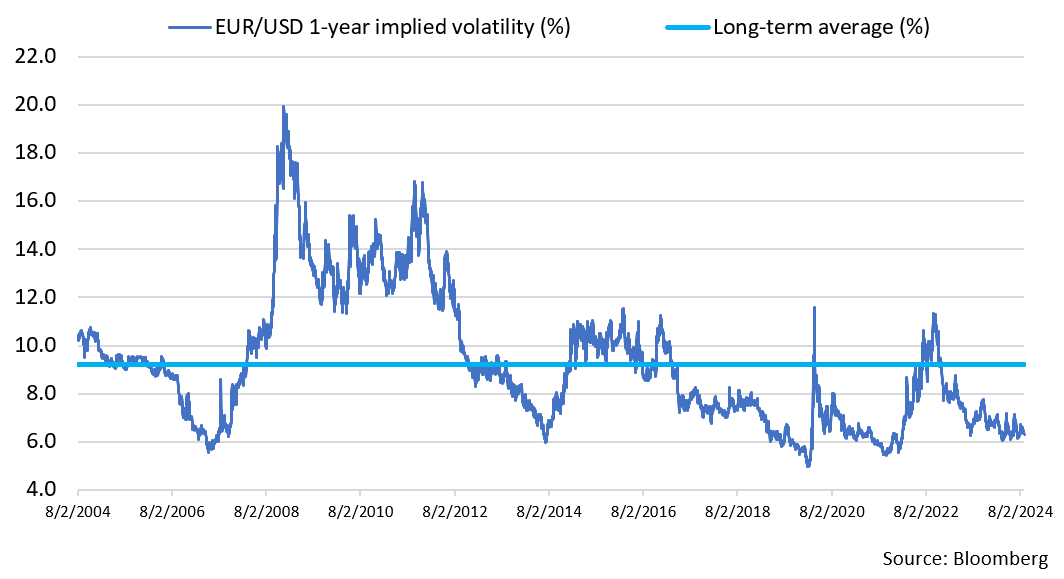

Aside from a few is isolated Black Swan events, such as the liquidation of the yen carry trade in August 2024, most major currencies have been range-bound for the last 12 months. Global central banks have oscillated between parity and lack of clarity regarding the future direction of interest rates, key drivers of currencies, resulting in mostly directionless trading over this period. Muted realized volatilities have depressed forward-looking implied volatilities, the primary input to option prices, to cycle lows.

Downside protection with upside potential

For global firms and funds looking to hedge currency risk, this pricing dynamic presents an attractive entry point for purchasing asymmetric option protection, that is, downside protection with upside potential. There is much to be resolved in 2025 for markets and economies with recession fears, general election anxiety, and geopolitical tensions all on the rise. Currency options are ideally suited to deal with the significant amount of two-way risk that lies ahead.

Options are cheap now, currently near cycle lows and well-below long-term averages

Hedge opportunity costs

Options address a key limitation of forwards when used to hedge risk. Forward contracts offer financial protection and certainty, but no price flexibility in the event the market moves in favor of the core position and against the hedge. By construction, forwards oblige execution at the contract rate, regardless of whether it is more or less advantageous.

In many situations, the opportunity cost described does not factor into assessment of hedge performance. For instance, the purpose of balance-sheet hedging is to insulate the income statement from FX remeasurement volatility. Losses on hedges are offset by gains on remeasurement of assets and liabilities, and vice versa. The objective is to minimize the net impact, and whether you get there with a hedge that makes or loses money does not matter. Similarly, for cash flow hedging mandates that aim to achieve certainty versus forward-looking budgets, the opportunity cost of forwards would not be a concern.

Two-way opportunity

However, companies with more established hedging programs may operate under alternative mandates that seek both protection and opportunity. A US-domiciled company with foreign-denominated operating expenses will be adversely impacted by a weaker US dollar (USD), as those USDs need to be sold to buy the currency needed to run overseas operations. A dual hedging mandate in this case would involve achieving protection (e.g., capped operating expenses versus forward-looking budgets), while at the same time retaining the upside potential (e.g., reduced operating expenses if currencies become cheaper to buy). This ‘take the cake and eat it too’ payoff is precisely what an option offers, in exchange for an upfront premium.

What about the premium?

Within risk management settings, there can be resistance to paying option premium because it involves a cash outlay at inception. The alternative, the forward, does not require an initial premium and may be easier to integrate into annual budgets as there is no explicit expense line item. However, the all-in cost of a forward can be greater than the premium paid for an option. That is, the opportunity cost from being locked into forwards when the market moves in favor may be larger, often multiples, than the premium that could have been paid for the option. See example below.

|

Situation US-based company must buy €1 million euro (EUR) in 3 months to fund European operating expenses. Appreciation in the EUR will have adverse economic consequences, while a depreciation in the EUR will reduce expenses in USD terms. Below are the outcomes from three strategies: unhedged, forward, option. EUR/USD Spot Reference: 1.1000 Forward: Option:

|

|

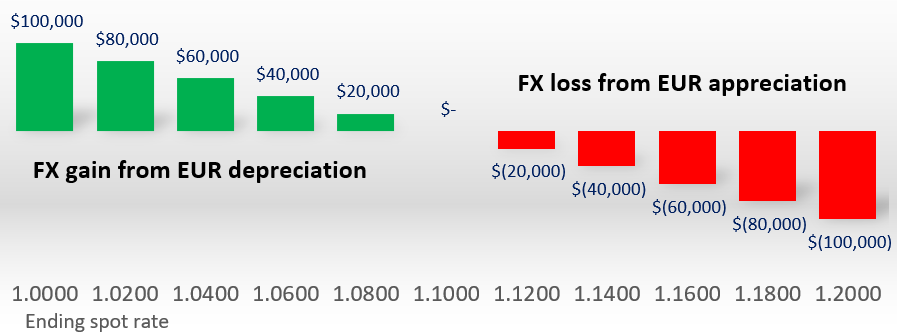

Unhedged The market determines the economic outcome. A weaker EUR results in an FX gain as company buys less expensive EUR, while a stronger EUR is an FX loss from buying more expensive EUR. |

|

|

|

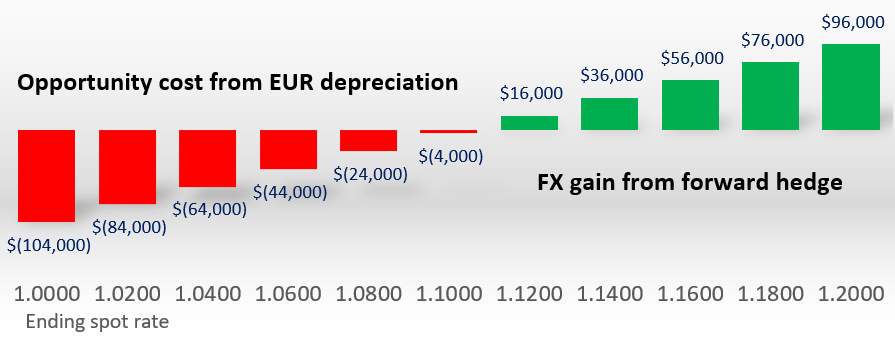

Forward The company locks in a rate to buy EUR which protects them from EUR appreciation. If, however, EUR depreciates, the company will experience a quantifiable opportunity cost. |

|

|

|

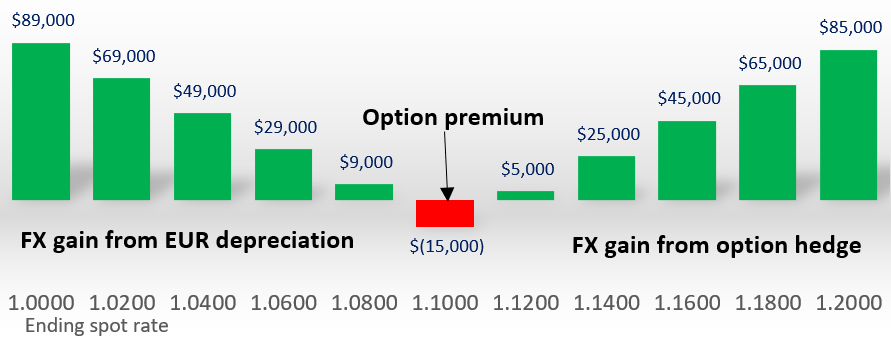

Option The option provides two-way benefit. The company is insulated from a stronger EUR but may benefit from EUR depreciation. It only takes 1.5% move in either direction to cover the cost of option. |

|

|

A few other benefits of purchased options include: 1) no credit line required to execute versus forwards (e.g., the premium serves are credit), 2) no residual obligation in case the notional amount on the hedge should exceed the actual exposure amount (e.g., reduction in business cash flows), and 3) if the protection is no longer needed, the option may be sold back to recoup some or all of the premium paid. The value-proposition of options is especially attractive due to current pricing dynamics.

If you’d like to discuss if options use is appropriate for your FX program or for information regarding SVB’s tailored FX risk management services, reach out to your SVB FX contact or [email protected].