We asked, and they finally heard. As of Jul 2024, YouTrip has finally added the feature of allowing you to withdraw money from your YouTrip account back into your bank accounts! This is a pretty big deal for a multi-currency account that was already a favourite among Singaporeans for travel spending. That isn’t only a claim they make on their website—”Singapore’s favourite multi-currency wallet”:

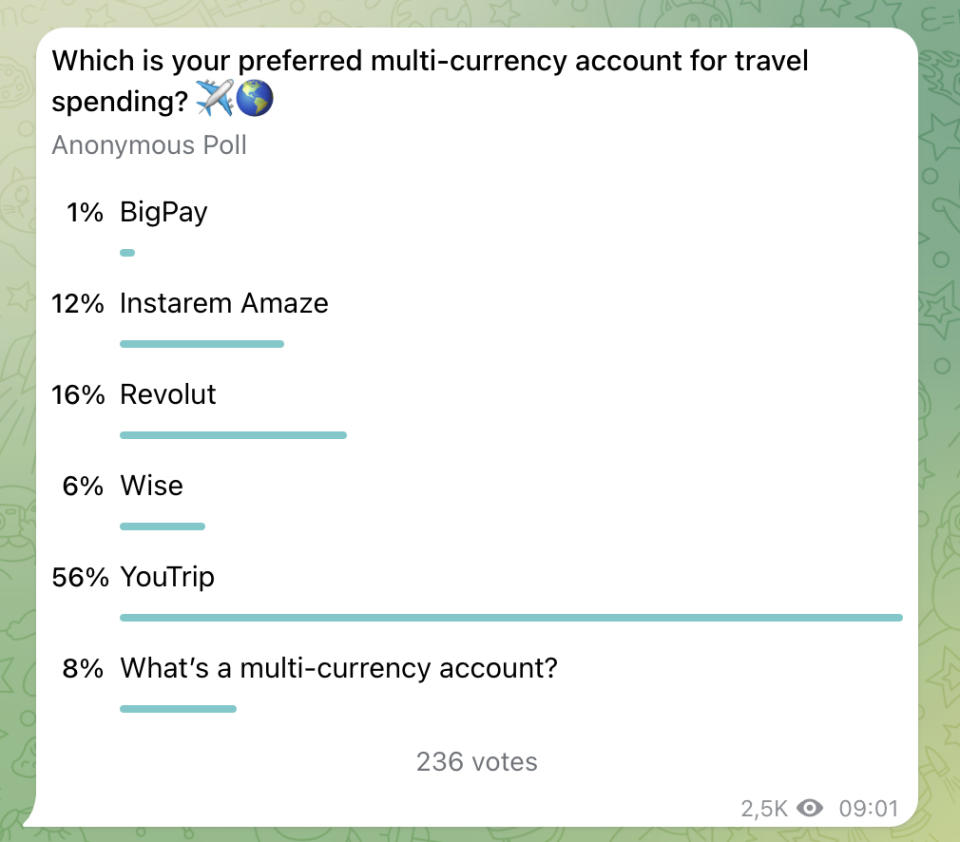

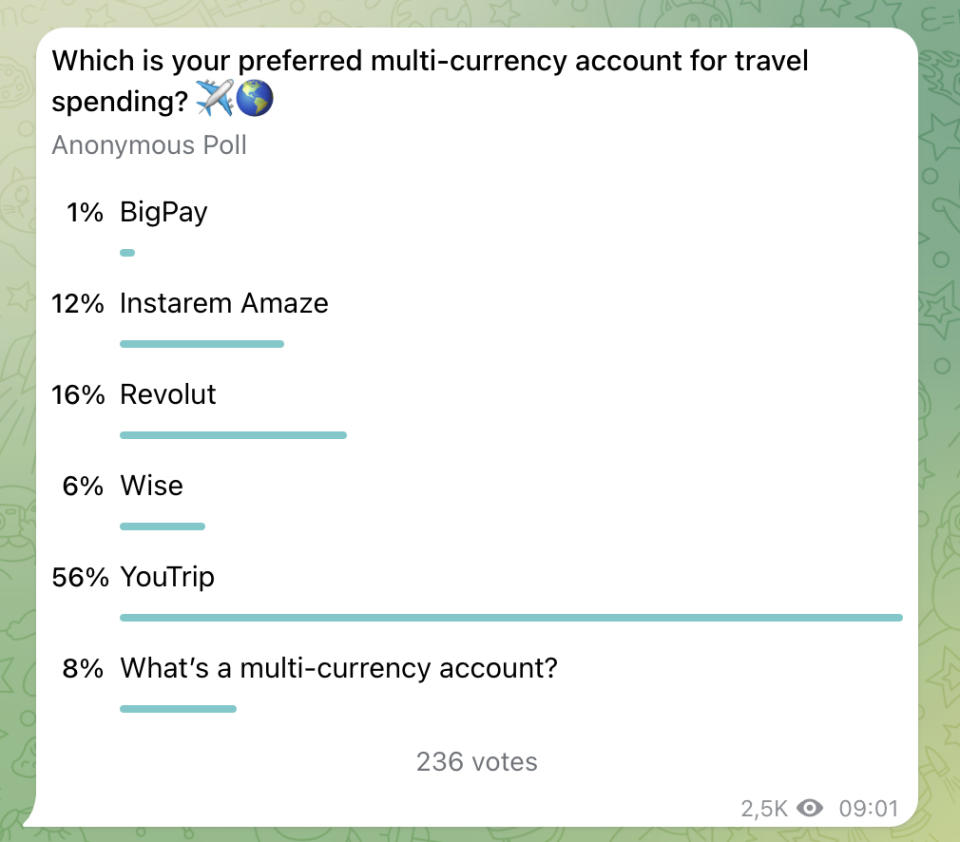

It also showed when we asked our Telegram channel subscribers to vote for their favourite multi-currency account:

If you aren’t familiar with it, YouTrip is a digital multi-currency travel wallet that enables you to exchange currencies on the go and spend overseas using a card. Cash is so 2000 and late, and we are so done with queueing up to exchange huge wads of cash at a money changer and praying we wouldn’t get robbed on the way home.

But there are tons of multi-currency cards out there. What makes YouTrip a popular choice among people in Singapore? Let’s review their exchange rate, fees, perks and more.

What is YouTrip?

YouTrip is a multi-currency travel wallet created by EZ-Link (yes, you heard that right) in partnership with You Technologies Group Limited, a company based in Hong Kong and Singapore. YouTrip was launched in 2018

Designed for travellers based in Singapore (and Thailand since 2019), YouTrip enables you exchange currencies using their smartphone application. You can then spend or withdraw money overseas using your YouTrip card, which is linked with MasterCard.

Since October 2019, YouTrip has obtained an electronic money licence to become primary issuer and stored value facility holder. This means that balances will be now held under YouTrip rather than EZ-link. It has also since expanded to Thailand.

YouTrip’s main competitors are other multi-currency travel wallets like Revolut, Wise and Instarem Amaze, all of which provide almost the same service functionally. Comparing these deserves a whole article by itself; we’re focusing on spilling the nitty gritty details of YouTrip in this one.

Are YouTrip exchange rates good?

YouTrip’s exchange rates are based on Mastercard’s wholesale rates and mid-market rates.

You can get a YouTrip card and convert currencies in-app using mid-market rates. For the 150+ currencies that are currently not available for exchange in-app, they will be converted using Mastercard’s wholesale rates.

When you compare it with its competitors like Wise and Revolut who use mid-market rates, YouTrip currency exchange rates may not necessarily be better, but there are instances where it could be.

For example, on weekends, Revolut charges a 1% markup fee, so on Saturdays and Sundays you may find that YouTrip provides better rates.

Another factor to consider is which currency you’re working with. Since Wise and Revolut are services that originated from the UK, they tend to provide competitive rates for GBP.

So, if you have no brand loyalty and just want the cheapest rates, you might want to have a few of these cards on hand so you can monitor and compare depending on which country and when you’re exchanging money.

Using multiple cards is also a good idea if you know you’re going to be withdrawing more cash overseas—most of these cards have monthly limits to how much cash you can withdraw for free, after which you’ll be charged a fee. YouTrip has the highest free withdrawal limit of S$400, with Revolut and Wise close behind at $350.

Benefits of YouTrip

Let’s break down YouTrip’s benefits:

-

Exchange 10 currencies (SGD, USD, EUR, GBP, JPY, HKD, AUD, NZD, CHF and SEK) 24/7 using their app. You can monitor the exchange rates in order to lock down the best rates.

-

Pay using your linked MasterCard in 150+ countries while getting charged 0% transaction fees on the wholesale exchange rate.

-

Withdraw up to $400 cash from overseas ATMs labelled MasterCard, Maestro or Cirrus for free each month. Further withdrawals will incur a 2% withdrawal fee.

-

No annual card fees, minimum income or account balance required.

-

YouTrip will also give you a virtual card that lets you make seamless in-app and online payments. You don’t need to pull out the physical card at checkout!

-

Add your YouTrip card to Apply Pay or Google Pay for easy contactless mobile payments. You can even link YouTrip with WeChat Pay to make payments in China easily!

I have a personal story to share about how useful the last 2 points are. I was headed to the UK with my mum in Mar 2024. She dug out her YouTrip card about 8 hours before we were supposed to fly—only to find that it had expired months ago! YouTrip had sent her a new card, but she couldn’t find it.

Thankfully, she did have her virtual YouTrip card on the YouTrip app. This let her add the card to her Apple Pay, and that’s how she paid for pretty much everything in London! Technology does occasionally let us down, but sometimes digital options are a lifesaver.

Of course, we can’t forget the latest improvement YouTrip has made: YouTrip now allows you to withdraw money from your YouTrip account back into your bank account.

This is a fantastic update I’ve been waiting ages for, but it does come with a catch: you can only do a bank withdrawal on money that put into your YouTrip account via these means:

-

Top-ups done via PayNow and Linked Bank Account (eGIRO)

-

Reversals from transactions using PayNow or Linked Bank Account top-ups

-

Dispute Credit or Dispute Resolution

-

Merchant refunds

-

Insurance Cashback

-

YouTrip Surprise Cashback

-

YouTrip Perks Cashback

If you topped up your YouTrip account via debit or credit card, you cannot transfer that money to your bank account. You can use it up in Singapore instead on everyday spending—food, transport, retail, and more.

Another limitation is that bank withdrawals have to be done in SGD, so you have to convert other currencies to SGD first. Plus, you’re limited to 10 bank withdrawals each month. Beyond those 10, you’ll have to request for a refund—read: incur a S$10 processing fee.

How do I sign up for the YouTrip card?

Simply download the YouTrip app from the Apple App Store or Google Play and fill in the sign-up form. You will be required to have your NRIC on hand.

Then, simply wait for your YouTrip MasterCard to arrive in the mail. It takes anywhere between 7 and 15 days for it to arrive. When it does, you need to enter the 10-digit Y-number on the back of your card to pair the card to your account. This number is just for things like card activation and verification—it can’t be used to authorise payments.

YouTrip fees

Perhaps the best perk about YouTrip is the lack of any fees to use their platform. There are no foreign exchange fees, annual membership fee, transaction fees, account fall-below fees or the like.

The one thing you may need to pay for is ATM withdrawals if you withdraw more than $400 a month. The charge after the first $400 is 2% and cannot be waived.

As mentioned above, there’s also a $10 processing fee if you make more than 10 bank withdrawals a month. Thankfully 10 is a pretty comfortable number, so this is unlikely.

YouTrip promo codes & perks

If you don’t have a YouTrip card, sign up with IGYT5 to get S$5 loaded into your account for free.

YouTrip users enjoy some perks at selected merchants just for having the card. There’s an entire roster of rewards that users can claim by entering their card’s Y-number. The rewards, however, are subjected to limited redemptions and only valid till certain dates.

As of 18 Apr 2024, I counted 21 perks you can redeem. That’s definitely a lot more than when YouTrip first started out. Perks include:

-

Up to 10% cashback on Shopee—valid till 31 Dec 2024

-

Up to 15% off Don Quijote (a.k.a. Don Don Donki)—valid till 1 Oct 2024

-

Up to 15% cashback on Booking.com (stays only)—valid till 31 Dec 2024

-

Up to 12% cashback on Amazon Singapore—valid till 31 Dec 2024

Visit the YouTrip Perks page to redeem these deals.

YouTrip vs Revolut vs Wise: How does YouTrip compare to similar cards?

YouTrip offers a very similar experience to similar multi-currency travel wallets like Revolut and Wise.

YouTrip is quite competitive and transparent—they aren’t lying when they say they don’t charge extra fees other than the fee incurred if you withdraw more than S$400 a month from ATMs overseas. By comparison, Revolut might charge mark-ups on weekends when you spend in certain currencies. (Not that Revolut hides this fact; it’ll be reflected in the app if you try to convert currency on a weekend.)

YouTrip was also the first multi-currency e-wallet to raise their wallet limit to S$20,000 and annual spending limit to S$100,000, following a change in MAS regulations. That’s up from S$5,000 and S$30,000 respectively, so it’s kinda. a big deal. If you know you’re going to be making a big purchase overseas, YouTrip is your best option until Revolut and Wise catch up—they are still capping wallet and spending limits at S$5,000 and S$30,000 respectively.

ALSO READ: Digital Multi-Currency Accounts & Cards For Travel Spending: BigPay vs Instarem Amaze vs Revolut vs Wise (Formerly TransferWise) vs YouTrip

One small disadvantage to YouTrip is that it doesn’t offer some of the other perks that Revolut and Wise give you, such as enabling you to make international money transfers.

Found this article useful? Share it with your friends and family!

The post YouTrip Review—Guide to YouTrip Card, Exchange Rates & Promo Codes appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post YouTrip Review—Guide to YouTrip Card, Exchange Rates & Promo Codes appeared first on MoneySmart Blog.

Original article: YouTrip Review—Guide to YouTrip Card, Exchange Rates & Promo Codes.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.