The Australian dollar did pull back during the course of the trading week, crashing through the 0.68 level, and therefore I think that we could continue to see a little bit of negativity at this point. All things being equal, the AUD/USD market is still very much in the same consolidation area we had been in, as the market has been very clearly stuck in the same range for the last couple of years. Keep in mind that this is a pair that will continue to pay very close attention to the risk appetite and of course the fact that the jobs number in America came out hotter than anticipated has favor the greenback.

The New Zealand dollar has collapsed during the course of the week, as we have broken below the 0.62 level, and it looks like we are ready to go much lower. At this point, it’s probably worth noting that the 0.6350 level above is significant resistance, just as the 0.5850 level underneath is a significant support level. We are approaching the middle of the overall range, but I think the week as shown its just how soft the New Zealand dollar could be. Pay attention to the US dollar, because it should move in the same direction in the NZD/USD currency pair as it does many others.

The US dollar initially tried to rally a bit against the Mexican peso (USD/MXN exchange rate), but then gave back gains during the week. At this point, the 19 MXN level offers support, and I think that we are still very much stuck in a range at this juncture, between the 19 MXN level in the 20 MXN level above. All things being equal, I think we have more or less a sideways market that is trying to sort out what’s going to happen next. All things being equal, keep in mind that the stronger the United States is, the stronger the Mexican peso becomes.

The British pound initially tried to rally during the course of the week, only to turn around and collapse. At this point, the GBP/USD market looks as if it could start looking to the 1.30 level, an area that of course is a large, round, psychologically significant figure, and of course will attract a certain amount of attention. The size of the candlestick is rather negative, as it suggests that perhaps a deeper correction could be coming. Either way, pay close attention to the 1.30 level.

The US dollar has exploded to the upside against the Swiss franc, as we continue to see the 0.84 level offer a hard floor in the market. After the size of this candlestick, I suspect that you will have more or less a “buy on the dips” type of market, as the jobs number has solidified the idea that the US economy should continue to outperform. Furthermore, there will be questions asked as to whether or not the Federal Reserve can aggressively cut rates any further.

The West Texas Intermediate Crude Oil market has rallied rather significantly during the course of the trading week, as we have bounce significantly from the $65 level, which of course has been a major support level for the last couple of weeks. The candlestick for the week is very strong, but it is slamming into the crucial 200 Week EMA, and if we can break above there, then the market could go looking to the $85 level. The size of the candlestick is of course a very bullish look at this point in time. Because of this, I would be a buyer of dips going forward.

The NASDAQ 100 initially did pull back just a bit during the course of the week, only to turn around and show signs of life. All things being equal, this is a market that is continuing to threaten the 20,000 level, then the market is likely to continue to go looking to the 21,000 level. I think at this point in time, markets are likely to see short-term pullbacks in order to find a bit of value in order to go higher. The NASDAQ 100 has been a market that has been very noisy, but ultimately, this is a situation where the market cannot be sold anytime soon.

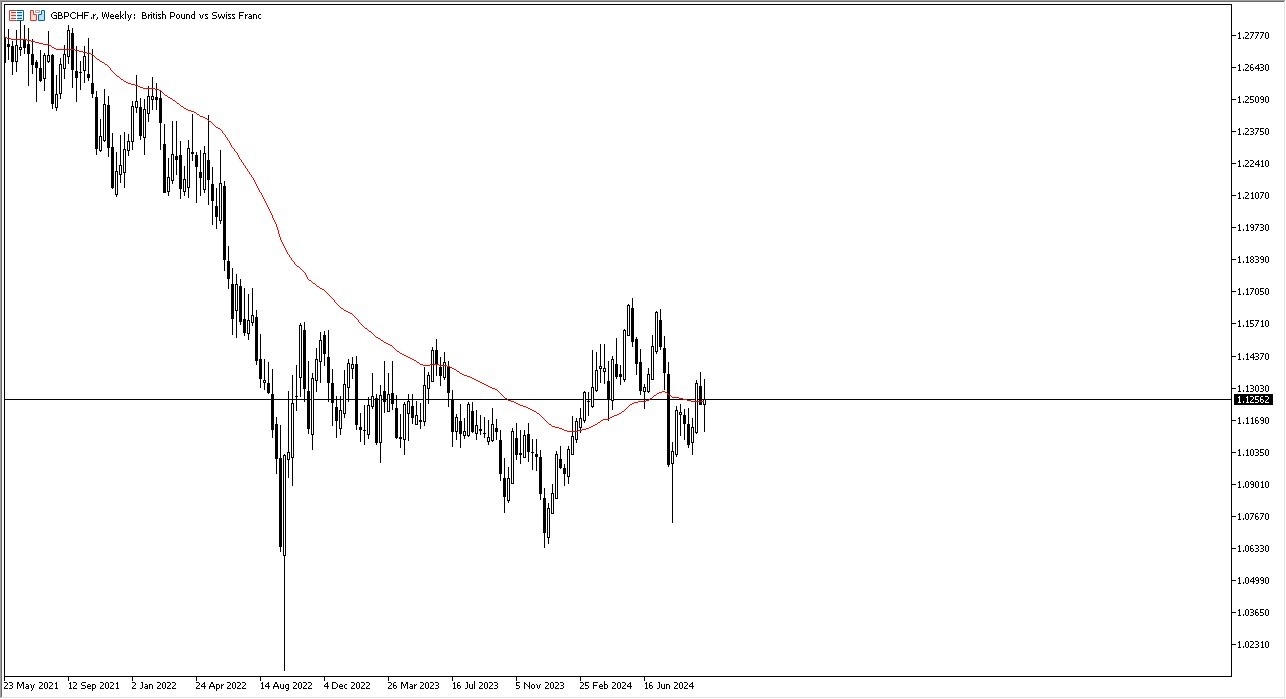

The British pound has gone back and forth during the course of the week against the Swiss franc, as we have seen risk appetite all over the place. Because of this, I think you have a situation where traders will continue to watch the overall risk appetite, and either buy or sell as a result. Remember, the Swiss franc is considered to be a major safety currency. With this, I think you can expect more noise, and it’s probably worth noting that we are right in the middle of the overall consolidation that we have been in since the middle of 2022.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.