A growing category of international payment specialists is set on proving that the conventional methods for sending student payments overseas are ripe for change. These companies – including such firms as Flywire, Cohort Go, NexPay, and WU GlobalPay – are focused on the global education market and determined to drive down the costs of sending money abroad. In the process, they are also building a better system for students and institutions alike.

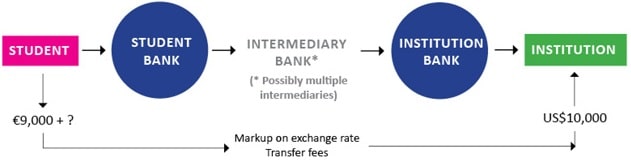

Just think about a traditional money transfer process for a moment. And imagine, for example, that a student in Germany needs to send US$10,000 to a university in the US for an upcoming semester’s tuition. If the student goes to his or her local bank to send that transfer, the bank will charge a markup on the foreign exchange rate, and generally an international transfer fee as well. There may well be additional fees levied by intermediary banks along the way, not all of which will be clearly known at the start of the process.

Conventional international funds transfer process via banks

The end result is that even if the student pays an amount equivalent to US$10,000 in Euros at the start of the process, plus whatever banking fees are billed up front, a different amount might actually end up in the university’s account (if exchange rates change during the transfer or if additional banking fees come into play). The student may not even know of any such shortfall until they arrive on campus to find they still have a balance owing, and they certainly will not be able to trace their payment or monitor any additional charges during the transfer.

Welcome to the mysterious – not to mention complex and highly regulated – world of moving money from one country to another. This is where retail banking and high finance collides, and where banks, along with a number of invisible money movers, have been quietly making big profits for years.

“The biggest players in international funds transfers are still the banks. In fact, historically they’ve been the only players that do it. People like ourselves are coming in and trying to disrupt that,” says Danny May of Trustly, a payment service for European clients offered by Flywire.

Here is what that disruption looks like for our German student who opts to send money to the US via a payment service provider. First, the student gets access to an online payment gateway that allows them to transfer funds locally and in their home currency. International transfer fees are eliminated as a result, or at least greatly reduced.

Second, the payment providers negotiate discounted exchange margins with the intermediary banks based on their volume of transactions, and pass that on in the form of lower costs for customers. As Mr May points out, “Banks are arguably charging 2%-3% more than the rest of the market, because they can. Although we use the banks for our [transactions], the volume that we do means that we can pass on some savings to the end users, be that students or parents.”

Third, the payment providers offer a more transparent process for students, families, and agents. They guarantee that the correct amount of foreign currency will be deposited with the student’s institution abroad – that is, they assume the risk of any shortfall arising from the foreign exchange or intermediary fees – and students are able to monitor the progress and status of their payments on the system at all times.

The bottom line is that the student or parent or agent is able to realise significant cost savings on international transfers – measured in the hundreds or even thousands of dollars per transaction. At the same time, the transfers are processed through quickly and transparently via routings established by the payment provider and the invoice amounts are guaranteed for the host institution or school.

Payments in a fragmented marketplace

Now expand the example of our single German student to the millions of internationally mobile students abroad today, coming in numbers from a rapidly expanding number of source countries. Those students are travelling to an increasing field of established and emerging host countries around the world and to tens of thousands of schools and institutions. Finally, many are being supported by agents – again, thousands worldwide – who in some cases are also making payments on the students’ behalf. Whatever way you slice it, that adds up to a complex web of millions of payments per year moving around the world.

International education has of course become a major industry over the past 30 years. It is a leading export sector in Australia valued at more thatn AUS$34 billion and a US$45 billion enterprise in the US. Education exports are valued at roughly £22 billion in the UK, and CDN$20 billion in Canada. Among those four leading destinations alone, that works out to more than US$100 billion per year in fees and related spending.

These export numbers give a sense of the scale of the potential market for international payment providers specifically for international education. They underscore why we continue to see an expanding field of providers and services the international payment space over the last few years, and also why some of those firms are growing so quickly today.

The sheer number of participants and countries involved illustrate as well the complexity of the enterprise, and the fact that efficiency – along with the ability to offer lower costs to customers – is a key source of competitive advantage for payment providers in international education.

“We’re in the business to be a disruptor based on volume rather than optimising profit based on individual transactions,” says Brent Hobson. (Mr Hobson founded a specialised payment transfer provider – PayEd – in 2015 and later sold the company to Vitesse PSP.) “In this scenario, you’ve got three players generally. You’ve got the school, the person paying (whether that’s the agent or student), and the payment provider. And so what we’re trying to do is to take that money back from the banking system and give it to all three groups.”

“This market is so big,” he adds, “you don’t need to be greedy. You just need to be efficient.”

The proposition for educators

Part of that efficiency arises in the ways in which international payment providers aim to relieve some of the pain points for institutions in receiving, reconciling, and processing international payments. When you imagine the sheer number of students involved, a great number of whom are transferring funds two or three times per year and all at about the same time, you begin to get a sense of what that looks like from the institution’s point of view. For many, this adds up to large volumes of transfer deposits, which may or may not correspond exactly to the amounts owing on the student’s accounts, and often without a great deal of supporting detail from the bank.

This in turn translates into a lot of additional expense in trying to connect individual payments to the correct student accounts, in lost receivables due to discrepancies in foreign exchange calculations or unanticipated transfer fees, or in additional efforts to collect on any shortfall on a student’s transfer amount.

“When students are making payments for semester fees, there is a big spike in the telegraphic transfers that universities get a couple of times per year,” says Cohort Go CEO Mark Fletcher. “Typically, what happens is that the universities will put on reconciliation staff to look at all of these transfers and try and work out who they are from. If they are dealing with a payment provider like us, we just give them a single payment but with a detailed report on the payment amounts and students corresponding to each.”

The regulatory burden

Underlying this growing volume of international fee transfers for education are extensive systems of regulatory oversight and compliance, both at the level of participating banks but also in the form of related legislation governing international funds transfers, foreign exchange, and currency controls.

Navigating those different requirements often leads payment providers to build transfer routes on a market-to-market basis, and this means in turn that payment firms can sometimes play an important role in easing financial transfers for markets where moving money has traditionally been more difficult.

On the compliance side, meanwhile, approaches vary by provider. Some meet their compliance obligations at the institutional level – in effect, the education provider becomes a client of the payment service and is established as a legitimate institution and destination for the transferred funds.

In other cases, the compliance is conducted at the student level. The student, or a representative or family member paying on the student’s behalf, has to clearly identify themselves within the payment system and is then checked against a variety of security lists and other controls against money laundering or other infractions.

Just as international payment firms have to navigate the many different regulatory regimes of both sending and receiving markets, they also have to quickly adjust to changing political and regulatory requirements. Mr Fletcher adds, “One of the biggest issues in the marketplace — particularly when you look at the regions where most of the world’s students are coming from — relates to the sovereign and regulatory risk arising in these countries.”

Looking forward

Even rough calculations suggest that the combined number of transactions of the major payment service providers still adds up to only a percentage of the total number of international student fee transfers each year. Given the large number of institutions, agents, students, and other stakeholders involved, the market is naturally fragmented in this respect.

But the rapid adoption of specialised payment services over the past four or five years points to the potential for continued growth and efficiency in managing international student payments. Mr May agrees that there is considerable upside: “Everybody seems to know each other in this industry. If you get a good name for yourself, that goodwill and reputation spreads very quickly. We see a huge opportunity to come in and make international fee transfers cheaper, easier, and faster.”