-

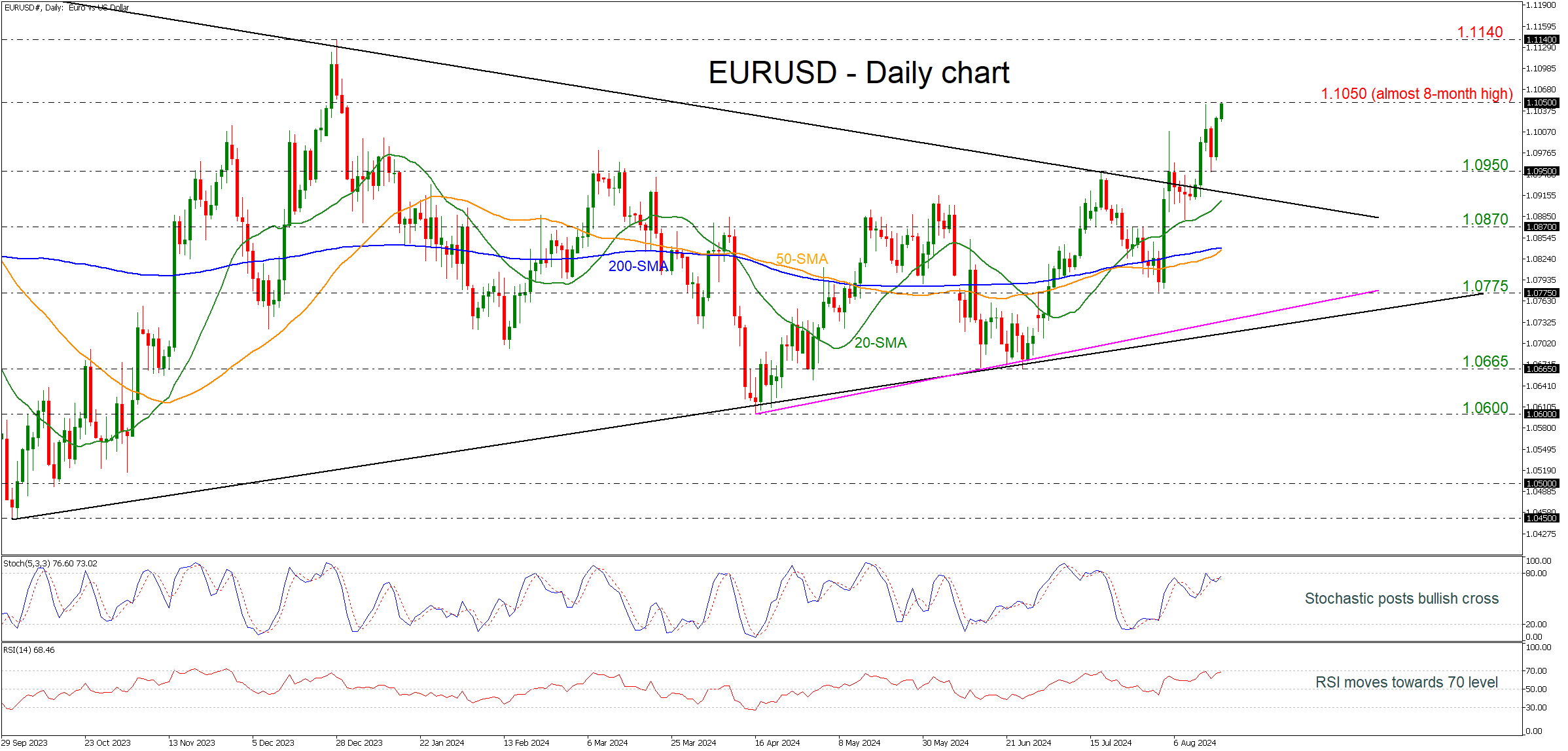

Remains well above the long-term symmetrical triangle.

-

50- and 200-day SMAs ready for bullish cross.

-

Momentum oscillators confirm upside move.

EURUSD has been in a bullish move, especially after the rally above the long-term symmetrical triangle in the preceding week. The pair is again battling with the almost eight-month high of 1.1050, with the simple moving averages (SMAs) mirroring the current upside movement as they are all ticking higher. Additionally, the 50-day SMA is ready to cross above the 200-day SMA.

According to technical oscillators, the stochastic is posting a bullish crossover within its %K and %D lines, while the RSI is flirting with the 70 level with strong momentum.

If the pair reactivates its uptrend above the previous top, the next target will be the 1.1140 resistance, taken from the peak in December 2023. Even higher, the bulls might head for the 1.1275 number, which was a key resistance area during the second half of 2023.

On the downside, the 1.0950 support has been guarding selling forces over the past two days. Hence, a step beneath that line, the 20-day SMA around 1.0900 might produce fresh negative volatility, likely squeezing the price towards the 1.0870 barricade. Another defeat there could add more fuel to the bearish wave, bringing the 200-day SMA at 1.0840 immediately under the spotlight.

Overall, EURUSD is sustaining an upward trend as long as it stands above the previous sideways pattern and the 1.1000 psychological mark. To attract new buyers, the pair will need to pierce through the 1.1050 bar.