Key Highlights

- EUR/USD started a fresh decline below the 1.1080 support.

- It traded below a key bullish trend line with support at 1.1145 on the 4-hour chart.

- GBP/USD declined below the 1.3150 support level.

- USD/JPY rallied above the 146.50 and 147.20 resistance levels.

EUR/USD Technical Analysis

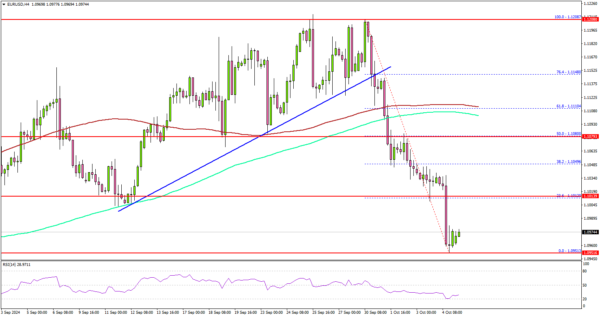

The Euro failed to continue higher above 1.1200 and started a fresh decline against the US Dollar. EUR/USD traded below 1.1100 to enter a bearish zone.

Looking at the 4-hour chart, the pair gained bearish momentum below the 1.1150 support, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour). The pair traded below a key bullish trend line with support at 1.1145 on the same chart.

The bears even pushed the pair below 1.1020. It seems like the pair might struggle to recover. On the upside, the bears might be active near the 1.1000 level.

The first major resistance might be near the 1.1080 level. It is close to the 50% Fib retracement level of the downward move from the 1.1208 swing high to the 1.0950 zone. A close above the 1.1080 level could set the tone for another increase.

The next major resistance could be 1.1145. A clear move above the 1.1145 level might send EUR/USD toward 1.1200. Any more gains might call for a test of the 1.1250 zone.

On the downside, immediate support sits near the 1.0950 level. The next key support sits near the 1.0920. Any more losses could send the pair toward the 1.0840 support.

Looking at GBP/USD, the pair also saw bearish moves, and the bears were able to push the pair below the 1.3150 support.

Upcoming Economic Events:

- Euro Zone Retail Sales for August 2024 (MoM) – Forecast +0.2%, versus +0.1% previous.