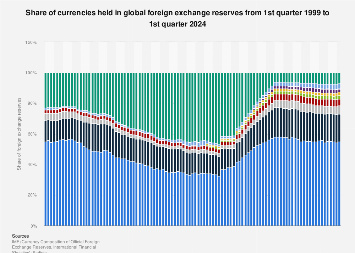

The U.S. dollar was the most common currency in foreign exchange reserves in 2023, comprising more than three times the amount of the euro in global reserves that year. This total peaked in 2015, partly due to the strength of the dollar during the Eurozone crisis. The share of the U.S. dollar has lost since to the Japanese yen and euro, as well as other currencies.

Why do foreign exchange reserves matter?

When countries with different currencies export goods, they must agree on a currency for payment. As a result, countries hold currency reserves worth trillions of U.S. dollars. After World War II, the U.S. dollar itself became the international currency in the Bretton Woods Agreement and is thus the most common currency for international payments. The United States Treasury is also seen by most as risk-free, giving the country a low-risk premium. For this reason, countries hold U.S. dollars in reserve because the currency holds value relatively well eventually.

China and currency reserves

Since 2016, the International Monetary Fund has included the Chinese renminbi (yuan) as part of the Special Drawing Rights (SDR) basket. This decision recognized the influence of the renminbi as a reserve currency, particularly in several Asian countries. China also holds significant foreign exchange reserves itself, funded by its large positive trade balance.