- Powell’s hawkish speech dashed hopes for a 50-bps rate cut in November.

- Data from the US showed a tight labor market.

- Middle East tensions increased demand for the safe-haven dollar.

The GBP/USD weekly forecast shows a sudden shift in sentiment to the downside as the dollar regains its shine.

Ups and downs of GBP/USD

The GBP/USD price made a solid bearish candle for the week as the dollar firmed against the pound. It was a strong week for the greenback as data, policymaker remarks, and Middle East tensions supported the currency.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The first catalyst for the dollar was Powell’s hawkish speech, which dashed hopes for a 50-bps rate cut in November.

Meanwhile, data from the US showed a tight labor market, with vacancies and private employment rising more than expected. Furthermore, the nonfarm payrolls report revealed a bigger-than-expected employment jump.

Elsewhere, Middle East tensions increased demand for the safe-haven dollar.

Next week’s key events for GBP/USD

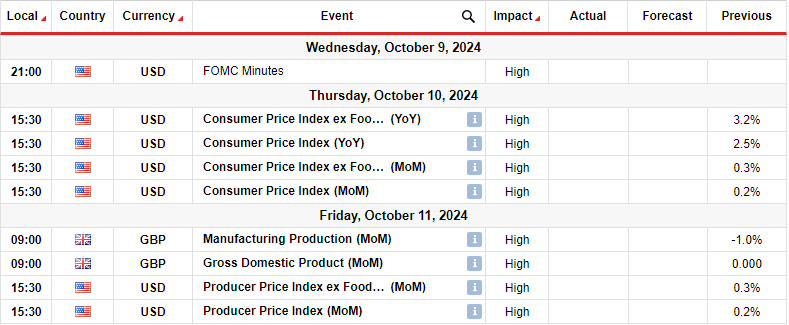

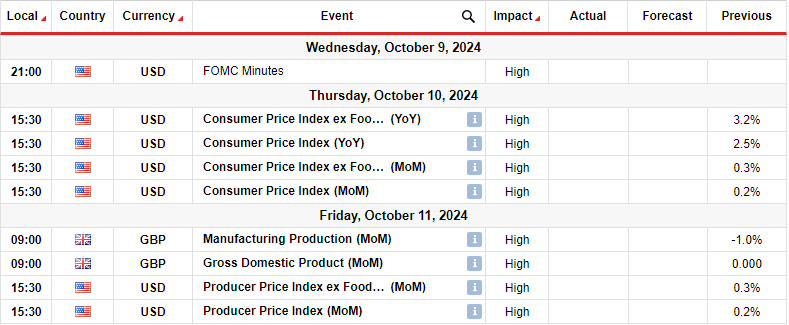

Next week, market participants will focus on the FOMC minutes. The minutes might contain clues on what policymakers might do in the future. At the same time, the US CPI and PPI reports will show whether inflation is nearing the Fed’s 2% target.

Analysts believe consumer inflation will ease further in September from 2.5% to 2.3%. A bigger-than-expected drop will pile pressure on the Fed to lower borrowing costs. As a result, bets for a 50-bps November rate cut would increase. On the other hand, an unexpected jump would favor a smaller rate cut.

In the UK, market participants will focus on manufacturing production and the GDP report. A resilient economy will lower bets for BoE rate cuts, while the opposite is true.

GBP/USD weekly technical forecast: Bears break out of rising wedge pattern

On the technical side, the GBP/USD price has broken out of its bullish wedge to the downside. At the same time, it has broken below the 22-SMA, indicating a shift in sentiment. Previously, the price made a series of higher highs and lows in a wedge pattern.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

However, the uptrend paused when it reached the 1.3400 resistance. Here, the RSI made a bearish divergence, indicating fading bullish momentum. Soon after, bears got strong enough to break out of the bullish wedge. In the coming week, the price will face the 1.3051 support level. A break below would clear the path to the 1.2701 support, strengthening the bearish bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.