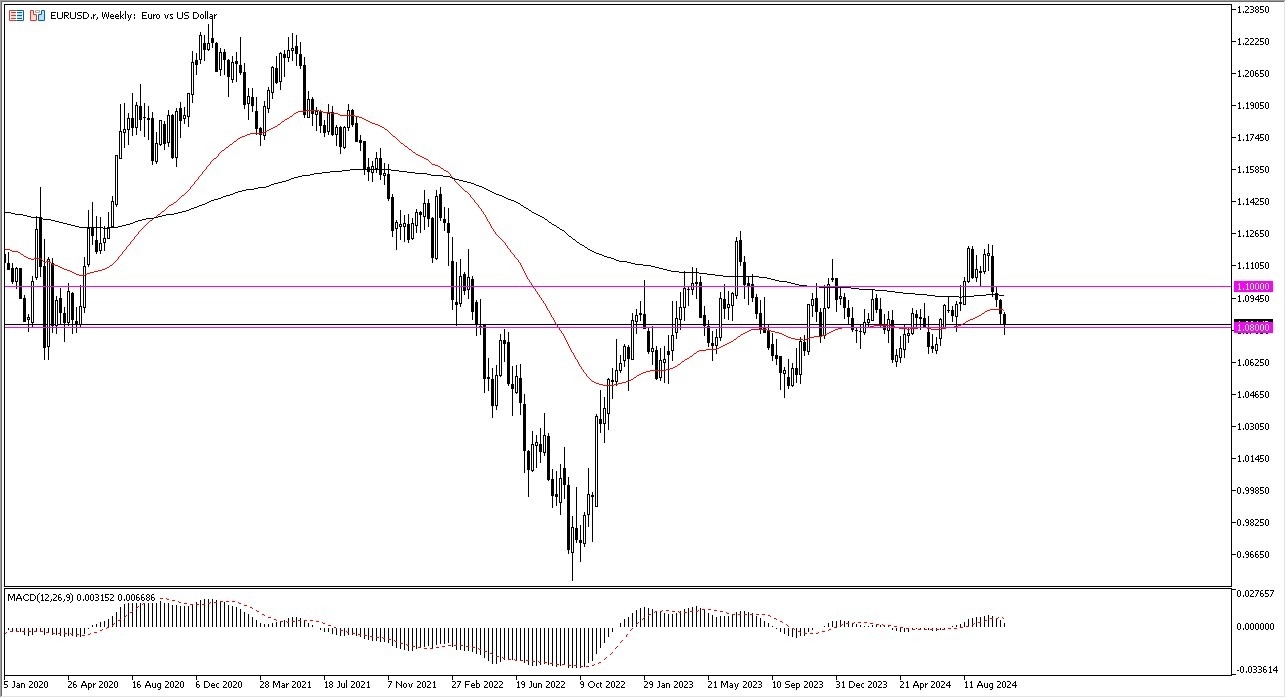

EUR/USD

The euro has plunged during most of the week, but we are starting to see a little bit of support near the 1.08 level.

At this point in time, the market looks as if it is trying to bounce but there is still a lot of negativity out there, and I believe any rally at this point in time will probably continue to attract short sellers and it comes to this pair, mainly due to the fact that interest rate spiking in the United States will be a major driver of the US dollar.

I have no interest in buying this pair in the short term, unless of course something changes from a fundamental point of view.

USD/CHF

The US dollar has rallied again during the course of the week, but it does look like we are struggling a little bit with a certain amount of resistance.

If we can break above the present area, then we could go looking to the 0.8750 level, an area that previously has been important due to both support and resistance, and it’s likely that we could go looking to that area.

I also believe that area would be very difficult to get above. Pulling back from this area could open up the possibility of a move to the 0.8550 level, which is a little bit of a floor. We are in the middle of 2 major areas, so expect choppiness.

NZD/USD

The New Zealand dollar has fallen pretty significantly during the course of the week, as we are testing the 0.60 level. Breaking down below the bottom of the candlestick for the previous week opens up the possibility of a move down to the 0.5850 level.

If we turn around and bounce from there, it’s very likely that the market could go looking to the 0.61 level, but quite frankly I think this is an area that should continue to be a massive resistance, and of course, if the interest rates in America continue to spike and of course we continue to see more “risk off behavior”, it makes sense that we will go negative in this pair.

NASDAQ 100

The NASDAQ 100 has fallen quite a bit during the course of the week to reach the 20,000 level, only to turn around and bounce rather significantly.

In fact, as we are closing out the week it looks like we are trying to do everything we can to continue to go much higher, perhaps reaching the 21,000 level before it is all said and done.

Ultimately, I think that short-term pullbacks could continue to be an issue, but I also recognize that we have a situation where traders are certainly bullish, and I think that it’s almost impossible to start shorting this index anytime soon.

USD/MXN

During the trading week, we have seen the US dollar rally toward the 20 MXN level, but that area continues to be a major resistance barrier.

If we can break above that area, then the market is likely to continue to see plenty of reasons to go higher. After all, the market has a lot of things to worry about right now, and that of course makes the US dollar much more attractive than the Mexican peso which is pretty far out on the risk appetite spectrum, and that of course is the most important thing to pay attention to.

If we can break above the 20 MXN level, that could open up a move to the 20.50 MXN level. As things stand right now, I do believe that this remains a “buy on the dips” market.

Gold

Gold markets have had another bullish week, and it is probably worth noting that we have sold off quite a bit toward the top.

That being said, I also recognize that a short-term pullback would probably be the best thing that could happen for gold. Whether or not we get it remains to be seen, but the one thing that I can take away from this chart is that we are most certainly due for some type of dip so that you can take advantage of it.

If and when it happens, I would be a major buyer, with the $2600 level being a massive support level

WTI Crude Oil

The West Texas Intermediate Crude Oil market has rallied a bit during the course of the week as we continue to see a lot of back and forth.

At this point, I believe that the $65.50 level is a major floor in the market, and the $85 level above is a major ceiling. As we are closer to the bottom than the top, I suspect that range bound traders will continue to look at each one of these dips as a potential trading opportunity.

Having said that, I don’t necessarily think that the market is going to take off and jump straight in the air, but at this point in time I also recognize that a little bit of sideways and back and forth trading makes a lot of sense.

USD/JPY

The US dollar has had a strong week against the Japanese yen, as we continue to see a lot of noisy behavior.

With that being the case, the ¥152 level looks to be a major area of importance, so if we can break above there, then the market could very well find itself looking toward the ¥155 level.

On the other hand, if we get some type of pullback, then I think you’ve got a situation where people will be looking for work value as the interest rate differential continues to favor the greenback.

Ready to trade our Forex weekly forecast? We’ve shortlisted the top forex trading accounts to choose from