- GBPCAD stabilizes near 3-year high, at the top of a bullish channel

- Technical signals flag weaker sessions ahead; bears eye 1.7700 level

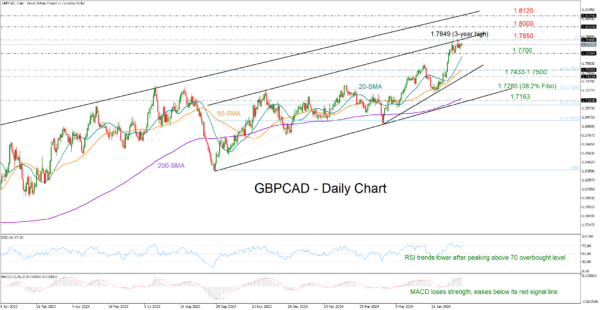

GBPCAD is in the fifth week of gains, having exponentially risen to 1.7849 last week– the highest level reached since March 2021.

The pair has been on the sidelines this week, retaining marginal gains so far, with the RSI and the MACD signaling growing appetite for selling as the former has changed trajectory to the downside after peaking above its 70 overbought level and the has retreated below its red signal line.

If the bears drive the price below the 1.7700 level and beneath the 20-day simple moving average (SMA), the 50-day SMA coupled with the tentative support trendline drawn from April’s low might attempt to pause the sell-off within the 1.7433-1.7500 territory. The 23.6% Fibonacci retracement of the September-July upleg is adding extra credence to the region. Hence, a violation there could upset traders, leading to a swift bearish correction towards the 38.2% Fibonacci of 1.7285.

In the big picture, the pair seems to be trading within a bullish channel with support at 1.7135 and resistance at 1.7895. A decisive rally above the channel could last till the 1.8000 psychological number or even higher at 1.8125, where the resistance line from December 2022 is placed.

To sum up, GBPCAD seems to have become more sensitive to bearish developments after unlocking a three-year high, though only a close below 1.7000 could bolster selling appetite, whilst an outlook deterioration could happen lower and beneath 1.7433.