EUR/USD

EURUSD remains firmly in red and trading near the lowest level in almost one month on Friday morning.

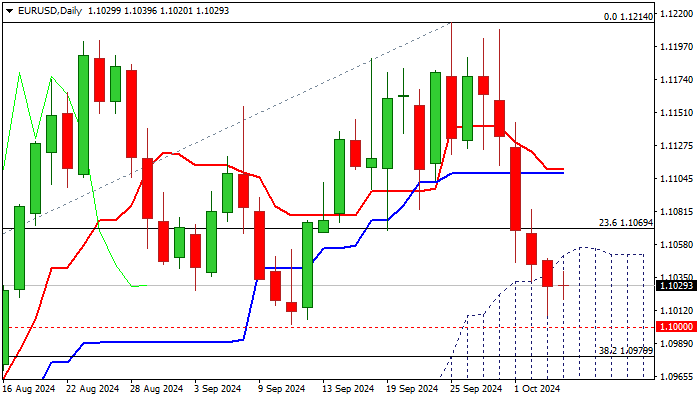

Bears eye key supports at 1.10 zone (psychological / Sep 11 higher low / Fibo 38.2% of 1.0601/1.1204 uptrend) break of which to generate reversal signal on breach of the floor of multi-week consolidation range and completion of a double-top pattern on daily chart.

Bears broke through initial Fibo support at 1.1069 (23.6%) and penetrated into ascending thick daily Ichimoku cloud (spanned between 1.1056 and 1.0933) with weekly close within the cloud to contribute to negative outlook.

Rising negative momentum and converging 10/20 MA’s in bearish setup and about to create a bear-cross, add pressure, but partially countered by oversold conditions and anticipated stronger headwinds from thick daily cloud and strong 1.10 support zone.

We look for firmer signals on sustained break below 1.10 zone or bounce and close above cloud top, which would ease immediate downside risk, further bullish signals to be expected on rally through converged daily Tenkan / Kijun-sen (1.1111/08).

Fundamentals work against Euro, as the ECB got more support for further rate cuts after inflation fell below 2% target, while EU composite PMI fell below 50 threshold in September, signaling contraction.

Release of US labor data for September is expected to play a key role today, with Nonfarm payrolls expected to rise moderately (Sep 147K f/c vs Aug 142K) average earnings to ease (Sep m/m 0.3% f/c vs Aug 0.4% and unemployment to remain unchanged at 4.2% in September).

If hiring in the US falls below expectations and particularly dips below 100K trigger, it will signal that US labor market is cooling and add to bets for another outsized Fed rate cut next month, providing strong support to the single currency.

Conversely, stronger than expected NFP numbers would inflate Dollar and increase pressure on Euro.

Res: 1.1056; 1.1069; 1.1110; 1.1144.

Sup: 1.1000; 1.0980; 1.0930; 1.0907.