this meeting or defer action until the next session. Canadian Dollar, already the weakest performer of the week, faces the risk of a more pronounced selloff if BoC adopts more dovish than expected stance.

Meanwhile, Dollar is also under pressure, ranking as the second weakest for the week so far, after selloffs triggered by disappointing manufacturing data. Investors are now looking forward to today’s release of ADP private employment data for an early indication of May’s job market performance. Nevertheless, ISM services data is likely to be a more significant market mover. Meanwhile, Dollar’s future direction would also hinge on the broader cues from stock and bond markets, with particular attention on Friday’s Non-Farm Payrolls report.

Overall in the currency markets, Swiss Franc and Japanese Yen stand out as the strongest performers, buoyed by the ongoing decline in US and European benchmark treasury yields. New Zealand Dollar follows as the third strongest, while Australian Dollar aligns closer to Dollar and Loonie as the third weakest. Euro and Sterling are positioned in the middle of the pack.

Technically, DOW remains capped by 55 D EMA (now at 38799.44) despite this week’s recovery. Fall from 40077.40 is seen as correction to the rise from 32337.20, and further fall is in favor. Break of last week’s low of 3800.96 will target 38.2% retracement of 32327.20 to 40077.40 at 37116.82. However, sustained break of 55 D EMA will bring stronger rebound back to retest 40077.40 instead.

In Asia, at the time of writing, Nikkei is down -1.15%. Hong Kong HSI is up 0.36%. China Shanghai SSE is down -0.54%. Singapore Strait Times is up 0.22%. Overnight, DOW rose 0.36%. S&P 500 rose 0.15%. NASDAQ rose 0.17%. 10-year yield fell -0.066 to 4.336.

Japan’s nominal labor earnings rise 2.1% yoy, real wages still declining

Japan’s nominal labor cash earnings increased by 2.1% yoy in April, surpassing the expected 1.7% and marking the 28th consecutive month of growth. Excluding bonuses and nonscheduled payments, average wages climbed by 2.3% yoy. However, overtime and other allowances were down by -0.6% yoy.

Despite the rise in nominal wages, real wages fell by -0.7% yoy, continuing a 25-month streak of declines, the longest on record. Nonetheless, the rate of decline was smaller than the revised -2.1% yoy drop in March, as many major companies implemented salary increases during the latest spring annual wage negotiations.

Japan’s PMI composite hits highest since August 2023

Japan’s PMI Services index was finalized at 53.8 in May, slightly lower than April’s 54.3. Meanwhile, PMI Composite index rose to 52.6 from 52.3 in April, marking its highest level since August 2023 and staying above 50 neutral mark for the fifth consecutive month.

Trevor Balchin, Economics Director at S&P Global Market Intelligence, noted that the Japanese service sector’s “strong upturn was sustained,” with only slight easing in growth rates for activity and new work. New export business expanded the most since this metric was introduced in September 2014. Both the future activity and employment indices increased since April and were among the highest on record.

Balchin also highlighted that while costs continued to rise sharply, the strong demand for services led firms to be confident in raising prices. In May, average prices charged for services increased at the third-fastest rate on record, following only April 2014 and April 2024.

RBA’s Bullock discusses plan A and two backups amid inflation concerns

RBA Governor Michele Bullock addressed a senate panel today, emphasizing the importance of controlling inflation despite balanced risks. She underscored the necessity of bringing inflation back down to the target band, warning that if inflation doesn’t appear to be heading in the right direction, “we’ll have to take action.”

In her elaboration on the RBA’s rate-setting approach, Bullock described a “Plan A,” which involves a data-driven methodology, keeping all options open without committing to a specific course of action prematurely. That is, RBA does “not rule anything in or out.”

She also outlined two contingency “Plan Bs” depending on economic developments: one for persistently high inflation, and another for a significant economic downturn.

“If it turns out that inflation is starting to head higher again or it’s much stickier then we won’t hesitate to move and raise interest rates again,” Bullock declared. Conversely, she noted that a weaker-than-expected economy would prompt considerations for easing rates to mitigate deflationary pressures.

Australia’s Q1 GDP rises 0.1% qoq, lowest annual growth since late 2020

Australia’s GDP grew by 0.1% qoq in Q1, below the anticipated 0.2% growth. On a year-over-year basis, GDP increased by 1.1%.

Katherine Keenan, head of national accounts at ABS, remarked that GDP growth was weak in March, marking the lowest annual growth rate since December 2020. She also highlighted that GDP per capita fell for the fifth consecutive quarter, declining by -0.4% in March and -1.3% over the past year.

China’s Caixin PMI services rises to 54, highest level since July 2023

China’s Caixin PMI Services index jumped from 52.5 to 54.0 in May, exceeding expectations of 52.6. This marks the 17th consecutive month of expansion and the highest reading since July 2023. Similarly, PMI Composite rose from 52.8 to 54.1, indicating expansion for the 7th straight month and at the fastest pace in a year.

Wang Zhe, Senior Economist at Caixin Insight Group, noted that growth in supply and demand in both the manufacturing and services sectors picked up pace, with a particularly strong increase in services demand. He mentioned that exports in both sectors improved amid market optimism. Additionally, employment in the services industry shifted from a decline to an increase, driving the composite index into expansion for the first time in nine months.

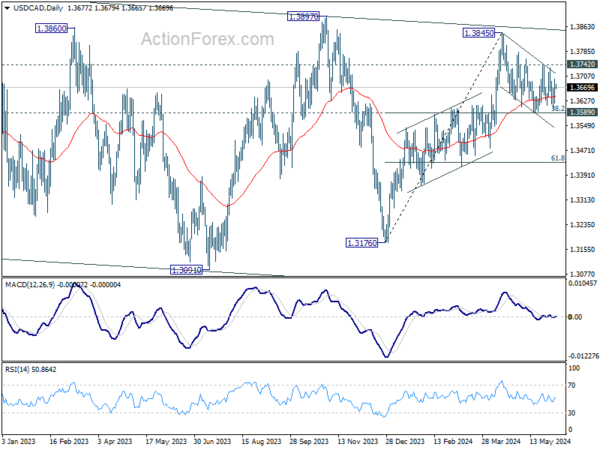

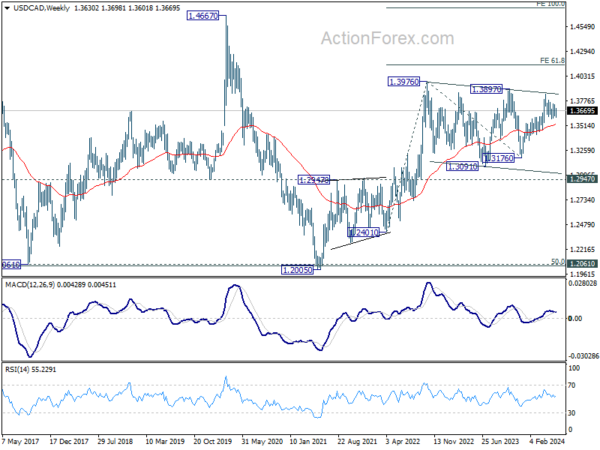

BoC in spotlight, USD/CAD ready for breakout?

BoC rate decision is under the spotlight today. There is palpable readiness within the central bank to commence monetary policy easing especially following unexpectedly weak Q1 GDP data. The primary question being is whether it will take action today or defer until the next meeting in July.

Currently,most economists anticipate that conditions are now conducive for a 25bps rate cut to 4.75% at this meeting. Even if Governor Tiff Macklem opts to hold rates steady today, it is expected that he will signal an imminent rate cut.

Meanwhile, opting to wait until July would enable BoC to present a more comprehensive outline of its easing strategy, coinciding with the release of a new monetary policy report containing updated economic and inflation forecasts. This would provide a clearer framework for understanding the central bank’s expectations and strategic intentions moving forward.

Canadian Dollar is trading as the worst performer of the week at this point, partly dragged down by the extended fall in oil prices. As for USD/CAD, near term outlook stays bullish with 1.3589 cluster support intact (38.2% retracement of 1.3176 to 1.3845 at 1.3589). Break of 1.3742 resistance will be an early sign that rise from 1.3176 is ready to resume through 1.3845.

More importantly, that would put 1.3976 key resistance into focus. Firm break there will resume long term up trend from (1.2005). Next medium term target is 61.8% projection of 1.2401 to 1.3976 from 1.3176 at 1.4149.

Elsehwere

Eurozone will release PMI servies final and PPI in European session, while UK will also publish PMI services final. Later in the day, US will release ADP employment, as well as ISM services.

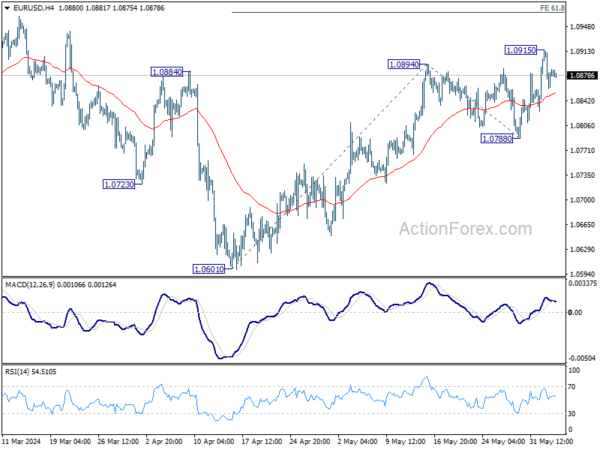

EUR/USD Daily Outlook

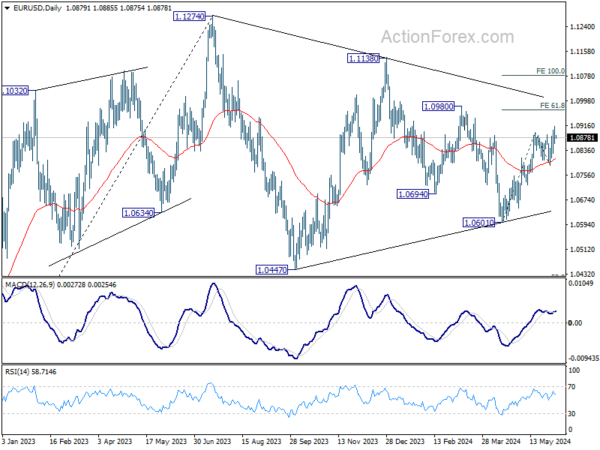

Daily Pivots: (S1) 1.0853; (P) 1.0885; (R1) 1.0910; More…

Intraday bias in EUR/USD is turned neutral with current retreat and some consolidations would be seen below 1.0915. Further rally is expected as long as 1.0788 support holds. Break of 1.0915 will resume the rally from 1.0601 to 61.8% projection of 1.0601 to 1.0894 from 1.0788 at 1.0969. However, firm break of 1.0788 will turn bias back to the downside for deeper decline instead.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern. Fall from 1.1138 is seen as the third leg and could have completed. Firm break of 1.1138 will argue that larger up trend from 0.9534 (2022 low) is ready to resume through 1.1274 high. On the downside, break of 1.0788 support will extend the corrective pattern instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q1 | 5.10% | 2.80% | -7.80% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Apr | 2.10% | 1.70% | 0.60% | 1.00% |

| 00:30 | JPY | Services PMI May F | 53.8 | 53.6 | 53.6 | |

| 01:30 | AUD | GDP Q/Q Q1 | 0.10% | 0.20% | 0.20% | 0.30% |

| 01:45 | CNY | Caixin Services PMI May | 54 | 52.6 | 52.5 | |

| 06:45 | EUR | France Industrial Output M/M Apr | 0.50% | -0.30% | ||

| 07:45 | EUR | Italy Services PMI May | 54.5 | 54.3 | ||

| 07:50 | EUR | France Services PMI May F | 49.4 | 49.4 | ||

| 07:55 | EUR | Germany Services PMI May F | 53.9 | 53.9 | ||

| 08:00 | EUR | Eurozone Services PMI May F | 53.3 | 53.3 | ||

| 08:30 | GBP | Services PMI May F | 52.9 | 52.9 | ||

| 09:00 | EUR | Eurozone PPI M/M Apr | -0.50% | -0.40% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Apr | -5.10% | -7.80% | ||

| 12:15 | USD | ADP Employment Change May | 175K | 192K | ||

| 12:30 | CAD | Labor Productivity Q/Q Q1 | 0.40% | 0.40% | ||

| 13:45 | CAD | BoC Interest Rate Decision | 4.75% | 5.00% | ||

| 13:45 | USD | Services PMI May F | 54.8 | 54.8 | ||

| 14:00 | USD | ISM Services PMI May | 51 | 49.4 | ||

| 14:30 | USD | Crude Oil Inventories | -2.1M | -4.2M |