- The US PPI and CPI reports confirmed that inflation was on a consistent path to the 2% target.

- US retail sales jumped, and jobless claims fell.

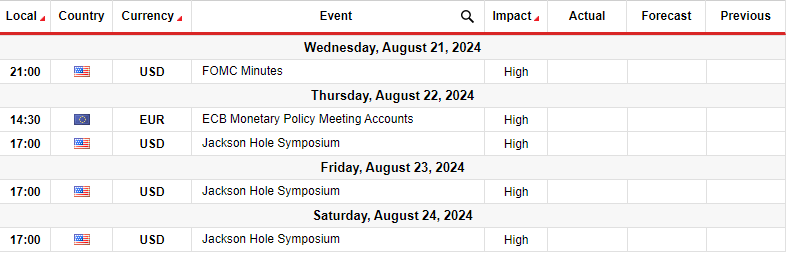

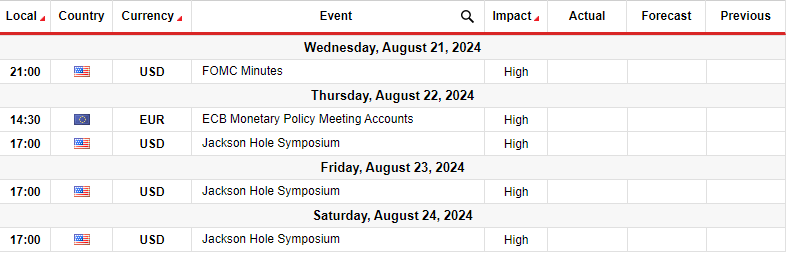

- Next week, investors will scrutinize the Fed’s and ECB’s policy meeting minutes.

The EUR/USD weekly forecast shows solid bullish momentum, as US inflation data suggest a Fed rate cut at the September meeting.

Ups and downs of EUR/USD

The EUR/USD pair ended the week up as the euro rose amid dollar weakness. The dollar had a tough week as data increased the likelihood of a 25 bps Fed rate cut in September. The US PPI and CPI reports confirmed that inflation was on a consistent path to the 2% target. Therefore, traders are more confident that the Fed will start lowering borrowing costs. This view has kept pressure on the US dollar, boosting the euro.

-Are you interested in learning about the forex signals telegram group? Click here for details-

Meanwhile, the economy has painted a mixed picture. Last week, there were fears of a recession. However, retail sales jumped this week, and jobless claims fell, indicating a resilient economy.

Next week’s key events for EUR/USD

Next week, investors will scrutinize policy meeting minutes from the European Central Bank and the Federal Reserve. Additionally, Fed Chair Powell will speak at the Jackson Hole Symposium. The policy meeting minutes will contain clues on the outlook for ECB and Fed rate cuts.

While the ECB has started lowering borrowing costs, markets expect the first Fed cut in September. Similarly, economists expect the ECB’s next rate cut to come in September. However, inflation in the Eurozone has paused while that in the US is easing. Therefore, there is a high chance Fed policymakers will be more dovish than ECB officials.

When Powell speaks next week, he might hint at the future, which could cause the US dollar to be highly volatile.

EUR/USD weekly technical forecast: Bulls retest channel support in uptrend

On the technical side, the EUR/USD price trades in a bullish channel and has retested the channel resistance. Moreover, it trades above the 22-SMA with the RSI nearly overbought, supporting a bullish bias. The bulls moved sharply from the 1.0800 support to the channel resistance.

-If you are interested in forex day trading then have a read of our guide to getting started-

The price might fall back to the 22-SMA or the channel support line from here. Nevertheless, the next target is at the 1.1051 level since the direction is up. The uptrend will continue as long as the price keeps making higher highs and lows.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.